Bonds, Bullion, & The Greenback are all higher since The Fed threw in the towel… stocks are lower…

And despite the desperate efforts to talk up the economy, SHTF today…

[youtube https://www.youtube.com/watch?v=zDAmPIq29ro]

Chinese stocks managed gains on the week, thanks to three big liftathons…

European markets were ugly all week…

US equity markets had their worst day since Jan 3rd – all ending the week lower…

Dow futures fell 500 points from the overnight highs…

As Bloomberg noted, you know things have gone a bit pear-shaped when utilities and tech are the top gainers, comfortably outperforming the broader market. But they took quite divergent paths to get there.

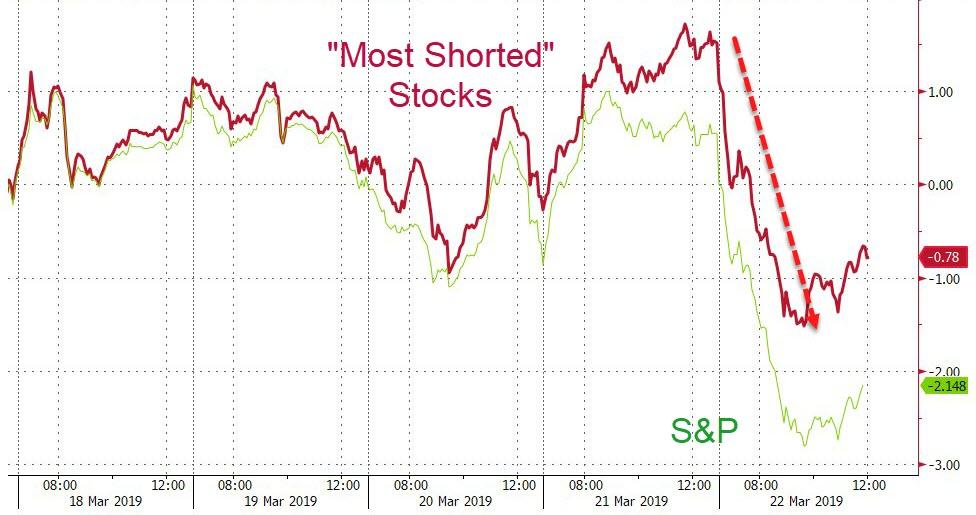

It appears the squeezers ran out of ammo…

Buybacks had a good week – until Friday, as the blackout window looms…

Big bank stocks have bloodbath’d this week (worst week of the year) as the hopes of higher rates and steeper curve evaporate…

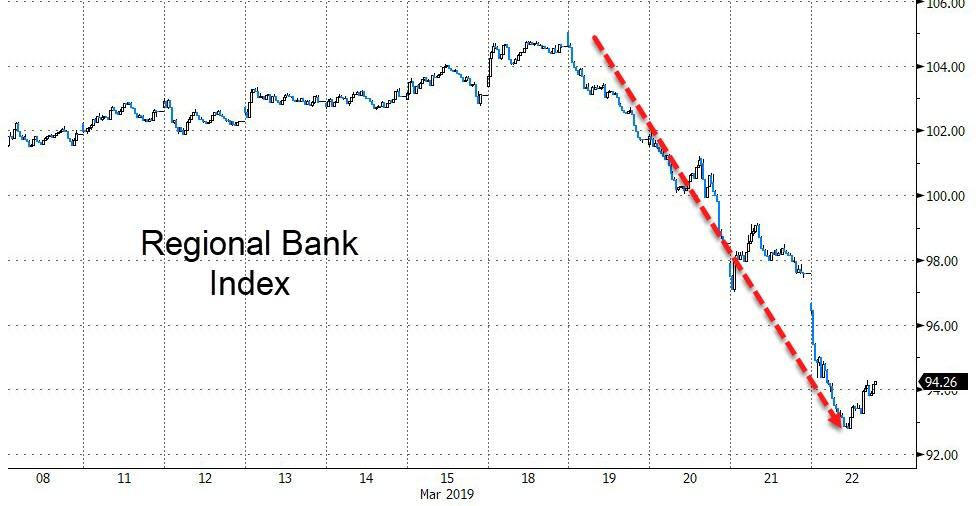

But Regional banks were clubbed like a baby seal… the biggest weekly drop since Sept 2011 – after the USA downgrade

