When it comes to the Morgan Stanley house view, it’s not just Michael Wilson that is borderline apocalyptic, most recently warning on Monday of a “vicious” end to the bear market, one which drags stocks to fresh cycle lows: it appears that the bank’s global head of research, Katy Hubary, is not too far behind.

In her latest weekly closely read “Charts that Caught my Eye” report (available to pro subs here), she writes that there has been a lot of market debate over the past year about whether yield curve inversion, which historically has been a precursor of US recessions, meant that a recession was inevitable this time, in light of key idiosyncrasies in the current environment.

She then points to an “interesting section” of the bank’s Cross-Asset Strategy team’s latest dispatch which examines the confluence of five macro developments that, like inversion, are consistent with a strong economy that is starting to slow and leads to a sharp drop in risk assets:

-

S&P 500 forward earnings are declining relative to three months ago;

-

The yield curve is inverted (or has been over the last 12 months);

-

Unemployment is below average;

-

US Manufacturing PMIs are below 50; and

-

More than 40% of US banks, on net, are tightening lending standards.

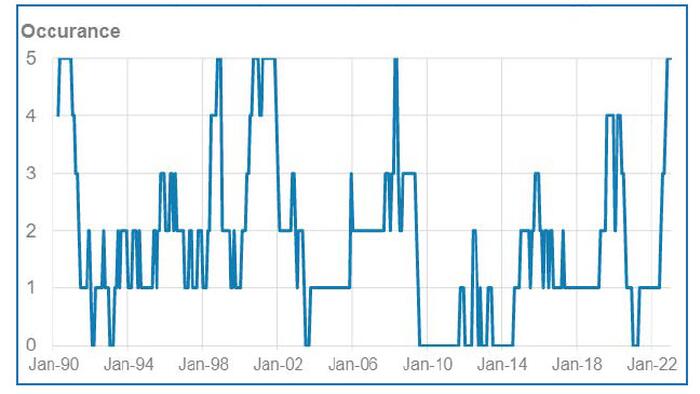

Pointing to the chart below, which shows that these five events tend to cluster just before major market crises (2007, 2001) that “all five are in place today, which is rare”

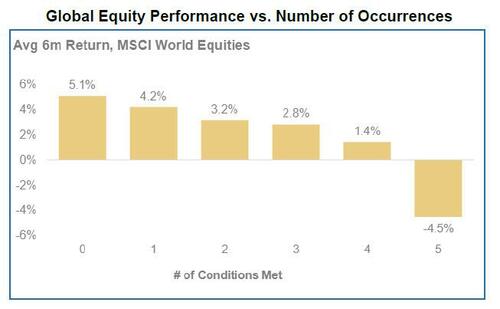

… but what is more ominously is that as the MS team highlights, since 1990, the more of these conditions that are in place, the worse global equity performance has tended to be:

Loading…