Mixed bag in stocks today (mega-tech bid, rest of market offered) but Bitcoin grabbed the headlines as it overtook Nasdaq’s performance in the last 12 months…

Source: Bloomberg

And longer-term, it’s not TSLA…

Source: Bloomberg

Nasdaq outperformed and the machines tried desperately to get the S&P green on the day. Small Caps and The Dow lagged…(NOTE, everything slid into the close after Trump said “Your 401(k)s, down the tubes. Look how great our stock market – – had a little blip yesterday because Nancy Pelosi will not approve stimulus, that’s all,”)…

Nasdaq manage to hold its bounce above the 50DMA but S&P and The Dow did not…

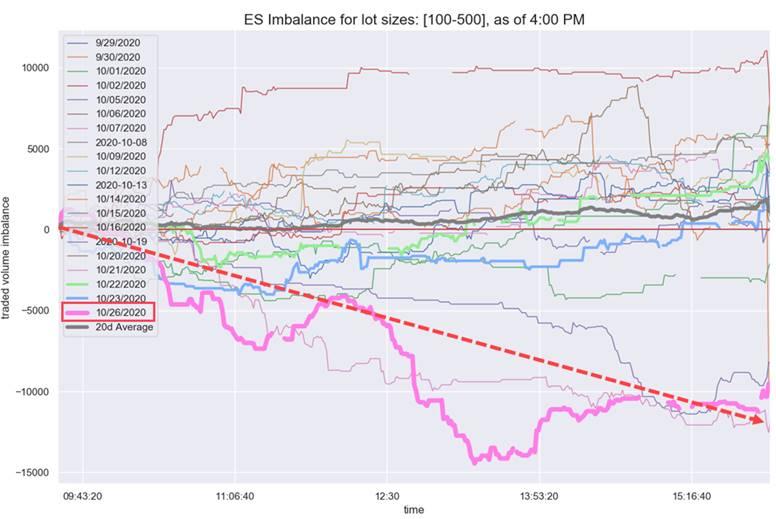

As we noted earlier, we have seen persistent “large lot” selling and “small lot” dip-buying…

Will everyone follow each other’s tracks down too?

Europe was ugly again today as lockdown threats escalated (no bounce)…

Source: Bloomberg

YTD, China (SHCOMP) still leads the US (Nasdaq is outperforming but S&P seems more appropriate) as Europe (DAX) dumps…