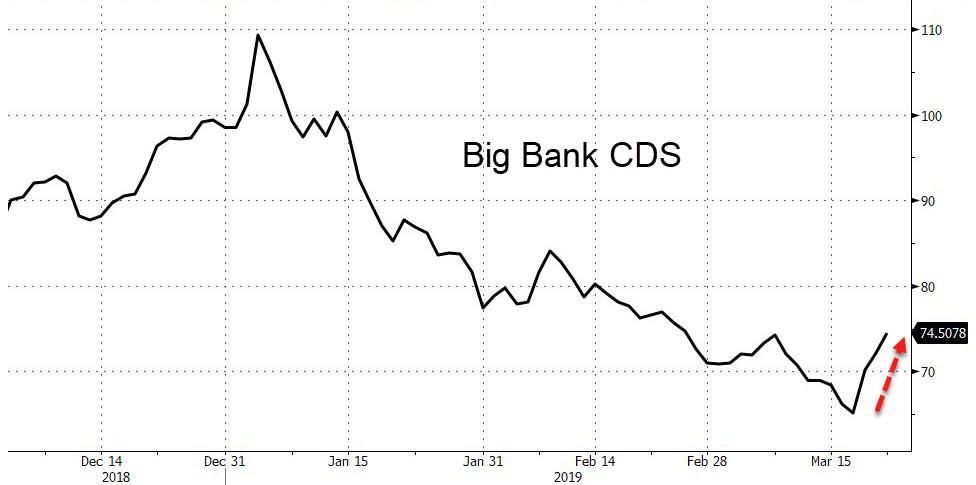

And bank CDS have started to creep higher…

Tesla had an ugly week…

Credit and equity protection costs surged on the week…

Yields collapsed around the world this week, with 10Y bunds going negative once again…

Global average sovereign yields plunged to lowest since April 2018…

US Treasury yields crashed this week… this is the biggest weekly drop in 5Y, 7Y, and 10Y yields since April 2017

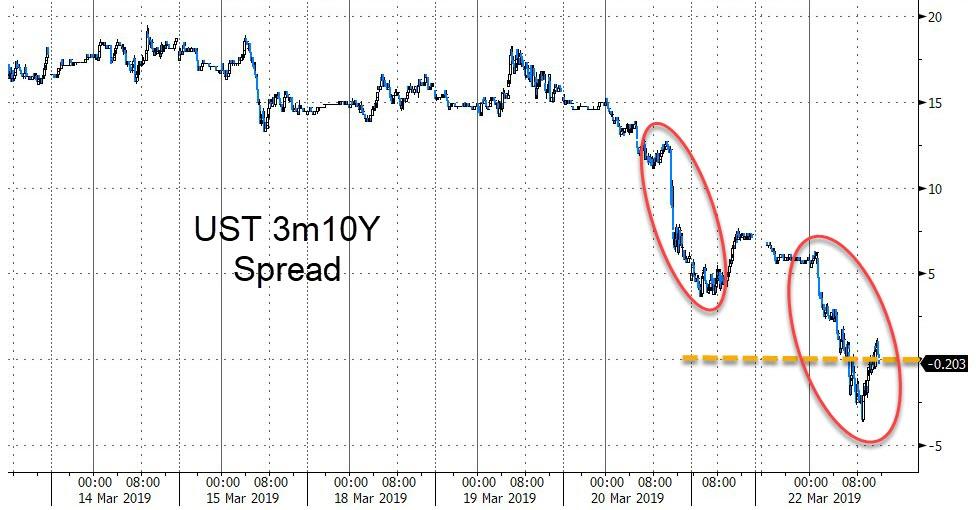

For the first time since 2007, the spreads between 3m and 10y yields inverted – flashing the most-effective recession indicator since WW2…

