The last few weeks have seen the US Treasury yield curve flatten dramatically, suggesting The Fed’s ‘delayed liftoff’ and longer-term normalization narrative is anything but written in stone.

And now, even The Wall Street Journal is starting to admit that the market may be on to something with its very divergent view of where rates go in the next few years.

“The market is saying that the Federal Reserve is going to be raising rates sooner and faster than the central bank itself thinks it will.

But the market is also saying that rates won’t go as high as the Fed eventually thinks they will.”

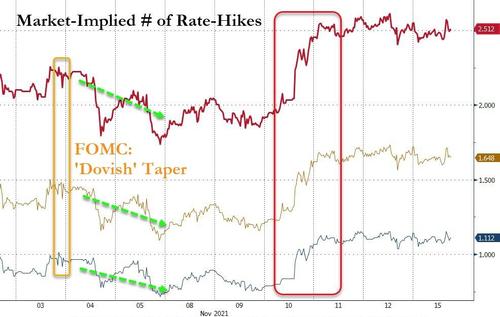

Short-term interest rate expectations are soaring – entirely shrugging off Fed Chair Powell’s efforts to jawbone hawkish expectations during his taper press conference – with more than one rate-hike priced in for July 2022 (when The Fed’s current taper schedule is expected to end)…

…and the trajectory of rate-hikes after is accelerating with 2.5 rate-hikes priced in by the end of 2022…

Both of those are dramatically more hawkish than The Fed’s expectations. As WSJ notes:

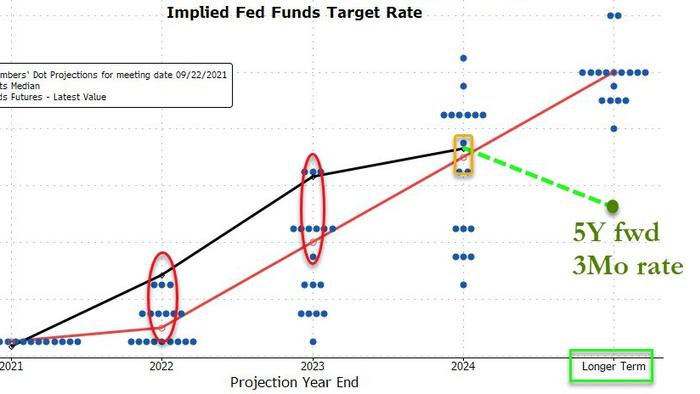

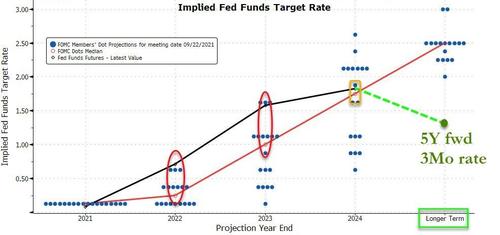

“In September, when Fed policy makers last offered projections on where they thought interest rates would go, they were split on what would happen next year: Half thought they would be leaving their target range on overnight rates near zero. Most of the rest thought they would raise the range by a quarter of a percentage point. Judging by Fed Chairman Jerome Powell’s remarks following the November Fed meeting, more policy makers might now be leaning toward a single, quarter-point increase than before.”

But, while the ‘Dot-Plot’ only indicates ‘Longer-Term’ rate indications, if we consider ‘long-term’ to be five years from now, then the market is implying a 3-month interest rate of 1.35%, significantly lower than both the market and Fed’s own expectations of where rates will be in 2024.

So, accepting that there is a lot of grist to be milled between then and now, the market would seem to suggest that The Fed will re-engage QE somewhere between 2024 and 2026. Bear in mind that 2024 is an election year – will the ‘independent’ Fed really re-engage QE ahead of the vote? And for that matter, will The Fed actually hike rates in July of next year (and again in September) as the market expects, dead-ahead of what is shaping up to be a very ugly midterm election for the Democrats.

As WSJ concludes:

“The market might be smarter than any one forecaster or the Federal Reserve when it comes to where rates are going.”

But, we suspect the market itself is under-estimating the level of panic that will set in at The Eccles Building for a more dovish/leftist-dominated Fed should the markets deteriorate too rapidly.