Source: Bloomberg

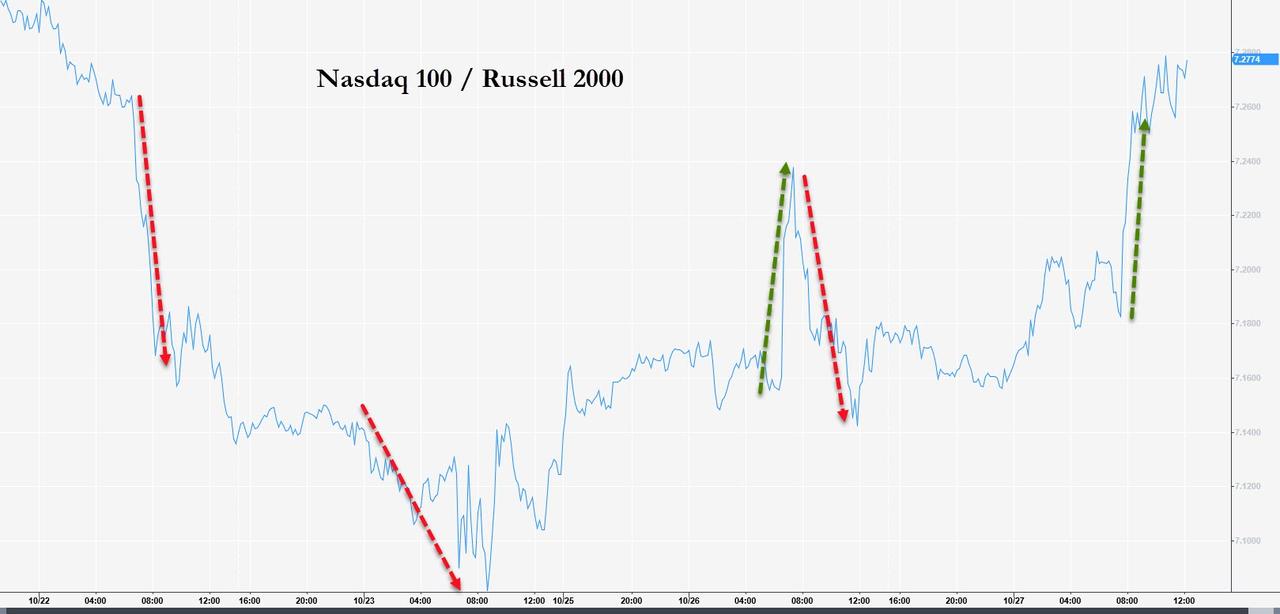

Nasdaq surged relative to Small Caps once again…

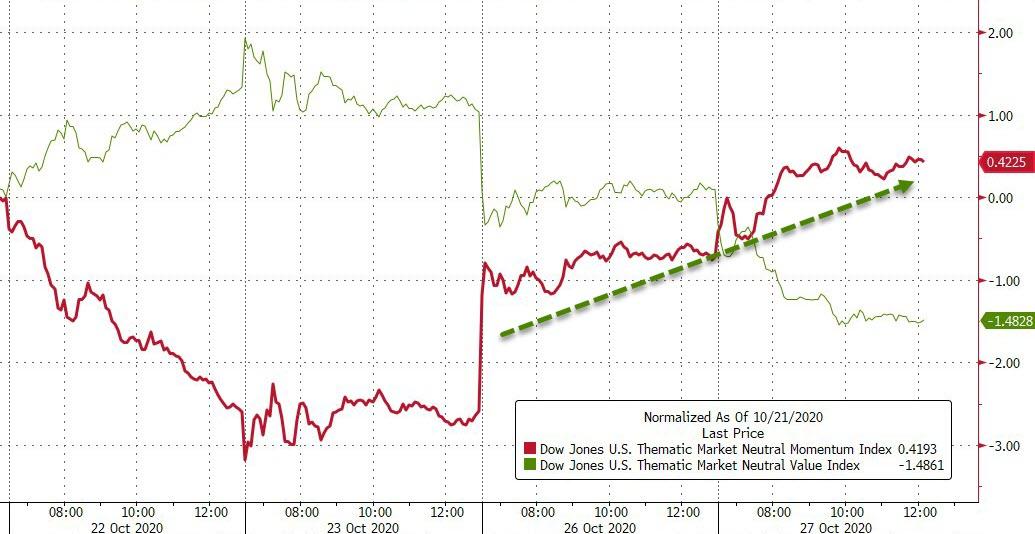

Momentum continued to rebound as Value lagged…

Source: Bloomberg

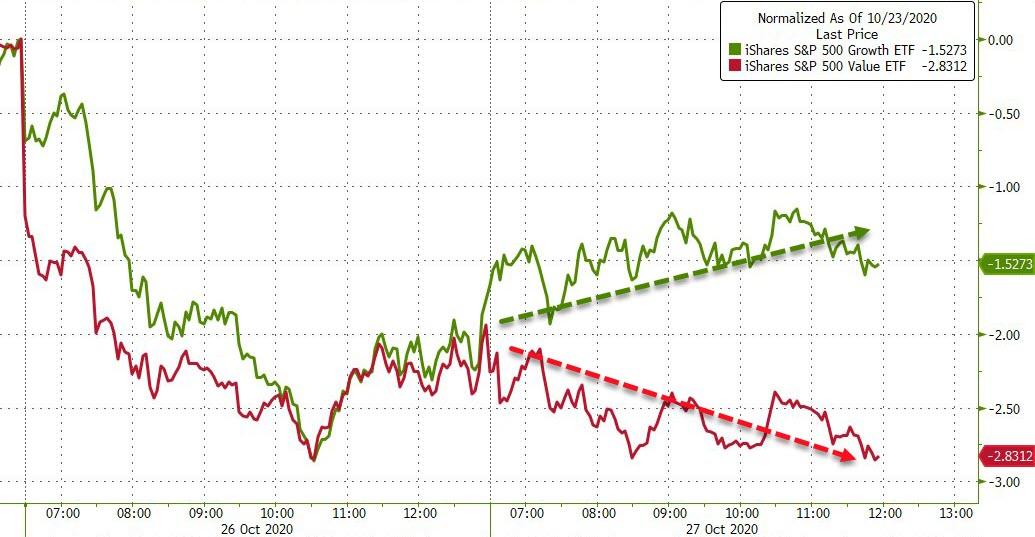

Some rotation today with value dumped as growth rebounded modestly…

