Authored by Lance Roberts via RealInvestmentAdvice.com,

Review & Update

This week I want to step back and talk about some misconceptions with concerning markets, cycles, and investing. However, before we get to that, let me give you a quick review and update on where we are following the “sellable rally,” we have discussed over the last couple of weeks.

In review, we said last week:

“We remain primarily long-biased in our portfolios, but are also slightly overweight in cash, and portfolio weight in fixed income. We are also carrying some hedge by having overweighted “defensive” stocks a couple of months ago which have continued to provide outperformance.

There is a very good possibility this rally will continue next week as momentum and short-covering levels have been breached. However, if the market fails to set a new high and turns lower, the risk of a downside break will grow as we progress into summer.”

The rally did continue on Monday and hit our initial targets. We alerted our RIA PRO subscribers (FREE 30-day trial) to this on Monday. To wit:

- As stated last time:

- “The correction last week has set up a tradeable opportunity into June.”

- That tradeable rally is in process and we are approaching our initial target of $290

- Short-Term Positioning: Bullish

- Last Week: Hold full position with a target of $290.

- This Week: Sell 1/2 of position on any rally next week that hits our target.

- Stop-loss moved up to $280

- Long-Term Positioning: Neutral

That target was hit on Monday, and we sold 1/2 of our trading positions accordingly.

Since then, the market has languished around the 50-day moving average seemingly awaiting some catalyst to move it in one direction of the other. Fortunately, there are plenty of those on deck as next week the Fed will give us their latest musings on whether they are inclined to cut rates or not and Trump will be confronting China in the upcoming G-20 meeting.

Pass the popcorn, please.

