In his latest note, which we covered on Friday, JPMorgan Marko Kolanovic discussed how much higher he thinks 10Y yields can rise “before they become a potential problem” for stocks (his answer: 150bps, although an even more important question is how fast they get there, and lately they have been surging).

The JPM quant also explained why he thinks stocks are primed to rise further from current levels: in short, an unwind of the massive defensive “recession is coming” trade that defined much of 2019, as active managers rush to dump losers and scramble to make up for underperformance in the last 7 weeks of the year, in the form of a “chasing beta” rotation, to wit:

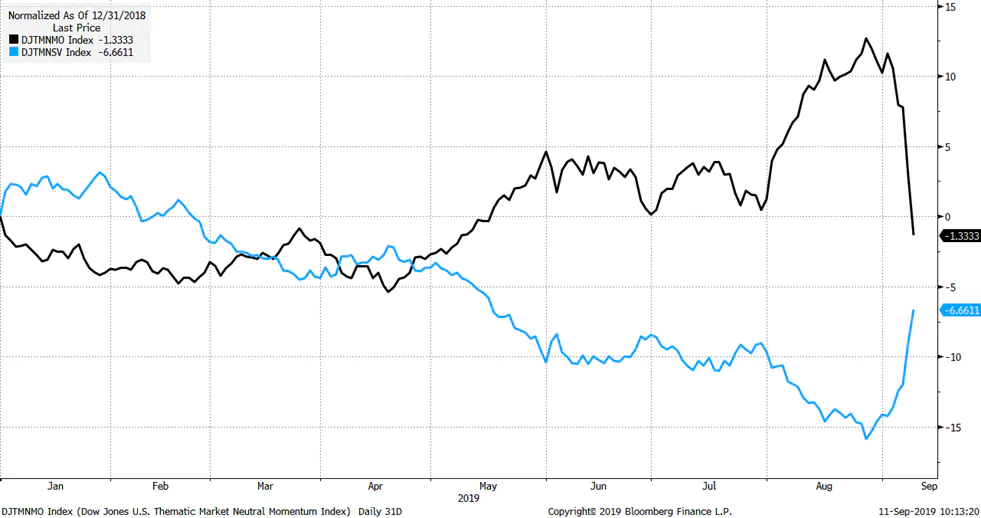

There is still extreme crowding in defensive styles and momentum that we illustrated in our previous reports. An additional illustration is shown in Figure 1 below. It shows two strategies that in theory should have little to do with each other: one is equity long-short selection of winning/momentum stocks (momentum factor) and the other is CTA macro investing that doesn’t even hold any individual stocks, but rather mostly fixed income instruments. One can see that recently they are nearly 100% correlated. This is yet another indication of the prevalence of groupthink and crowding across investment strategies. The most recent crowding episode was largely driven by bond yields, and fears of the trade war impact and recession. A similar level of crowding can be illustrated by the performance of small-large factor and value equity factor. In theory these should be uncorrelated, but they are effectively one and the same, and they are just the inverse of the previously described momentum strategies. Our view is that the best hedge for a continued unwind of this investment groupthink is to overweight deep cyclicals like energy, metals/mining, as well as small cap stocks.

Shortly after Kolanovic laid out his thesis, Bloomberg followed suit with “Get Ready as ‘Beta-Chasing’ Stock Managers Try to Make Up Ground.”

It’s been the same trade all year. A recession is coming, so get defensive. Now the strategy is unwinding and stock managers who toed the line all the way into November have furious catching up to do.

We disagree.

While we discussed previously why we find issues with Kolanovic’s assessment that cyclical and value stocks are set to explode higher at the expense of defensive/momentum names, here is an alternative take, one from Nomura, which looks at ‘the main driver behind the main driver’ of the recent stock market move, so to speak.

