US equity futures are set to continue the post-Christmas rally, boosted by both a record liquidity injection in China overnight…

… and a pair of earnings from Bank of America and Goldman which were “not as bad” as some had expected, but the key catalyst for the continued upside now that the S&P has risen above the key resistance level of 2,600 may be the equity “force-in” which as we discussed previously commenced yesterday, as systematic trend funds reduced their prior “Max Short” positions in SPX, NDX and SX5E through meaningful notional buying (and following the prior day’s covering in “Max Shorts” in Russell 2k, DAX, FTSE, Hang Seng, ASX and KOSPI as well), with CTA Equities trades now sized-down to a smaller “-82% Short” position according to Nomura’s Charlie McElligott.

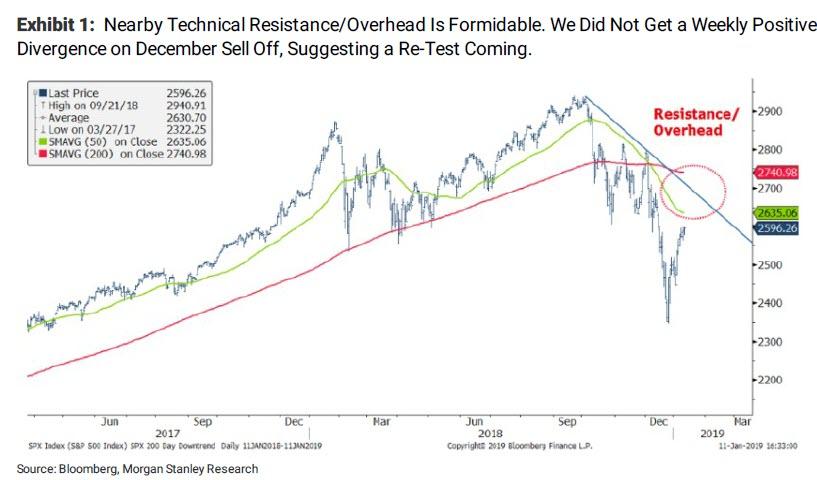

As the Nomura strategist continues, with some systematic investors still on the fence about joining in the rally as we pointed out on Tuesday, the performance of equities continues to dictate the overall cross-asset sentiment, with the sliding VIX and “macro calm” provided by EPS season critical in maintaining this rally and further perpetuating this scramble back into adding exposure (gradually increasing net- and gross- hedge fund exposure) from the fundamental/discretionary side of the universe — and as McElligott observes, so far investors are increasingly comfortable “buying the lowered bar” following the powerful negative earnings revision impulse, although macro traders and risk parities continue voicing a desire to “short the rally,” currently identifying the 2630-35 area (50% retrace of SPX 1Y move and 50DMA) as the next key resistance zone.

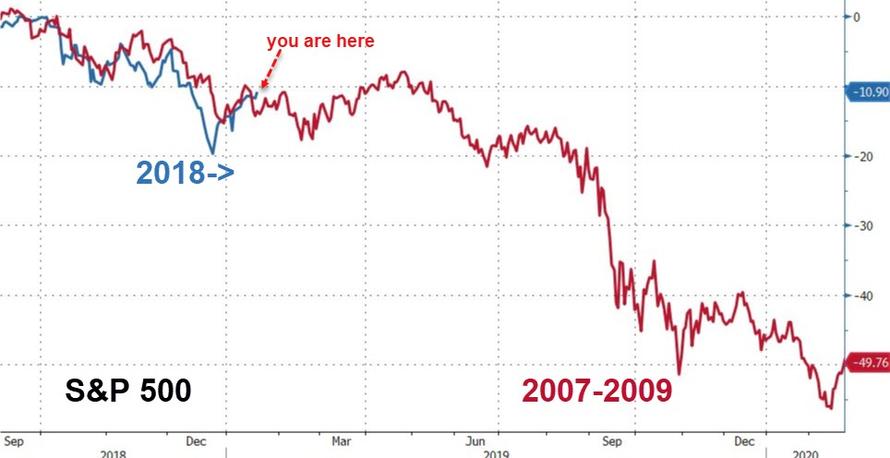

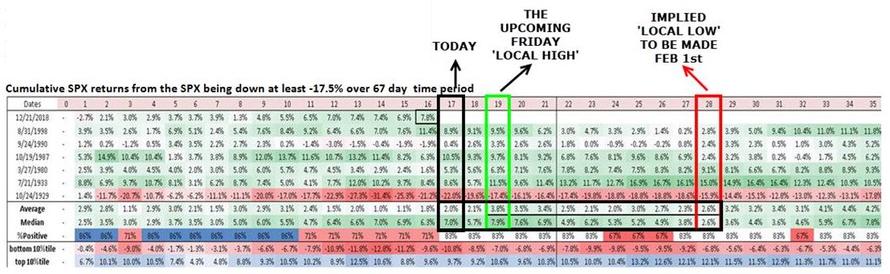

So while the technicals (as one unexpected Trump tweet could bring chaos back in a hurry) suggest there appears to be nothing but smooth sailing ahead for the next 20 or so point in the S&P, storm clouds may be gathering, and as Nomura once again cautions, it is worth noting from a “tactical sequencing” perspective the bank’s Sep 2018-Jan 19 S&P “comp” to the Oct 2007-Oct 08 analog (highest correlation btwn current environment and prior “trigger dates” of -17.5% SPX selloff in 67 days or less)…

