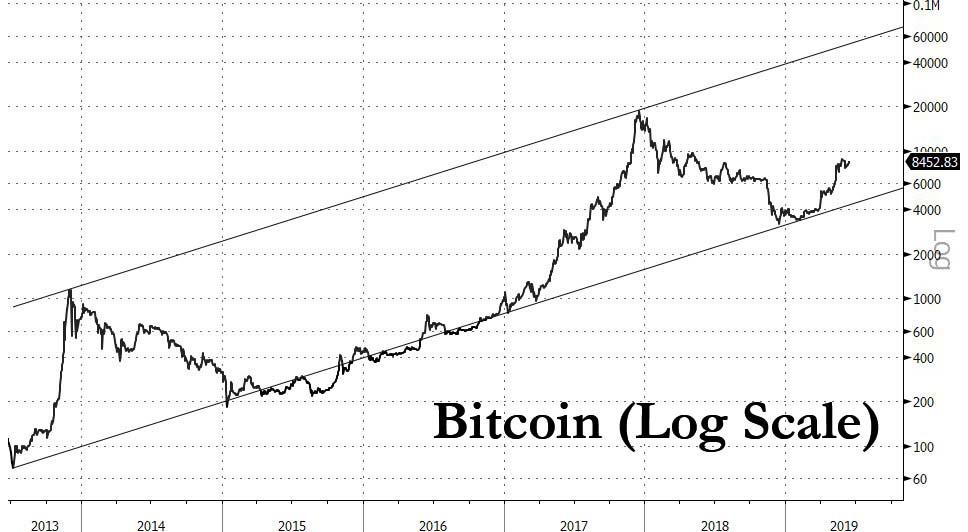

The recent surge in bitcoin, and the entire cryptocurrency space accelerated over the weekend, coinciding with the latest massive protest in Hong Kong which may be among the catalysts for the aggressive buying, and sending bitcoin above $9,000 for the first time since May 10, 2018, a price that is almost triple where bitcoin traded at the start of the year, making it the best performing major asset class of 2019, with a market cap of $163 billion.

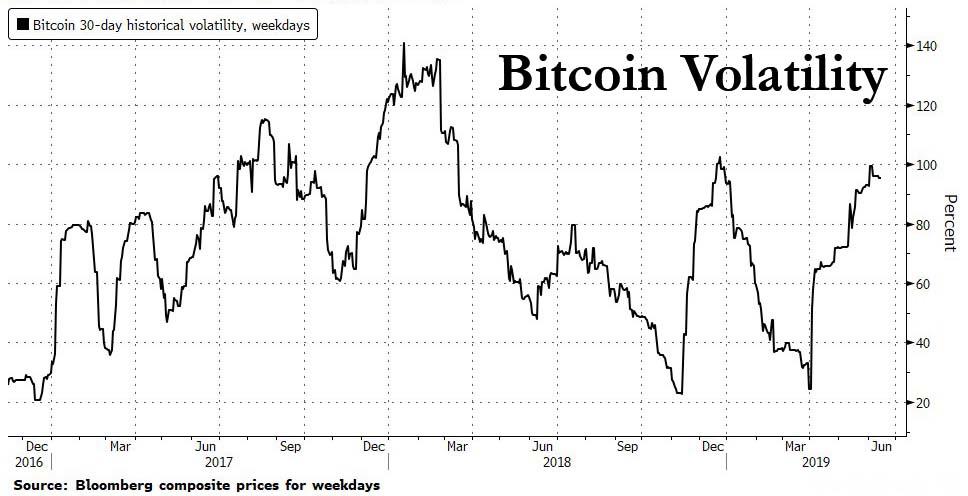

And as the price of bitcoin surge, naturally so does its volatility, which has quadrupled from its near all-time lows hit at the start of April to 95 for the 30-day historical vol, in the process making it once again a favorite of traders desperate for highly-volatile assets.

It’s not just Bitcoin’s volatility that has returned: so have volumes as what appears to be the latest reflation of the bitcoin bubble is drawing in investors from around the globe, hoping to make a quick profit. Only this time there is one major difference as JPMorgan explains.

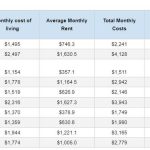

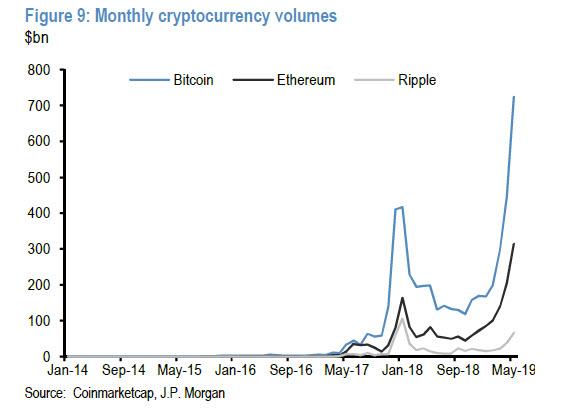

According to JPMorgan’s Nikolaos Panigirtzoglou writes, there has been a sharp increase in reported trading volumes of Bitcoin and other cryptocurrencies over the past few months, with Bitcoin trading volumes on crypto exchanges increasing to $445bn in April from a 1Q19 average of $220bn per month, and in May volumes increased further to around $725bn. This compares to previous peak volumes in Dec17 and Jan18 of $420bn. Curiously, for the three largest three cryptocurrencies by market capitalization, Bitcoin, Ethereum and Ripple, the combined volumes for May stand at above $1tr compared to a previous peak in Jan18 of around $685bn, suggesting that all else equal, there is an even greater interest in the crypto space .