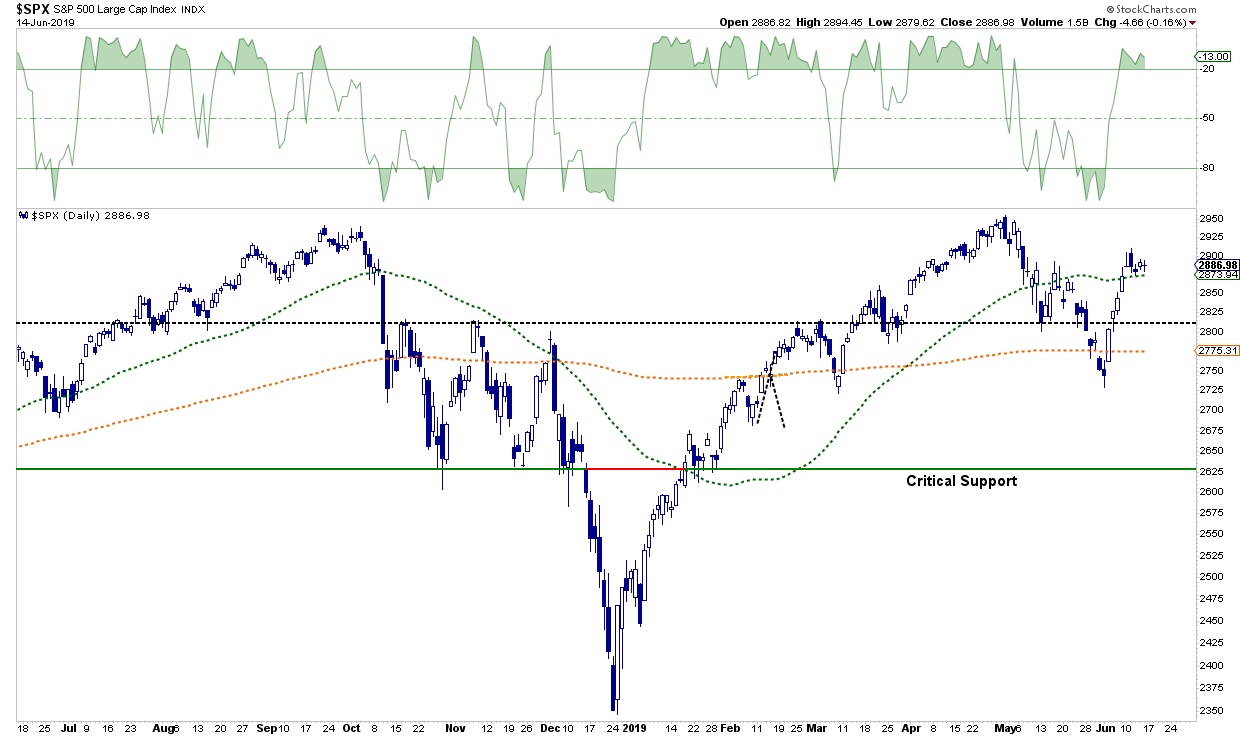

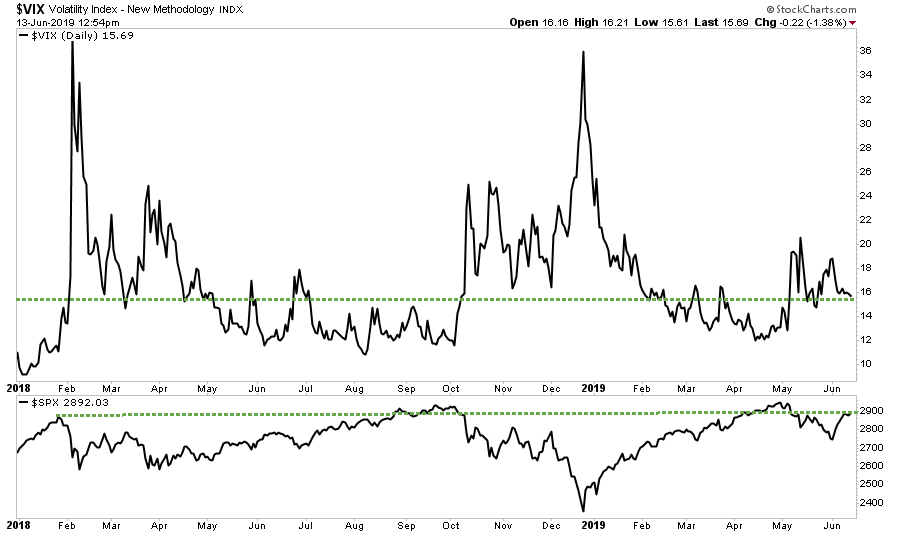

As shown in the chart below, the short-term oversold condition has been reversed which limits upside, but the 50-day moving average has acted as support all week.

