Macron’s not-so-secret ambitions for France to supplant AAA-rated Germany as Europe’s superpower took a nosedive on Friday when rating agency Fitch downgraded the eurozone’s second-largest economy one notch to AA- (with a stable outlook) late on Friday night over concerns that social unrest and political paralysis following the pensions fight will limit government efforts to improve public finances.

“Political deadlock and (sometimes violent) social movements pose a risk to Macron’s reform agenda and could create pressures for a more expansionary fiscal policy or a reversal of previous reforms,” Fitch wrote.

Fitch had rated France AAA until July 2013, when it downgraded it to AA+, and then to AA in Dec 2014.

The move is another blow to Macron only weeks after his government enacted a long-promised and much-hated pension reform to raise the retirement age by two years to 64, despite months of street protests, stiff resistance in parliament and ongoing strikes.

The president’s party does not have a parliamentary majority and may struggle to deliver on other priorities such as boosting employment and cutting fiscal deficits while improving public services such as schools.

According to the FT, Fitch also echoed our own assessment when it said the government’s use of a constitutional tactic known as Article 49.3 to pass the unpopular pension reform without a parliamentary vote could “further strengthen radical and anti-establishment forces” in French politics.

Similar to the US downgrade by S&P in 2011 over the debt ceiling fight, which sparked a witch hunt of the rating agency by minions of the then Treasury Secretary Tim Geithner, the French government was also terribly vexed by this particular case of truthiness about France’s economic outlook, and Finance minister Bruno Le Maire, who recently presented the government plan to bring deficits back in line with EU targets by 2027, said France remained committed to structural reforms while explaining why Fitch was wrong.

“This decision is the result of a pessimistic assessment by Fitch regarding France’s growth prospects and its debt trajectory,” Le Maire said in a statement.

“It underestimates the consequences of the structural reforms adopted in the last few months by the French government, [notably] the reforms on unemployment insurance, pensions and production taxes.”

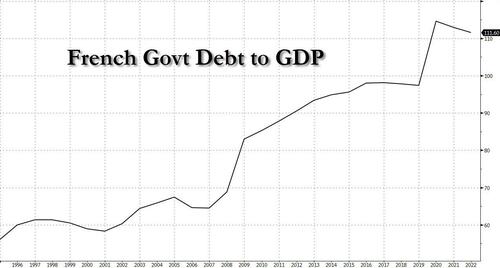

Fitch expects France to have a fiscal deficit of 5% of GDP this year due to weaker growth and higher expenditure linked to inflation, up from 4.7% in 2022. It forecasts that it will then fall back again next year as measures to help households with bills during the energy crisis are phased out; in reality this was a concession by the rating agency, and what will really happen is that deficits will keep ballooning higher.

While France’s economy barely grew by 0.2% in the first three months of the year despite the strikes, inflation also rose in April to 5.9% year on year.

France’s “fiscal metrics are weaker than peers”, Fitch wrote, warning that its government debt when measured as a proportion of economic output would “remain on a modest upward trend, reflecting relatively large fiscal deficits and only modest progress with fiscal consolidation”.

The credit rating agency expects pressures on spending to remain high in the short term as a third of all spending – largely on social benefits and pensions – is indexed to inflation. However it said that the savings generated by the pension reform, expected to total €17.7bn by 2030, will be “moderately helpful” over the longer term.

It also forecast inflation in France will ease in the second half of this year, averaging 5.5% for the year before dropping to 2.9% in 2024.

Le Maire has repeatedly underlined the need to cut public debt because interest rate rises have caused annual debt servicing costs to balloon.

As reported previously, France has been rocked by months of protests and strikes against the pension reform since January. Many smaller scale protests continue and labor unions plan to hold a large protest march on May 1.

Loading…