Source: Bloomberg

Semis were marginally lower on the day after the AMD/XLNX deal…

Source: Bloomberg

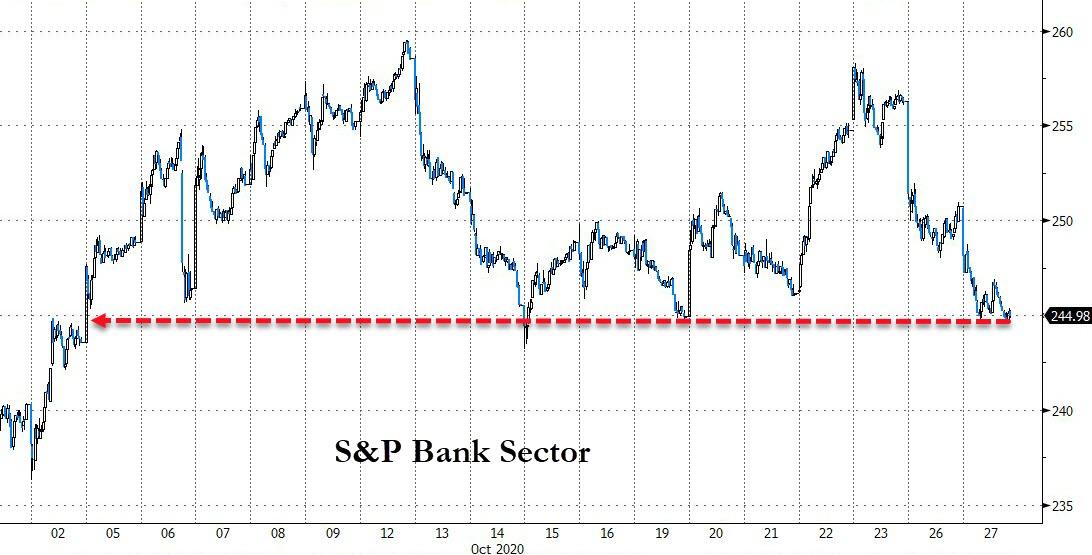

Bank stocks sank again today…

Source: Bloomberg

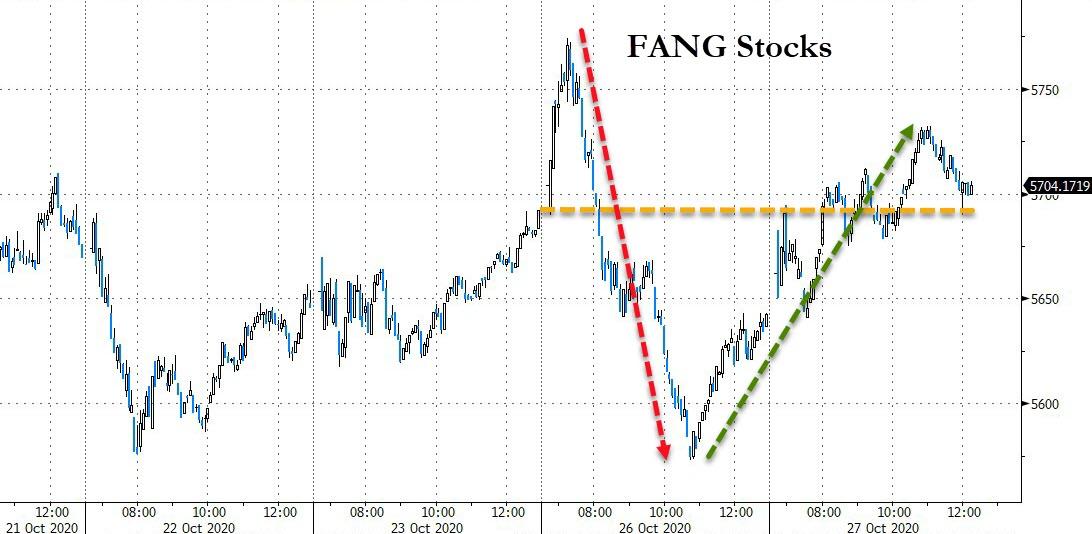

FANG stocks erased yesterday’s losses…

Source: Bloomberg

Meanwhile, HOG had its best day ever as the machines ran the stops to the pre-COVID levels…

VIX was higher on the day, signaling more pain to come for stocks…

Source: Bloomberg

Bond yields fell for the 3rd day in a row with the curve flattening significantly (2Y -0.5bps, 30Y -11bps)…

