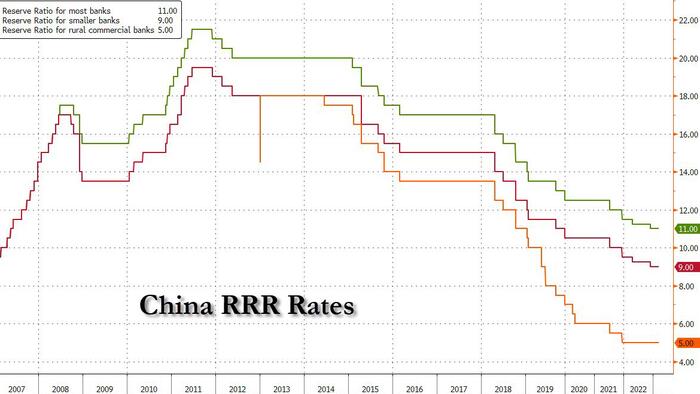

Early Friday, China’s central bank surprised by announcing an unexpected cut to the amount that banks set aside for deposits by 25 basis points, vowing to keep ample liquidity in the interbank system and better fund the real economy.

The People’s Bank of China reduced the reserve requirement ratio for almost all banks by 0.25 percentage points, effective from March 27, it said in a statement on Friday. The PBOC last cut the RRR in December, by the same magnitude. The cut, effective March 27, is expected to inject 500 billion yuan ($72.6 billion) worth of liquidity into the market, while the average reserve requirement ratio of Chinese financial institutions will be lowered to 7.6 per cent.

The RRR cut comes just days after China’s new government took office and the freshly inaugurated Premier Li Qiang pledged to achieve an annual economic growth target of around 5% this year.

“The PBOC will keep monetary policy targeted and powerful,” the central bank said in a statement adding that “We’ll provide better support for key areas and weak links, refrain from a big stimulus … and concentrate on pushing for high-quality development.”

Economists said the cut was aimed at ensuring liquidity in the banking system to sustain the rapid pace of lending seen in January and February, yet which led to modest economic results as discussed earlier this week.

China’s consumer spending and investment rebounded in the first two months of the year after pandemic restrictions were dropped in December, according to recent official data. But the recovery remains uncertain, with unemployment still elevated, property investment continuing to contract and falling exports dragging on industrial output.

“It seems that the central bank is not going to slow the pace of credit growth as people feared,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd.

The timing of the cut could be due to concerns that credit growth could slump in April, following the completion of financing for a number of government-led investment projects early this year, Xing added. The yuan pared an advance of as much as 0.6%, trading 0.1% stronger at 6.89 in the onshore market after the PBOC’s move.

Here are some snap reactions by economists and commentators, courtesy of Bloomberg:

Niu Chunbao, a fund manager at Shanghai Wanji Asset Management:

“The decision by the Chinese central bank to cut reserve requirement ratio signals that authorities are focused on supporting growth, not an indication of any problems in the economy. It could also be meant to give the market a boost after the poor performance in growth stocks this year. I don’t feel excited on the news as the main challenge this year is exports, and liquidity isn’t going to help much on that front”

Huang Yuhang, Fund manager at Lanqern Capital

“I don’t think this has much to do with fears about the banking stress, but rather the recovery seems to need a bit of help, judging by the economic figures this week. The key impediment to the recovery is demand still being weak, as confidence for incomes is still fragile, so liquidity hasn’t been the issue for the economic recovery, hence the market may or may not buy it”

Mingze Wu, a FX trader at StoneX Group in Singapore

“Given that global banks are now on defensive and liquidity is at premium, it make sense for PBOC to start getting ready before real problem arise. Likely Chinese banks have been affected by their bond portfolio losses just like the US bank albeit the impact will be lower but nonetheless still significant since you can’t escape US market”

Xiadong Bao, fund manager at Edmond de Rothschild Asset Management

“The Jan-Feb macro data indicates the recovery is well under way, while the early March high frequency data we’ve seen so far showed a certain weakness, which triggered recent market concerns on a weaker-than-expected recovery. This cut shows the strong commitment of PBOC to support the growth recovery in 2023, especially in the backdrop of a complicated exterior environment”

Mitul Kotecha, head of emerging-markets strategy at TD Securities

“The timing of the cut is a little surprising given the strength of recent data but it is consistent with recent comments by PBOC governor Yi Gang when he highlighted that cuts in the RRR would be an effective way to add liquidity. This is unlikely however, to translate into a cut in Loan Prime rates next week in our view but it does add further, albeit limited support to the economy. CNY trimmed gains on the news but overall we expect the currency to track USD gyrations, with some weakness on a trade weighted basis likely”

Fiona Lim, senior foreign exchange strategist at Malayan Banking Bhd. in Singapore

“A RRR cut at this point will not undermine the yuan much given that it is somewhat expected. USD has also been under pressure with a 25bps hike by the Fed already priced to a significant extent. USDCNH pairing is likely to remain within the 6.83-7.00 range barring fresh signs of bank stress in Europe”

Steven Leung, executive director, UOB Kay Hian

“The global banking crisis, even though it’s been stabilized after the major banks injected money into the banking system but still the situation isn’t yet over. So we really need some more liquidity in the global financial markets since China is in a different cycle – they’ve been loosening the policy. And secondly, if you look at the economic data released in February, it didn’t provide any surprise to the markets. So maybe Beijing recognizes the pace of the recovery is not as strong as they expected”

Shen Meng, director, Chanson & Co.

“China’s CPI is still low, which gives room for adjustment in monetary policy. The increase between M2 money supply and social financing is still notable. The 0.25 percentage cut can inject approximately 500 billion of long-term funds in order to support fiscal expenditure, which would fund state-owned enterprises’ investments. And with expectations of the Fed’s continued rate hikes, this move ensures stable market flows”

Sofia Horta E Cots, Bloomberg Analyst

Ah the classic late Friday RRR cut out of China. This is essentially a cash injection into the financial system — or dare we call it a bit of monetary stimulus. The RRR cut is one of the cheapest types of liquidity the People’s Bank of China can offer banks because it’s not a loan and carries no interest rate (unlike like the MLF or reverse repos instruments.) The PBOC, which also repeated a pledge to not flood the market with liquidity, is trying to keep borrowing costs low across the economy to aid the recovery from Covid Zero. It’s trying to do that without engaging in large-scale stimulus because of Beijing’s obsession with financial risks. Inflation, rapid rate hikes and bank failures are not on President Xi Jinping’s wishlist. Chinese banks are looking relatively resilient right now, as I wrote here. So is the PBOC also getting ahead of a potential spillover of financial-sector stress from the US and Europe? You never know with China’s monetary policy, but the timing is certainly interesting

The yuan pared an advance of as much as 0.6%, trading 0.1% stronger at 6.89 in the onshore market after the PBOC’s move. The move also helped push commodities higher.

Loading…