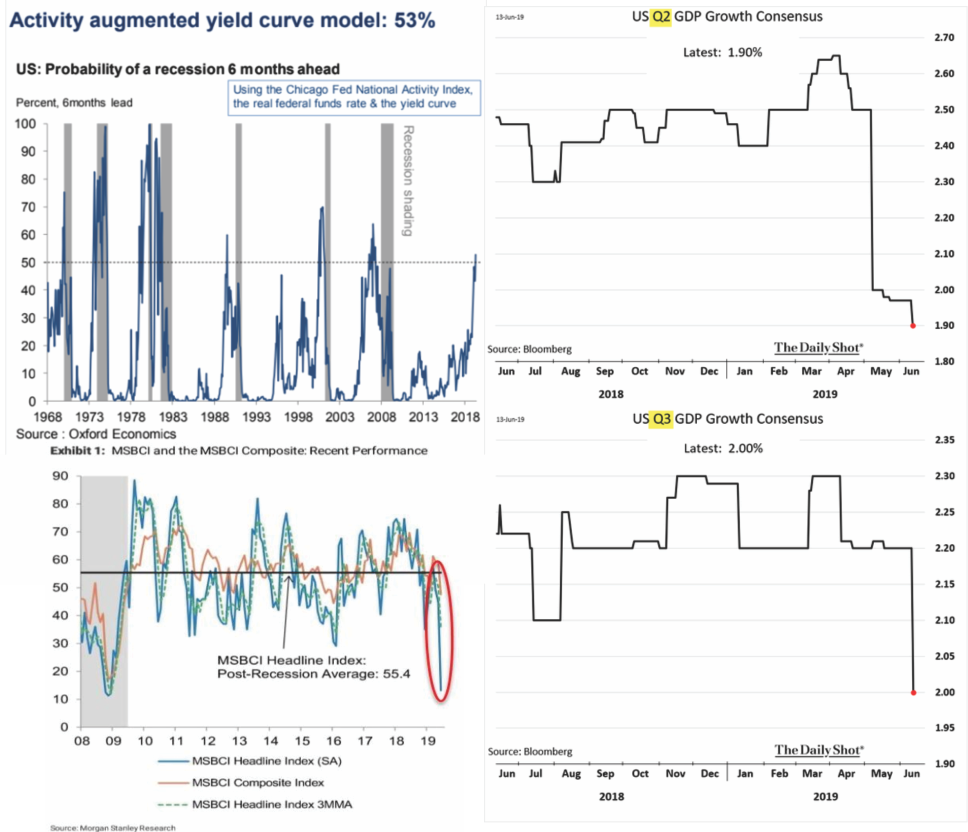

The concern this coming week will continue to be adverse news from the Fed, the White House, or the economic data which has continued to take a turn for the worse. Global economic growth has plunged as well as Q2 and Q3 economic growth estimates.

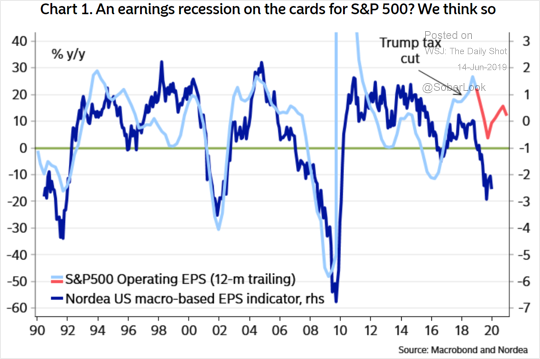

This also puts forward earnings at risk of recession, which will not play well with a market trading at rather extreme historical valuations.

“Oh my gosh, you are so bearish. You must just be all in cash and hiding in a bunker.”

Well, for those that are reading impaired, it must certainly sound that way.

However, in reality, we have consistently maintained long exposure to the markets, but continue to control our risks to protect against sudden losses of capital.

That brings us to today’s missive.

Understand Bear Markets, Don’t Fear Them

I am a value-oriented investor and prefer to buy assets when they are fundamentally cheap based on several factors including price to sales, free cash flow yield, and high return on equity. However, being a strict value investor can also lead to a variety of investment mistakes, primarily emotional, when markets become both highly correlated and driven by speculative excess.

Currently, there is little value available to investors in the market today as prices have been driven higher by repeated Central Bank interventions and artificially suppressed interest rates.

What we do know is that despite these interventions, the markets will eventually mean revert to the point that “value” is once again present.

The problem for investors is two-fold:

- Knowing when to sell excessively valued markets which seemingly will not stop rising, and;

- Knowing when to buy back into markets which seeming will not stop falling.

This is why a good portion of our investment management philosophy is focused on the control of “risk” in portfolio allocation models through the lens of relative strength and momentum analysis.

The effect of momentum is arguably one of the most pervasive forces in the financial markets. Throughout history, there are episodes where markets rise, or fall, further and faster than logic would dictate. However, this is the effect of the psychological, or behavioral, forces at work as “greed” and “fear” overtake logical analysis.

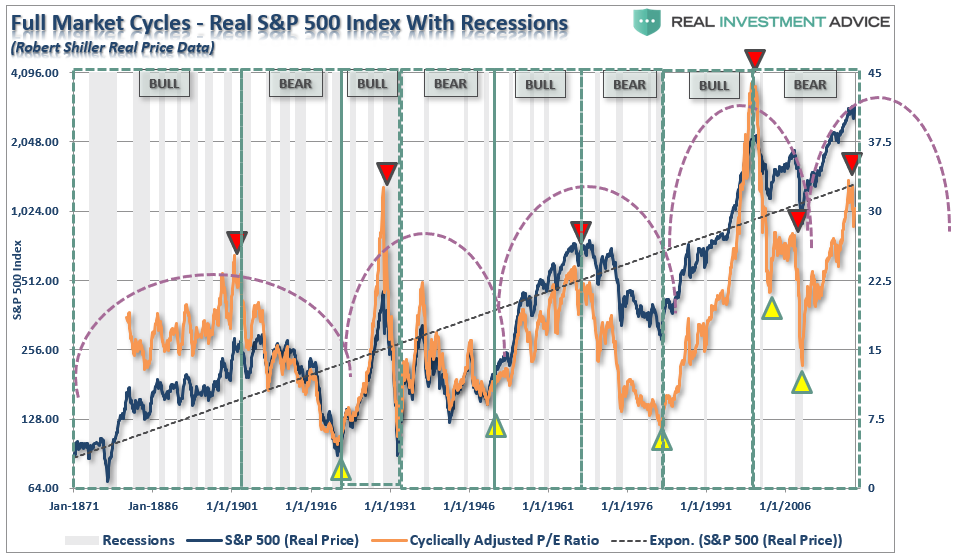

I have discussed previously the effect of “full market cycles” as shown in the chart below.