And inflation breakevens plunged, despite a lack of oil confirmation…

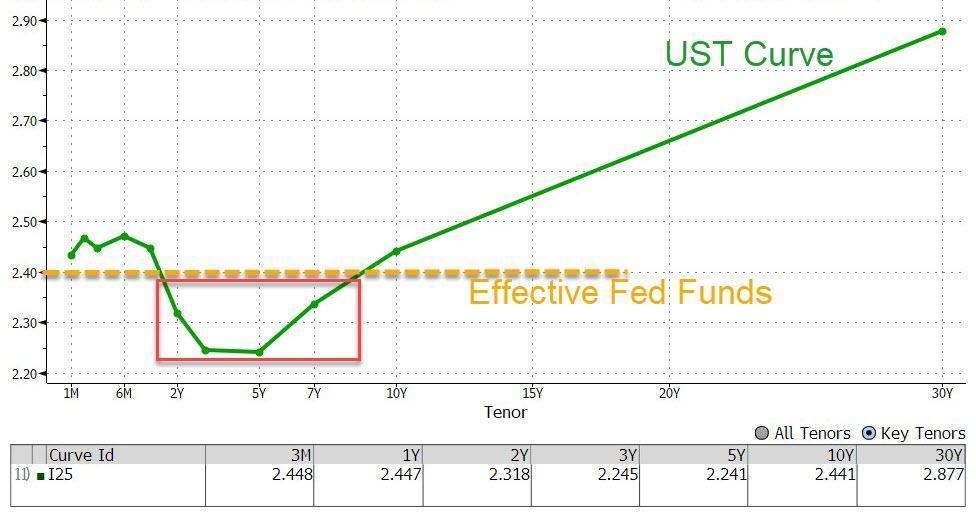

The yield curve is now inverted to Fed Funds out to almost 10Y…

Notably, The Fed is now priced to be easier than The ECB in 2019…

The dollar index ended the week very marginally higher thanks to serious buying-panic in the last two days since The Fed…

The relative stability expected from an easing Fed has prompted a run into carry trades and USD remains a big player.

The Turkish Lira collapsed today as a surprise tightening by the Turkish central bank failed to stem a rout in the wake of an unexplained drop in official reserves.

“Today the unsustainable nature of state-owned banks being the only sellers of [US dollars in exchange for lira] over recent weeks became evident,” said Roger Hallam, chief investment officer for currencies at JPMorgan Asset Management.

Bitcoin managed gains on the week but Bitcoin Cash outperformed…

Copper ended the week lower as China growth questions continued but WTI and PMs managed to hold on to gains despite the dollar ending higher…

Gold rallied for the 3rd week in a row…

WTI topped $60 intraweek, but ended back below $59…

Finally, we refer to Knowledge Leaders Capital Bryce Coward’s analysis of what happens next...

We’ve cataloged all 20 uninterrupted 15% declines in the post-war period and documented what has happened afterward, as well as the type of market environment in which those declines have taken place. By uninterrupted decline, we mean a waterfall decline of at least 15% without an intermediate counter-trend rally of at least 5%. Some bullet points describing the rallies following those declines are below:

-

The average counter-trend rally following a 15% waterfall decline is 11.9% (11% median) and it takes place over 21 trading days on average (median 11 days).

-

The rallies end up retracing 57% of the decline on average (median 52%).

-

Waterfall declines of at least 15% have only taken place in bear markets.

-

The average of those bear markets have a peak-to-trough decline of 33% (median 29%)

-

The duration of those bear markets is 284 trading days on average (median 139 days)

-

In 16 of 19 instances (excluding the decline we just witnessed), a recession was associated with the bear market

-

-

100% of the time the low resulting from the waterfall decline was retested, and in 15 of 19 cases a new lower lower was made.

It’s different this time though…