Authored by Sven Henrich via NorthmanTrader.com,

If you went panic chasing into stocks following Jay Powell’s ‘ready to act’ speech on June 4 on the expectation for imminent rate cuts you just got thrown a curveball: Economic data just printed than better expected results. Retail sales and industrial production data rebounded from the previous months’ dismal readings. 0.5% for retail sales and 0.4% for industrial production for May.

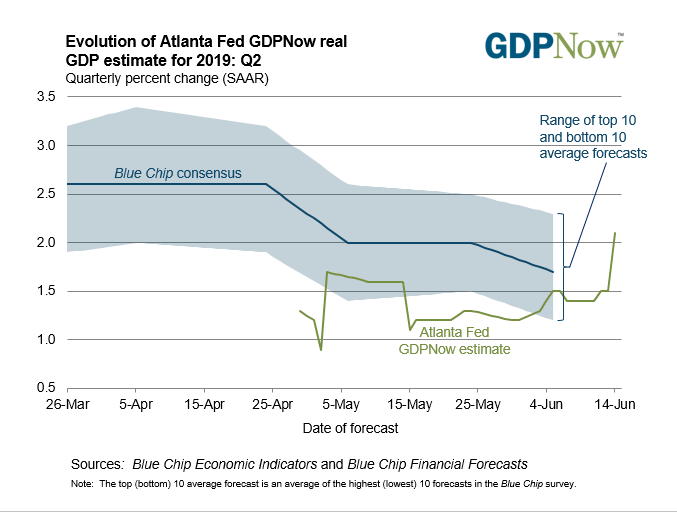

The Atlanta Fed reacted quickly and updated their Q2 GDP model north of 2%:

That smacking sound you’re hearing is the sound of any immediate rate cuts being kissing goodbye, certainly for June and perhaps now even July.

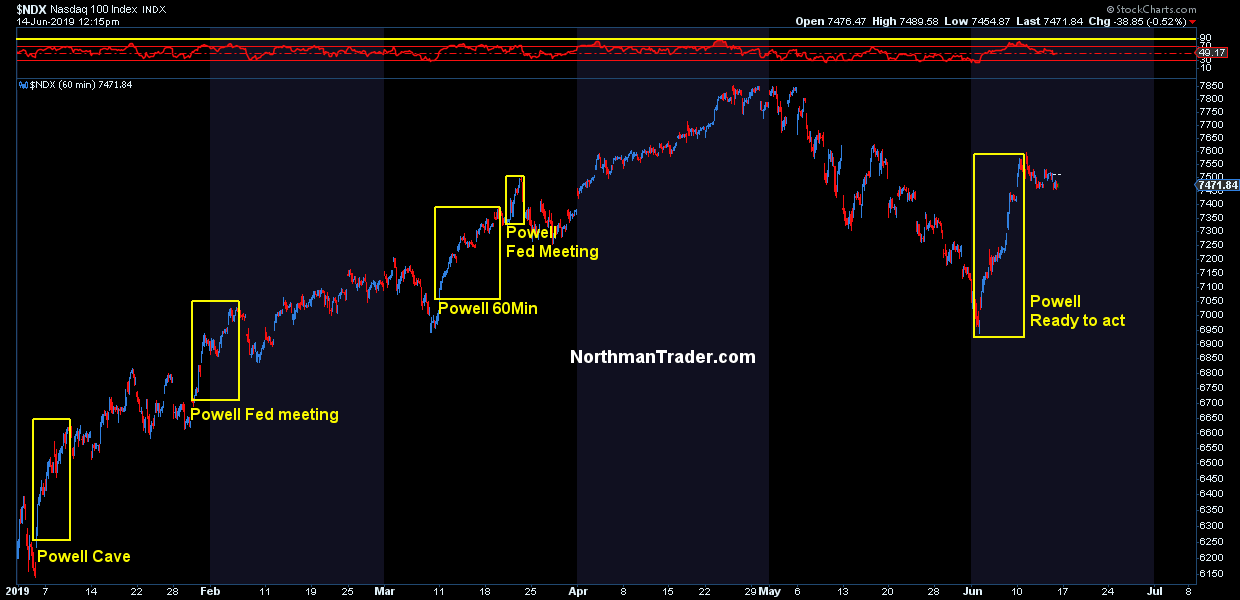

Remember, the Fed is coming from the lowest bound ever to commence a new rate cut cycle. 225 basis points. Compared to the last 2 cycles they have less than half of available ammunition available. They’d be nuts to cut here, but with this crew who knows. After all they jump as soon as the market so much as sneezes.

But that’s the problem for the Fed here, the market is not sneezing, it’s jammed near all time highs on the expectation of rate cuts.

But it’s the Fed’s now fault, the constant proactive interventions have created the expectation game.

It was not always so. Todd Harrison sent me a note this week he published in 2007 and back then he already rightfully lamented the change in the Fed’s role:

“The Federal Reserve is supposed to act as a buffer when times are tough, a beacon in the light if you will, the lender of last resort. Over the course of time, they have become entirely more proactive. They stopped acting in response to crisis and began targeting financial assets in a series of events that unintentionally created one.”

Boy, how far we’ve come. All is gaming the Fed these days, every time:

So next week will be an expectations gaming exercise and the Fed’s main task will be the same as always: Carefully craft its language to not disappoint markets. ‘Yea we may not cut right away, but don’t worry, anything goes wrong we’ll be right there to save you’. I suppose if they want to throw a dovish bone to not disappoint they may just as well announce ending QT right away. It’s become a joke anyways compared to the expectations of autopilot outlined in 2018.

Despite the economic beats today the bond market is not buying it.

10 year versus $SPX:

And perhaps that’s all the excuse the Fed needs to throw the dovish bone and coax markets to new all time highs.

After all that’s what markets want and are expecting. Here’s BAML telling people to go all in.

BAML is bullish on stocks heading into Fed meeting/G20: “we expect SPX>3000 in coming weeks, clear peak in US$ .. we are buyers of KOSPI, semiconductors, resources, China property stocks, high yield bonds, gold, and sellers of volatility.”

(h/t @pattidomm)

— Carl Quintanilla (@carlquintanilla) June 14, 2019

Protection? Who needs that? Sell that. Buy everything else. The Fed has our back.

3,000 may well happen first, we’re not that far away. But there’s a longer term technical target out there:

You want a real technical target where all this is ultimately heading?

Either from higher or here?

This chart from my wife, who was a long term bull.

I’ll discuss more in the weekend update.$SPX#notadaytradingchart pic.twitter.com/vQjoOm6bFX— Sven Henrich (@NorthmanTrader) June 14, 2019

Now there’s a reason for the Fed to cut rates. So if you’re buying stocks near all time highs anticipating rates cuts…be careful what you wish for.

If the Fed had a ton of ammunition a precautionary cut may make sense, but they don’t. They’re approaching this fight with the clip less than half full.

Better choose your battles very carefully, but don’t disappoint rate cut hungry markets. Best of luck with that.

* * *

More this weekend in the Weekly Market Brief. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

https://platform.twitter.com/widgets.js

Source link