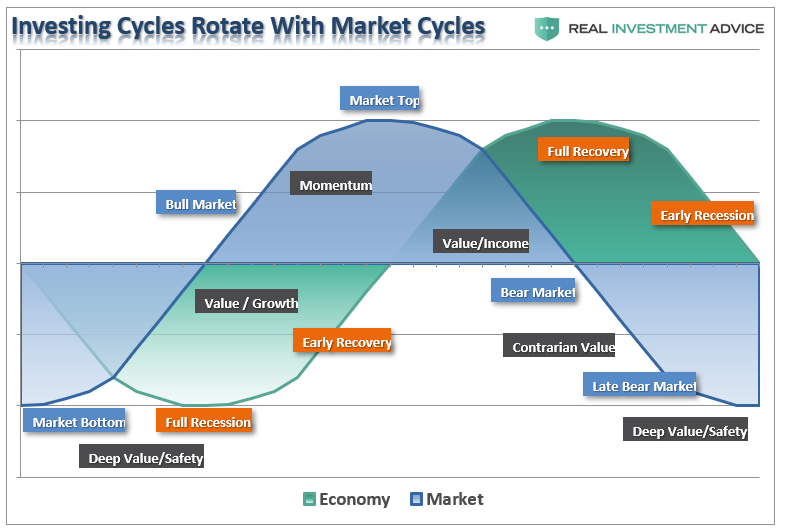

What is also important to note is that these full market cycles are ultimately driven by the economic cycle. As shown in the next chart, the sector rotation appears to lead the economic cycle.

Importantly, it should be noted that investment styles also shift during the broader cycle.

-

During recessionary bottoms, when assets are truly selling at “bargain basement” prices, deep discount value strategies tend to perform the best as investors are panic selling to find safety over risk.

-

As markets begin to recover, investor’s begin to cautiously re-enter the markets and begin to seek some risk with a degree of safety. Value oriented investment strategies will still work during while these early recovery cycles and growth strategies began to gain momentum.

-

During the latter stages of the economic cycle, growth and value give way to pure momentum as investor “greed” and “exuberance” began to view “value” as “out of favor.”

It is during this last stage of the cycle that “fundamentals appear not matter” as the fundamentally worst stocks lead the markets higher.

In other words, we begin hearing discussions of why “This Time Is Different (TTID),” “The Fear Of Missing Out FOMO),” and “There Is No Alternative (TINA).”

Complacency Lives

For now, complacency lives. Despite geopolitical turmoil, slowing economic data, weak corporate profitability, tariffs, and “trade wars,” the markets remain astonishingly close to their all-time highs. Furthermore, volatility, remains amazingly close to its historical lows despite a market that has gone nowhere for eighteen months.