Meanwhile, this development comes at a time when the market value of outstanding bitcoins is around half of its Dec17 high, and the combined market value of all crypto currencies is around a third of its previous high. While a substantial part of the increase in volumes in dollar terms reflects an increase in the market value of bitcoin and other crypto currencies, the volumes in bitcoin terms are also significantly above their previous peaks.

But there is more here than meets the eye.

As JPM explains, taken at face value, this volume surge would suggest a dramatic increase in cryptocurrency activity. But over the past year or so, concerns have increasingly been expressed over how authentic the reported volumes really are. To wit:

… recently published work by Bitwise, a cryptocurrency asset manager, to the SEC as part of an application for a bitcoin ETF suggests that bitcoin trading volumes on many cryptocurrency exchanges are significantly overstated by ‘fake’ trading, e.g. exchanges reporting volume of trades that never took place or via wash trades, and that genuine trading volumes could be around 5% of the reported total. Similarly, the Blockchain Transparency Institute publish monthly market surveillance reports, and estimated in April 2019 that less than 1% of reported volume for some exchanges represented real trades.

If these estimates of the proportion of real trades are correct, i.e. “that only around 5% of trading is genuine,” that would imply that the genuine volumes of Bitcoin trading on cryptocurrency exchanges in May were around $36bn, rather than $725bn.

If this sharp revision in actual trading volumes is accurate, a critical implication, beyond the fact that the actual market size is markedly lower than reported numbers would suggest, is that as JPM notes, “the importance of the listed futures market has been significantly understated.” According to the Bitwise report, traded futures are credited as an important development in allowing short exposures that enabled arbitrageurs in properly engaging in arbitrage (and also resulted in a massive squeeze at the start of April that sent bitcoin breaking out again, and which we discussed previously), and that the futures share of spot bitcoin volumes increased sharply in April/May.

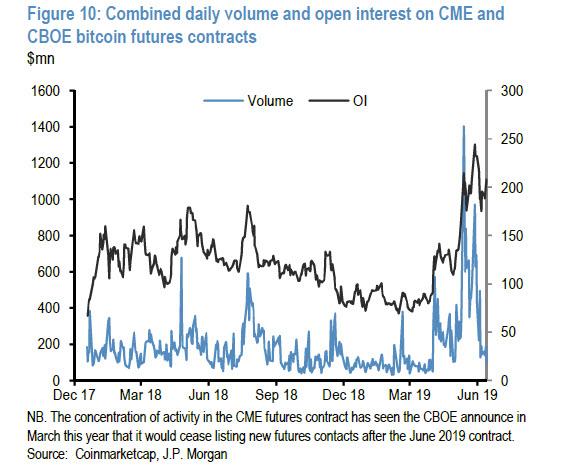

Indeed, when looking at aggregate volumes on both the CME and CBOE futures contracts (shown below), JPM estimates around $12bn of traded volume on these two futures exchanges in May. Indeed, the $12bn of bitcoin futures trading volume in May also represented a significant increase on the April’s $5.5bn and a 1Q19 monthly average of $1.8bn, suggesting that some rise in trading volume was genuine, even if the total volumes on cryptocurrency exchanges was likely vastly overstated.

The conclusion to this overstatement of trading volumes by cryptocurrency exchanges, and by implication theunderstatement of the importance of listed futures, suggests that in the two years since bitcoin’s last major spike in 2017 the “market structure has likely changed considerably… with a greater influence from institutional investors.”

This also means that whereas bitcoin’s historic surge to its all time high of $20,000 in December 2017 was largely retail driven, and thus extremely fickle as the subsequent crash showed, this time it is largely the result of institutional buying, which is far more stable and far less prone to sudden, painful shifts in sentiment and volatility.

In other words, “this time may be different” for bitcoin in a good way: because with institutions now piling into the crypto space, this is precisely the investor group that bitcoin bulls wanted from the beginning as it creates a far more stable price base for the future. Add to this the potential return of retail buying from east Asian (or even US) retail clients, and it is possible that what we predicted in early April, namely that the 3rd bitcoin bubble is starting…

… may soon be confirmed, and that the next bitcoin bubble peak will be somewhere between $60,000 and $100,000.

https://platform.twitter.com/widgets.js

Source link