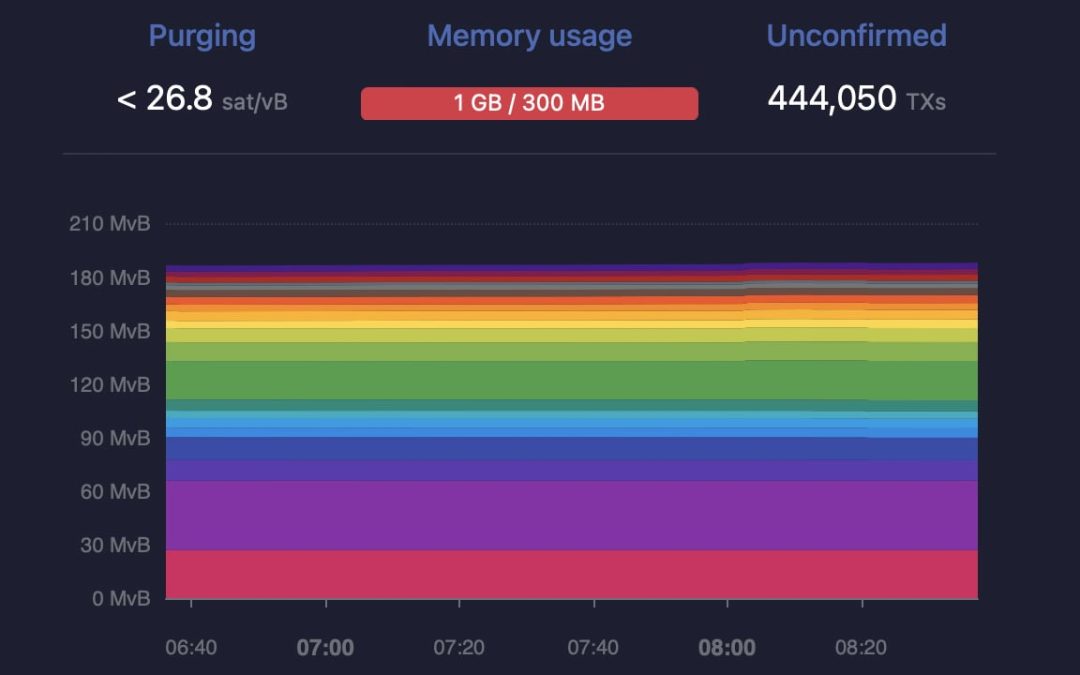

Bitcoin transaction fees have surged significantly in the past 24 hours, with the average fee reaching $19.20 per transfer. The increase in fees can be linked to a backlog of transactions trapped in the mempool, as over 440,000 unconfirmed transactions are currently awaiting confirmation.

Block Reward Dethroned: Bitcoin Transaction Fees Surpass Mining Subsidy for the First Time Since 2017

On Sunday, May 7, 2023, bitcoin transaction fees exceeded the block reward for the first time since December 2017 at block height 788,695. Subsequent block heights 788,700 and 788,702 also witnessed fees surpassing the subsidy.

At present, over 440,000 bitcoin transactions are pending confirmation with 193 blocks left to mine for clearing them all. Fees soared past the $25 mark per transaction on Sunday, and current data displays an average fee of 0.00069 BTC or $19.20 per transaction.

According to bitinfocharts.com data, the median-sized fee is 0.0004 BTC or $11.05 per transfer. High-priority transactions are paying upwards of $22.90 per transaction and individuals are paying $19.95 for medium-priority transactions.

Block intervals or mining times have been exceeding the ten-minute average lately. The most recent block time was approximately ten minutes and 34 seconds. Slower block times may result in another decline in difficulty — an estimated drop of around 5.3% is anticipated to occur on May 18, 2023.

The average hashrate over the past 2,016 blocks is roughly 338 exahash per second (EH/s). The network’s hashrate has dipped below the 300 EH/s range on some instances and is presently running at 385 EH/s at the time of writing.

What impact do you think the surge in bitcoin transaction fees and the backlog of unconfirmed transactions will have on the future of cryptocurrency adoption and scalability? Share your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, mempool.space

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.