By Marcel Kasumovich, head of research at One River Asset Management

Macro Pulse Early Warning – Need a Bigger Boat

Macro matters. For decades, financial markets were defined by long, passive trends. Brief periods of macro relevance punctuated by active policy intervention and a resumption of long-lived passive trends. In today’s unprecedented economic change, positive innovation cannot simply be managed with a long horizon and a portfolio dotted with tail risk hedges. Cycles are running shorter and hotter, raising the importance of calibrating risk to the macro cycle.

Digital asset markets don’t need a reminder. Prices have been joined at the hip with interest rate expectations. The correlation between the price of bitcoin and the peak expectation for US policy rates, captured by the June 2023 future, is a whopping 85% in the past year. It wasn’t “just the Fed.” The more aggressive normalization of policy – rate expectations are up more than 400 basis points in the past year – exposed speculative excesses across the digital ecosystem.

The current environment is begging for a macro tool to help with active macro risk management. So, we built the Macro Pulse. The Macro Pulse turns ISM survey of manufacturing business conditions into states of the economic cycle, ranging from growth boom to bust, built initially as proof-of-concept. Survey data is the right avenue for identifying these cycles – they are not revised and not beholden to past cycles, unlike official figures. Here, we illustrate portfolio analytics where asset allocation is conditioned on the state of the macro cycle.

We start by defining innocuous asset allocation in different macro states. The average asset allocation over the cycle is roughly 25% equities, 45% bonds, 20% commodities, and 10% foreign exchange, dating back to 1977. This is the weighted average of allocations that vary by macro state for a benchmark active portfolio, slanted towards equity and commodity assets in an economic boom and overallocated to bonds when growth is declining. Digital assets are added over a shorter period since 2011, with a constant 2.5% allocation to bitcoin at the expense of bonds. The portfolio simulations follow.

The performance of a 60-40, equity-bond passive portfolio and the portfolio based on active macro states are similar, on average. The average annualized return on a 60-40 portfolio is 9.1% compared to 9.3% on the active macro portfolio. But risk management is materially different. The volatility of the macro portfolio is substantially less at 7.8%, versus 9.7% (Figure 1). That’s where it gets interesting.

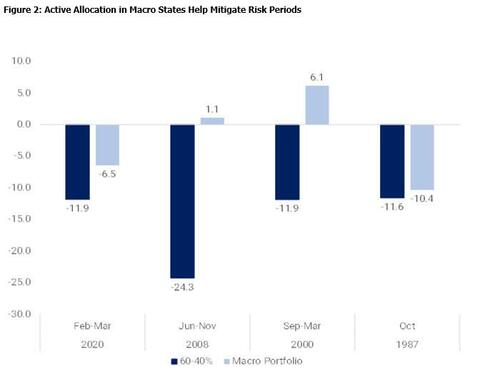

Isolating periods of negative portfolio events illustrates the risk management value of conditioning asset allocation to the states of macro cycles. We turn the portfolios through four well-known high-risk periods: 2020 (Feb-Mar); 2008 (Jun-Nov); 2000-01 (Sep-Mar); and 1987 (Oct). The average drawdown for the 60-40 portfolio in those periods is 14.9%, with all four down by double-digits. The active macro portfolio averaged a 2.4% decline, with only 1987 a material loss of 10.4% (Figure 2).

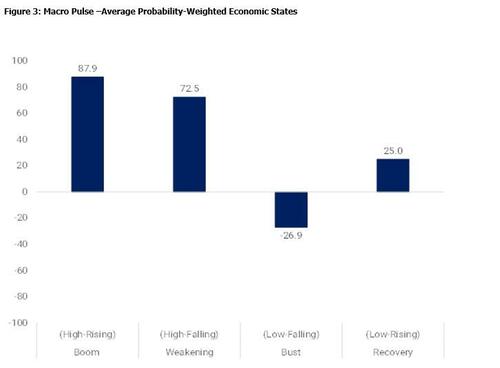

But that’s not all! We can calibrate expected future shifts in the state of macro cycles. This improves risk management even further. When in an economic boom, we estimate a 57% chance of staying in that state for three months’ time, a 37% chance of moving to slower growth, and 6% odds of recession. Probabilities are calculated across all states and applied to the asset allocation. It makes a big difference. The most pessimistic asset allocation scores -27 on a +/-100 scale, much less than the -100 scored in recession (Figure 3). The probability approach shifts weight to growth assets in a recession as the odds of transitioning to an expansion increase. On the growth side, there is little distinction between a boom and a softer growth cycle – the odds of a continued expansion are equally high.

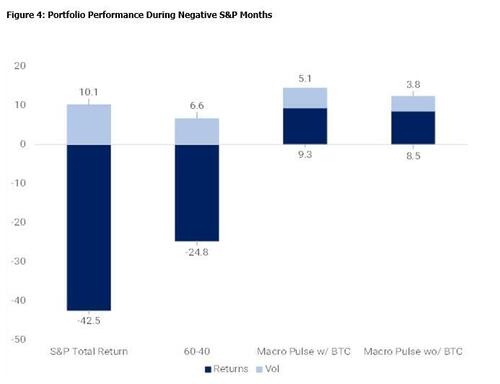

Periods of declining equity markets demonstrate the most striking risk management enhancement using Macro Pulse probability weights. The 60-40 portfolio has an annualized return of -23.9% in months with negative equity performance, an improvement from the 41.9% fall in equity portfolios. The active macro state-based portfolio shows a similar decline to the 60-40 portfolio. However, using transition probabilities to capture rising odds of different economic outcomes, the Macro Pulse portfolio yields a positive return. The message can be an early warning or an early opportunity signal. Either way, forward-looking probabilities matter.

Digital assets are additive to the process. To keep things simple, we include bitcoin with a fixed 2.5% monthly weight across all macro states, replacing bonds in the asset allocation. There is a strong belief that bitcoin just replicates equity beta in a portfolio. We evaluate this by examining periods when equity returns are negative. There is no doubt that drawdowns in digital assets are severe. But timing matters – they are also brief and decouple from traditional markets. Digital assets have been additive, leading to stronger returns, but with a higher volatility trade-off that calls for active management (Figure 4).

Economic activity is weak. Deflation in commodities, financial assets, and housing markets strongly suggests activity will weaken further. And it is when growth is falling from weak levels that the Macro Pulse calls for the most defensive portfolio positions. Once the recession hits, asset markets transition more quickly to growth opportunities. Active strategies are the best umbrella for the current macro climate – a feature shared by digital and traditional asset markets.