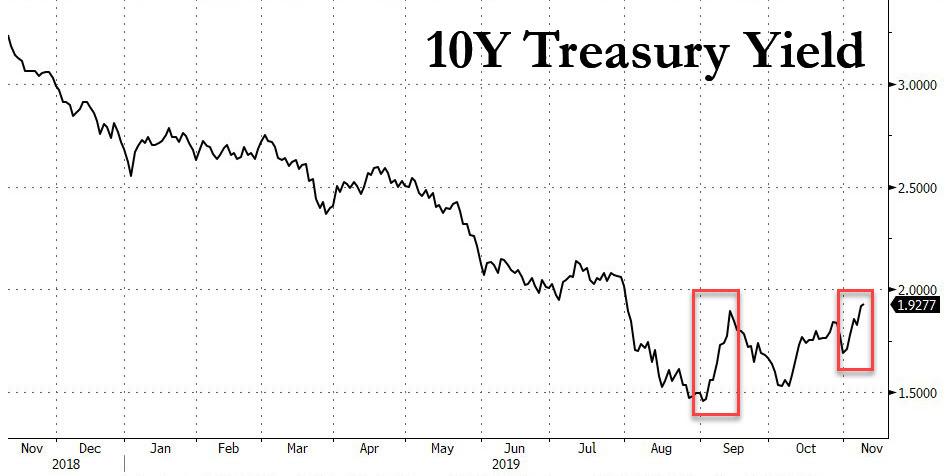

As a reminder, the biggest catalyst for September’s violent rotation out of momentum/growth names and into value stocks was the sudden spike in Treasury yields as the market repriced the probability of a near-term recession. As such, it was the sharp move in yields that catalyzed the quant crash of early September, resulting in the violent reversal between cyclicals and defensives…

… and specifically the sudden reversal in that most aggressive investor class, CTAs.

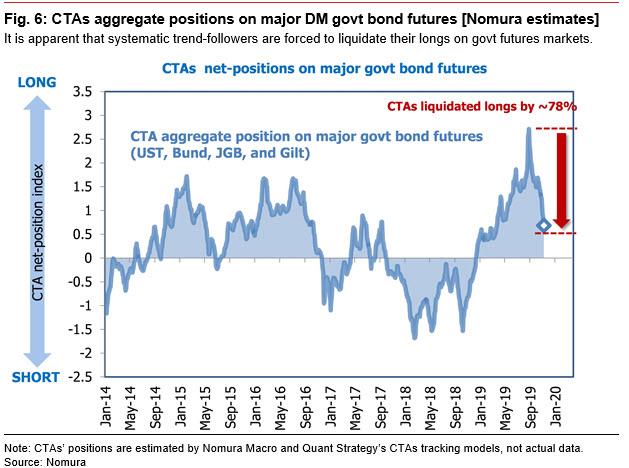

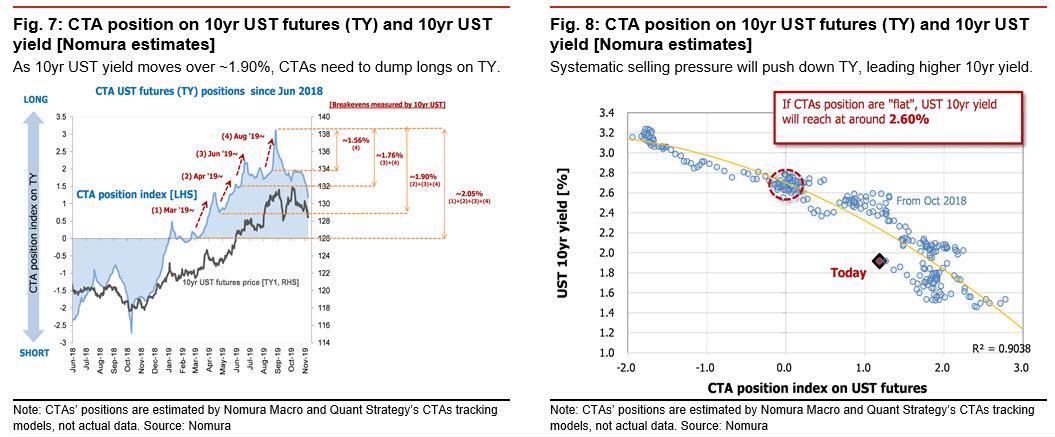

So looking at the role CTAs played in the sharp yield moves of 2019, what becomes clear is that it was the aggressive build up of net long positions by CTAs starting in September 2018 and culminating in September 2019, before a violent reversal saw CTAs puke their long bond positions, in the process crashing pure momentum portfolios…

… as trend-following strategies were clobbered as a result of the kneejerk moves in the 10Y:

So what happened since?

For the answer we go to Nomura, which points out that while the period through August was characterized by selling (shorting) of high-risk assets and factors and buying of low-risk assets and factors, these tendencies were thrown into reverse by hedge funds liquidating positions in advance of their November results announcements. Of course, DM sovereign debt stands as the classic example of a low-risk asset.

Why does this matter? Because trend-following CTAs, which are more technically minded than other hedge funds and also quicker to act, have since September been unwinding the substantial net long positions in DM government bonds that they had accumulated.