Source: Bloomberg

With 10Y back to 76bps intraday…

Source: Bloomberg

Real Yields tumbled back in line with gold today…

Source: Bloomberg

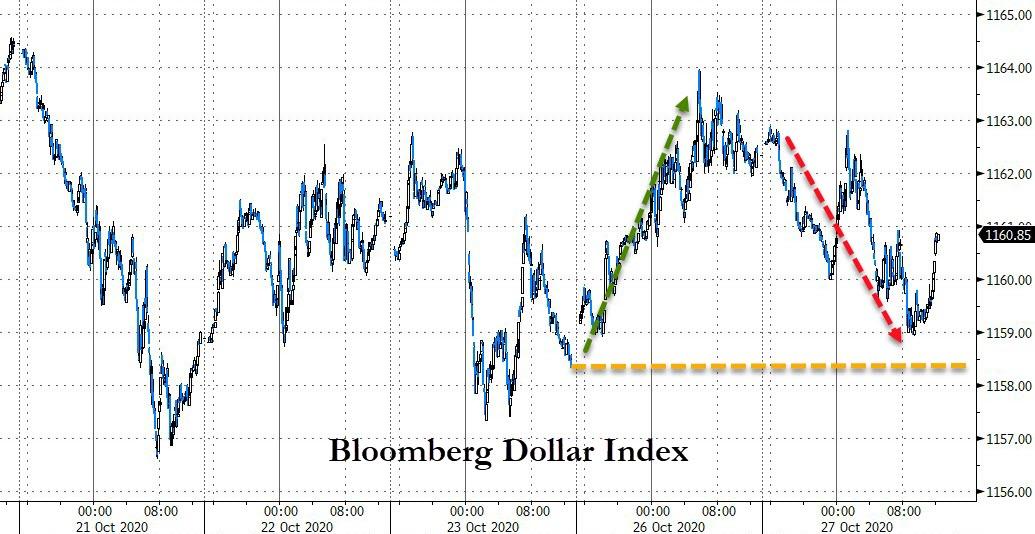

The dollar leaked lower today…

Source: Bloomberg

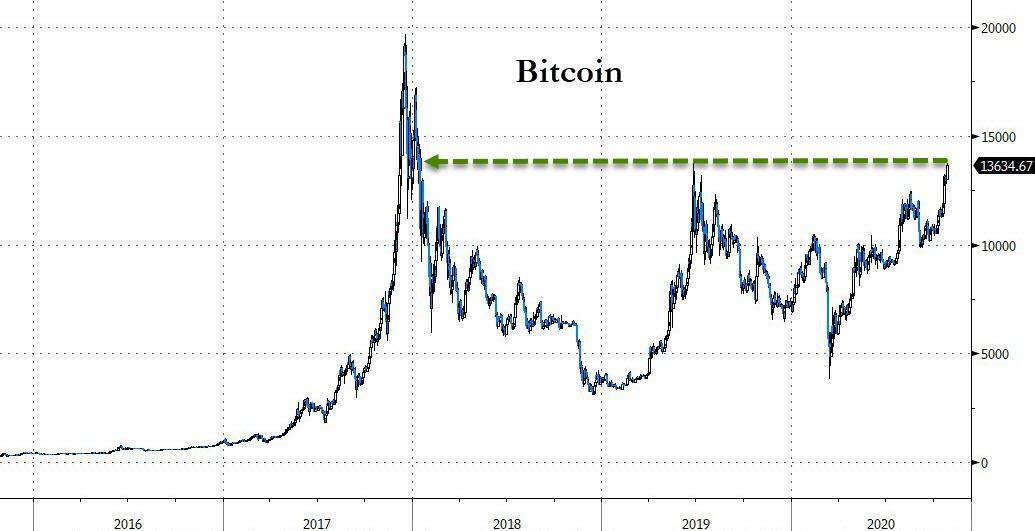

Cryptos were mixed today with Bitcoin leading, now up over 20% in the last 10 days…

Source: Bloomberg

Bitcoin surged above $13,500, its highest close since Jan 2018…

Source: Bloomberg

Oil prices rebounded from yesterday’s weakness but WTI failed to get back to $40 ahead of tonight’s API inventory data…

Gold futures rallied off $1900…

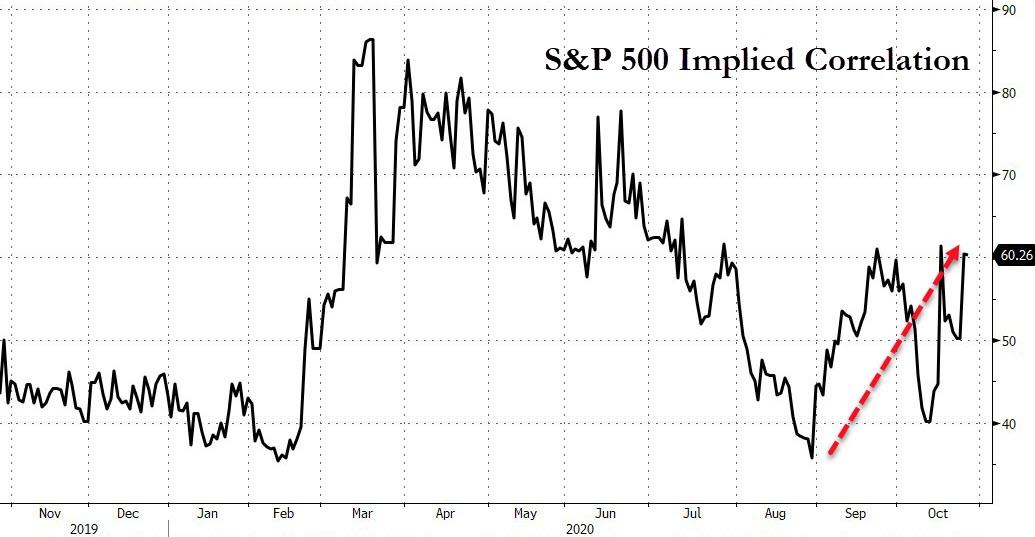

Finally, we note that implied correlation is on the rise suggesting investors are piling into protective macro overlays ahead of the election (as opposed to individual stock hedging), expecting a systemic re-rating of stocks…

Source: Bloomberg