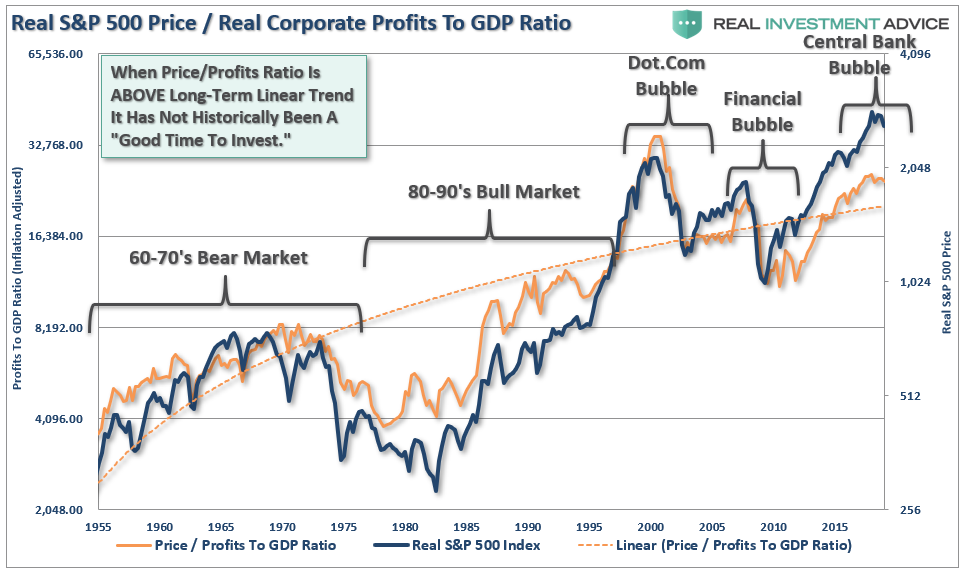

Moreover, complacency also in how much investors are willing to pay for each dollar of profits from owning stocks relative to overall economic growth. As shown below, investors are paying much more for every dollar’s worth of profits than what the economy should actually generate. (Profits are a reflection of economic activity, not the other way around.)

Clearly, paying excess valuations is not uncommon throughout history. However, so are the eventual reversions are investors reprice values during economic slowdowns and recessions.

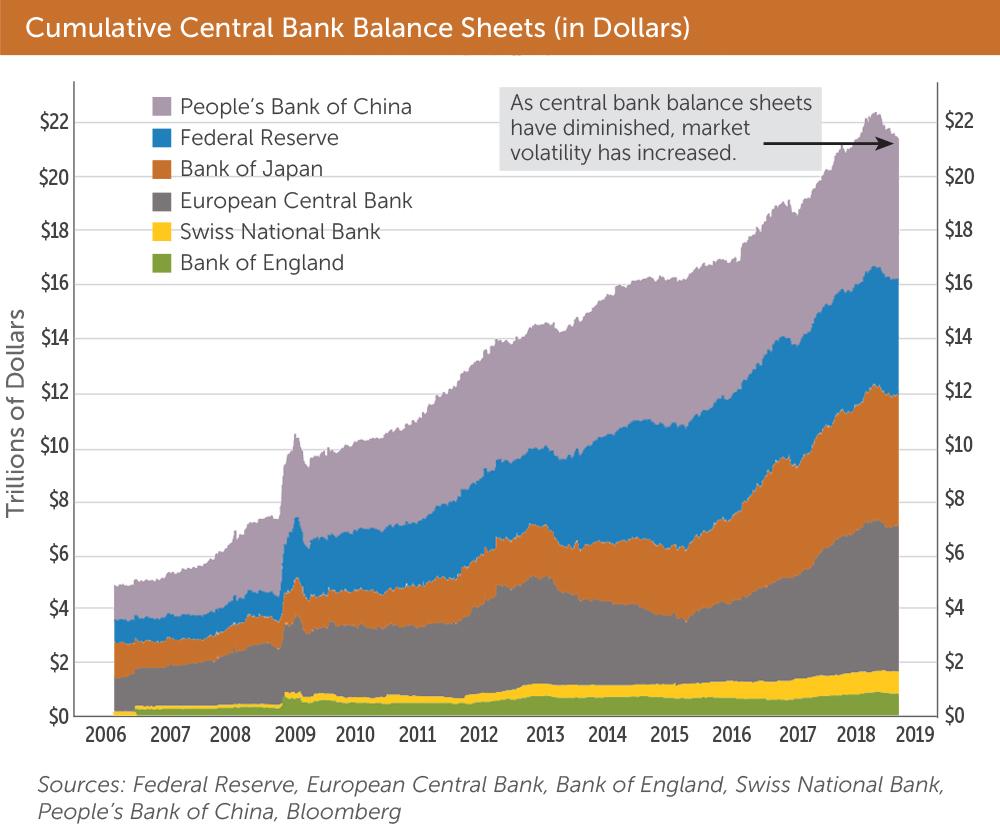

But the driving force behind today’s multiple expansion has been the relentless expansion of global central bank balance sheets since the outbreak of the financial crisis nearly a decade ago. Overall, global central bank balance sheets have expanded from just over $5 trillion prior to the crisis in 2007 to nearly $22 trillion today.

There is little doubt we are currently in a bull market. But as with all things, despite hopes from the mainstream media to the contrary, they do come to an end. This should be of no real surprise to anyone that has managed money for any length of time.