… would suggest that Friday could mark a “local high” in SPX before resumption of a -5% selloff over the 9 sessions thereafter… before then commencing another extended rally thereafter (see day count table below)

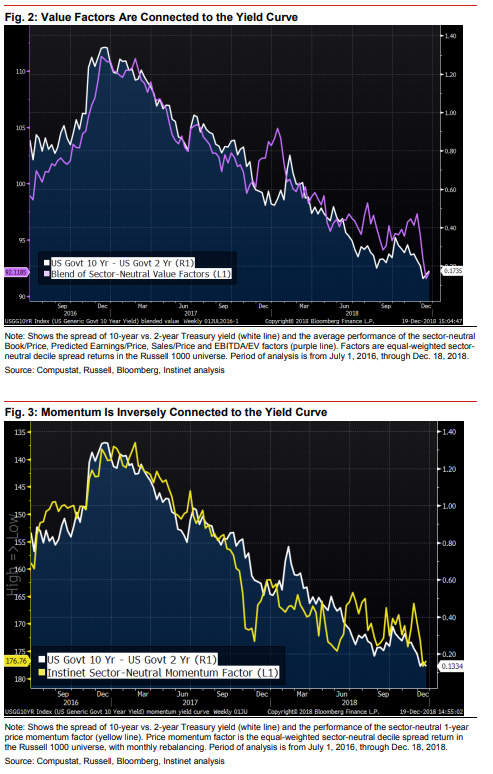

Meanwhile, having previously warned to “Fear the Steepener“, which is far more ominous than continued flattening, McElligott notes that US Rates are modestly “bear-steepening” today on the continued risk-asset rally/easing of the late Dec “stress” conditions as central banks ride to the rescue (PBoC liquidity injection overnight, and yesterday’s Draghi comments that stimulus is still needed in the Euro Area—all on top of the now consensually voiced “Fed Pause” into at least Summer via the last two weeks’ worth of speakers)

To the Nomura strategist, this “steepening” behavior in the yield curve will likely dictate the terms of trade for US Equities factors as the post-GFC period regime has seen steepening correlated to outperformance of “Value-”/underperformance of “Growth-” and “Momentum-” factors in US Equities.

Going back to the warning about the Lehman analog, many traders could ask what if anything could spark another market-wide risk revulsion, to which McElligott offers one possible answer: China, which he sees as transition to “spasm” as the economic data is set to get much worse in 2019. He explains:

Just as we have suspected with regard to the response of Chinese authorities in addressing their economic slowdown and credit crunch, “it had to get worse before it got better”—recently collapsing Chinese data has now clearly forced an escalation of easing-/stimulus-/ liquidity- policies.

Sure enough, as we noted overnight, the annual PBoC liquidity injection to offset the pre-Lunar New Year holiday-/pre-tax payment peak- / maturation of MLF funds-cash drain went “full mental” – as Nomura calls it – last night, with the Chinese central bank injecting a record 560B Yuan ($84B USD) into the system using 7d reverse repo operations—the largest 1d cash injection in their history.

This happens as Chinese Premier Li calls for more investments in infrastructure and services, while also voicing support for a “stepping-up” of targeted economic controls from authorities. It also comes after the “unified front” two days ago in a press conference between the PBoC, the MoF and the NDRC where new tax cuts, fresh measures to stabilize auto consumption and an announcement that authorities are supportive of increasing issuance of local government “special bonds” to stimulate infrastructure spending were all made in a “stimulus” spasm.

Finally this short-term liquidity injection adds to the larger “credit impulse” being re-engineered by Chinese authorities, which on the headline level came in as “better than consensus” estimates across new aggregate social financing & new loans.

In other words, while China is scrambling to offset the adverse effects of ongoing deleveraging, the question is whether or not it will succeed, with the risk of course being that continued trade war and economic slowdown spills over into other risk assets. So keep an eye on both news out of China and the Lehman analog chart for clues if the torrid last December, early January rally is about to peak in just two days and roll over once again, as Morgan Stanley also predicted earlier this week, would happen.

.jpg)