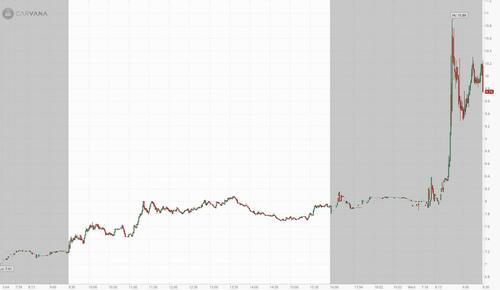

Carvana, one of the high-flying stocks during the post-covid lockdowns which came crashing down to earth almost as fast at is soared, is surging this morning, rising as much as 30% after the FT first reported, and the company then confirmed, that it was offering to exchange billions of bond principal at below-par prices as the struggling online car seller works to restructure its debt load.

The company is offering to swap five series of bonds, including its 5.625% unsecured notes due 2025 and 10.25% unsecured notes due 2030 for new secured notes due 2028 that pay 9% in cash or 12% in-kind, according to a statement Wednesday. The company would swap the existing bonds maturing between 2025 and 2030 for between 61.25 cents on the dollar and 80.875 cents on the dollar, depending on when they submit the notes. The early deadline for the swap, which offers the best terms for investors, is 5 p.m. on April 4 in New York. The bondholders would have a second priority claim, behind lender Ally Financial, on vehicle inventory and intellectual property including Carvana’s brand.

If successful, the company will restructure a substantial portion of its $9BN debt load as it attempts to stay afloat at a time of declining vehicle sales. If the offering is fully subscribed, the exchange offer to existing creditors would reduce the face value of its outstanding $5.7bn of unsecured bond debt by $1.3bn and its annual cash interest bill by roughly $100 million.

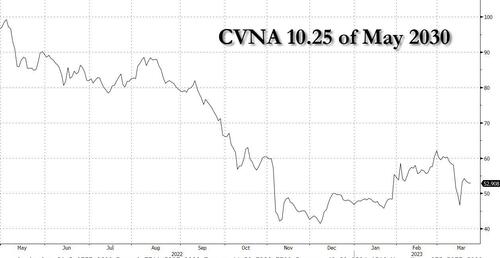

The exchange comes as Carvana deals with deeply distressed debt and plunging shares. The company’s stock soared during the pandemic as a chip shortage sent used car prices soaring, but Carvana’s outlook has since crashed, losing over 94% of its value since peaking in August 2021. It also posted a bigger-than-expected loss in February following its lowest retail unit sales in two years.

Carvana’s 10.25% bond due 2030 last changed hands at 53 cents on the dollar, according to Trace.

The Financial Times has previously reported that at least six prominent credit investment firms have joined forces to negotiate with Carvana. According to a person familiar with the situation, there has not been much interaction between the company and its bondholders. One prominent member of the group, Apollo Global Management, which had bought $800mn in bonds issued by Carvana in 2022 at par, would take a significant loss should it decide to participate in the restructuring.

Participation is voluntary and Carvana says that for the deal to close, at least $500mn of new debt will have to be issued. The kind of restructuring the company is proposing can often serve as a prelude to the renegotiation terms or an entirely different agreement.

Carvana released preliminary first-quarter results alongside the terms of the exchange, which showed that a cost-cutting plan — including a reduction in headcount from 21,000 to 17,000 over the past year — is starting to bear fruit as the company’s massive cash burn is starting to shrink, with EBITDA expected to come between ($50MM) and ($100MM), an improvement to the ($348MM) EBITDA one year ago. Some more details:

- For the three months ending March 31, 2023, we expect retail units sold to be between 76,000 and 79,000 units, compared to 105,185 retail units sold for the three months ended March 31, 2022. This reduction in retail units sold is primarily driven by higher interest rates, lower inventory size, lower advertising expense, and our focus on profitability initiatives.

- For the three months ending March 31, 2023, we expect total net sales and operating revenues to be between $2.4 billion and $2.6 billion, compared to total net sales and operating revenues of $3.5 billion for the three months ended March 31, 2022. The decrease in total net sales and operating revenues is primarily driven by the reduction in retail units sold.

- For the three months ending March 31, 2023, we expect gross profit, non-GAAP to be between $310 million and $350 million, compared to gross profit, non-GAAP of $314 million for the three months ended March 31, 2022. The change in gross profit, non-GAAP is primarily driven by higher total gross profit per retail unit sold offset by lower retail units sold.

- For the three months ending March 31, 2023, we expect total gross profit per unit, non-GAAP to be between $4,100 and $4,400, compared to total gross profit per unit, non-GAAP of $2,985 for the three months ended March 31, 2022. The increase in total gross profit per unit is due to higher retail gross profit per unit, primarily driven by the benefit of a lower inventory allowance adjustment, higher wholesale gross profit, primarily driven by strong wholesale market demand and price appreciation, and higher other gross profit, primarily driven by higher finance receivable, principal sold.

- For the three months ending March 31, 2023, we expect SG&A, non-GAAP to be between $400 million and $440 million, which excludes approximately $55 million of depreciation and amortization expense and $15 million of share-based compensation expense, compared to SG&A, non-GAAP of $662 million, which excludes $37 million of depreciation and amortization expense and $28 million of share-based compensation expense, for the three months ended March 31, 2022. The reduction in SG&A, non-GAAP is primarily driven by our continued focus on operating efficiency and reduced advertising spend.

For the three months ending March 31, 2023, we expect Adjusted EBITDA to be between $(50) million and $(100) million, compared to Adjusted EBITDA of $(348) million for the three months ended March 31, 2022. The improvement in Adjusted EBITDA is primarily driven by reduced selling, general, and administrative expenses and higher total gross profit per unit, partially offset by lower retail units sold.

Carvana’s market capitalization soared to nearly $50bn in 2021 after customers flush with stimulus cash flocked to its website and vending machines when a global chip shortage and supply chain problems had resulted in a dearth of new vehicles. It sold 425,000 cars that year, up from 245,000 in 2020.

The stock jumped as much as 30% this morning following news of the proposed exchange offer.

Loading…