But how much? And here is the punchline: after hitting a near record high net long exposure in sovereign rates which peaked right around the time $17 trillion in global bonds traded with a negative yield, the same CTAs have now shrunk their aggregate net long position in major DM government bond futures (US, Japan, Germany, UK) by about 80% from the late August peak!

In other words, there is just over 20% left in the great rate unwind before CTAs turn neutral, and there is no more impetus for them to liquidate positions.

Meanwhile, as the 10yr UST yield broke above 1.90% earlier this week, which Nomura estimates to be the average cost of CTAs’ cumulative net buying of TY since April, this drew CTAs into further loss-cutting, and even more negative rates in a higher yield – greater liquidation feedback loop.

* * *

Yet even as the forced liquidation of CTA bond net longs – the primary catalyst behind the violent cyclical/defensive rotation – comes to an end, the big question is what happens next: do they resume accumulating long positions, or do they turn short.

Here Nomura points out that if the last trigger line at around 2.05% (average cost of net buying since March) gets knocked out, CTAs would be pressed not only into the final phase of unwinding their TY long positions, but potentially moving net short, something they haven’t done since last summer. In that event, Nomura estimates that the systematic selling pressure on bond futures could lift 10yr UST yields well into the 2.0-2.5% range.

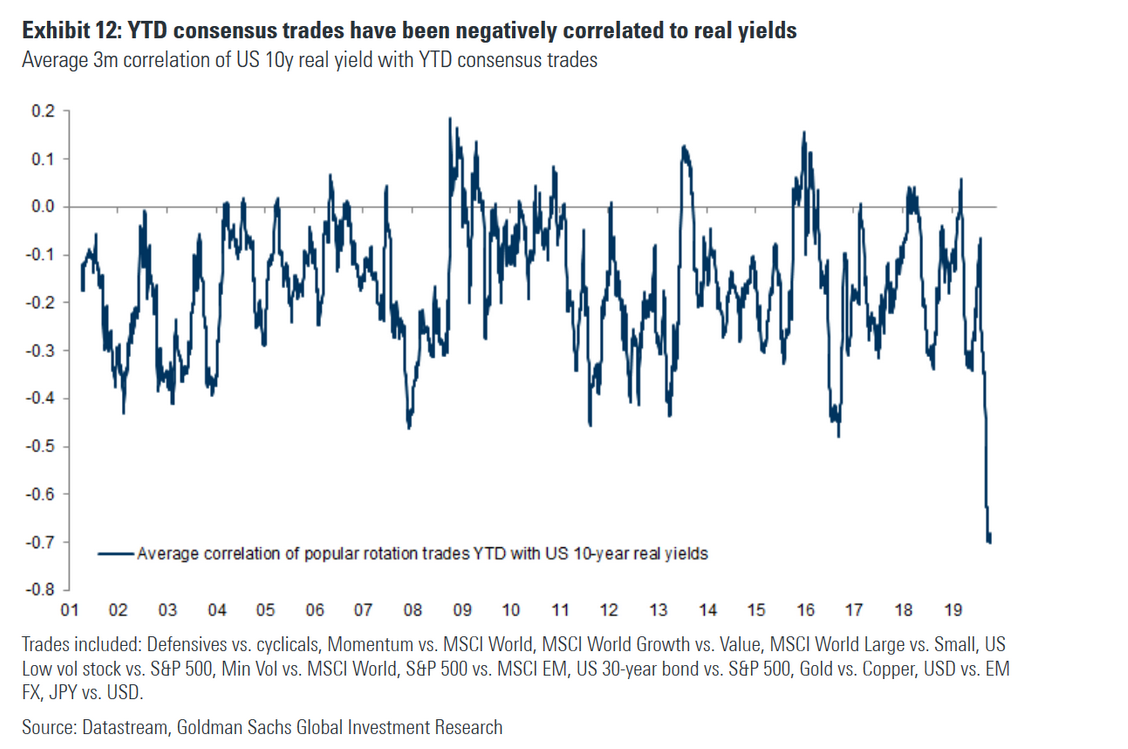

If that happens, then the violent reversal of consensus trades predicted by Kolanovic will be fully in place, resulting in a potentially shattering surge in value stocks (the question whether any value funds are left to take advantage of such a move is worth pursuing). After all, as we showed yesterday, the correlation between 10Y yields and YTD consensus trades has never been more negative.

Here, we repeat the final point we made yesterday: since it is the consensus trades that get crushed as yields and cyclicals rise and as defensive stocks fall, hedge funds should be praying that Kolanovic is wrong. Because if he is right, 2019 will be another year in which the vast majority of hedge funds not only underperform the market, but post negative absolute returns, and find themselves out of a job.