But here is the most important point for investors.

The speculative asset chase over the last decade, which is a direct result of Central Bank activity, has locked investors into a period of near zero prospective total returns in virtually in every asset class for the coming decade.

Read that again.

-

The 1999-2000 Dot.com bubble was about technology stocks. (7-Years to breakeven)

-

The 2007-2008 debacle was centered around real estate and subprime debt. (7-years to breakeven)

-

The 2020, or whenever it occurs, scenario will involve multiple bubbles in stocks, corporate debt, and real estate.

There is little doubt that we are in both the late stages of an economic cycle and a momentum driven market. Therefore, investment focus must be adjusted to current market dynamics that requires a focus on relative strength and momentum as opposed to valuation-based strategies.

There have been many studies published that have shown that relative strength momentum strategies, in which as assets’ performance relative to its peers predicts its future relative performance, work well on both an absolute or time series basis. Historically, past returns (over the previous 12 months) have been a good predictor of future results. This is the basic application of Newton’s Law Of Inertia, that states “an object in motion tends to remain in motion unless acted upon by an unbalanced force.”

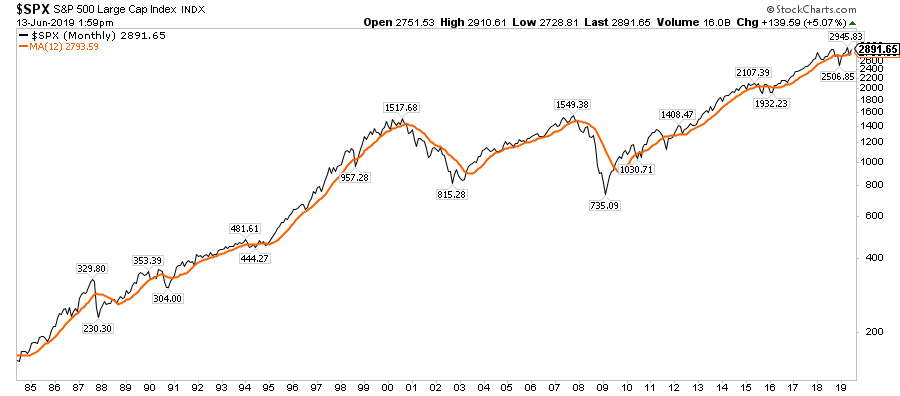

The chart below shows a simple example of a strategy using the 12-month moving average. The theory is you are long equities when the S&P 500 is above the 12-month moving average, and in cash when below it.

Momentum strategies, which are trend following strategies by nature, have been proven to work well across extreme market environments, multiple asset classes and over historical time frames.

Unfortunately, few investors can actually use such a system for the following reasons:

-

Investors are slow to react to new information (they anchor), which initially leads to under-reaction but eventually shifts to over-reaction during late cycle stages.

-

Investors are ultimately driven by the “herding” effect. A rising market leads to “justifications” to explain over-valued holdings. In other words, buying begets more buying.

-

Lastly, as the markets turn, the “disposition” effect takes hold and winners are sold to protect gains, but losers are held in the hopes of better prices later.

The end effect is not a pretty one.

By applying momentum strategies to fundamentally derived investment portfolios it allows the portfolio to remain allocated during rising markets while managing the inherent risk of behavioral dynamics.

It is just really hard to do because of the “psychological pull” from the markets and the media.

However, this is why, despite the fact that I write like a “bear,” the portfolio model has remained allocated like a “bull” during the market’s advance. Our job is simple, make money for our clients when markets are rising and avoid potentially catastrophic losses when trends change.

Maintaining your portfolio through a disciplined investment process will reduce risk and increase long-term profitability. With markets currently hovering near all-time highs, despite a continuing erosion of underlying fundamental and technical strength, the risk/reward ratio remains out of favor.

-

Tighten up stop-loss levels to current support levels for each position.

-

Hedge portfolios against major market declines.

-

Take profits in positions that have been big winners

-

Sell laggards and losers

-

Raise cash and rebalance portfolios to target weightings.

Eventually, this cycle does end, and the reversion process back to value has historically been a painful one.

But the important point is that you shouldn’t “fear” bear markets.

They are just part of the investment cycle and are required for the next “great bull market” to begin.