Authored by Sven Henrich via NorthmanTrader.com,

Oh dear. People are embracing the bubble and, as it happens in every bubble, fantastical narratives are emerging to justify the valuations and the price momentum as folks cannot square reality with non stop levitation in equity prices. Never mind that the final price spurt in any bubble is the most dangerous and most deceiving.

And with these fantastical narratives suddenly debt no longer matters because MMT. Inflation is declared dead as central bankers keep missing their inflation targets yet consumers are well aware of inflation in their daily lives, and yield curves no longer matter because they are simply a play thing of central bankers who can now prevent recessions forever:

“The Fed has the power to “prevent or quickly undo” an unwanted inversion, the BofA economists said.”

If debt doesn’t matter, inflation doesn’t exist, and yield curve inversions can be prevented by an all powerful Fed we must truly live in a world of milk and honey.

After all:

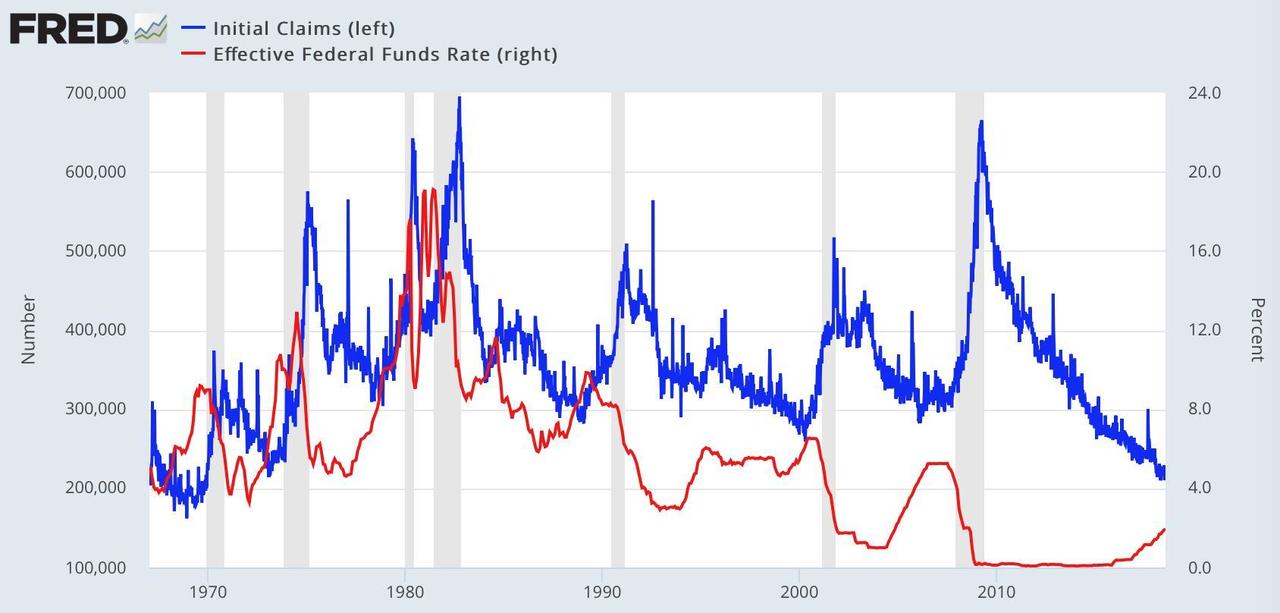

United States weekly jobless claims just hit a 50 year low. The economy is doing GREAT!

— Donald J. Trump (@realDonaldTrump) April 20, 2019

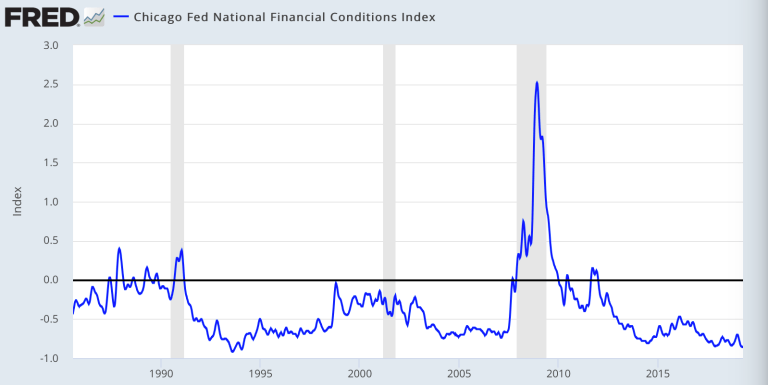

Things are so awesome we are experiencing some of the loosest financial conditions in history:

And global liquidity keeps running at record levels:

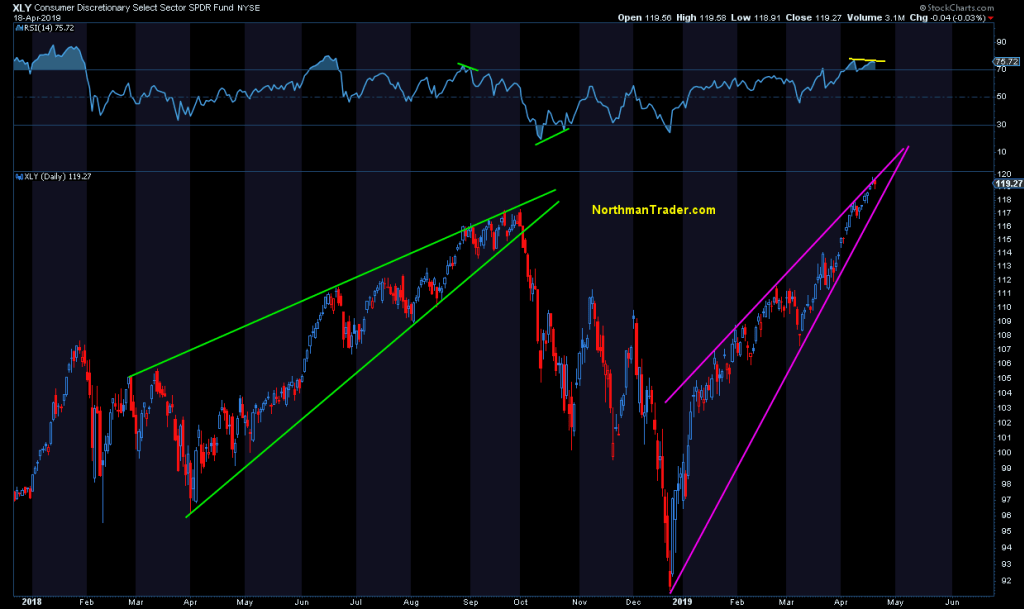

No wonder stocks are celebrating and flirting with record highs, indeed record highs are already seen printed on tech and consumer discretionary:

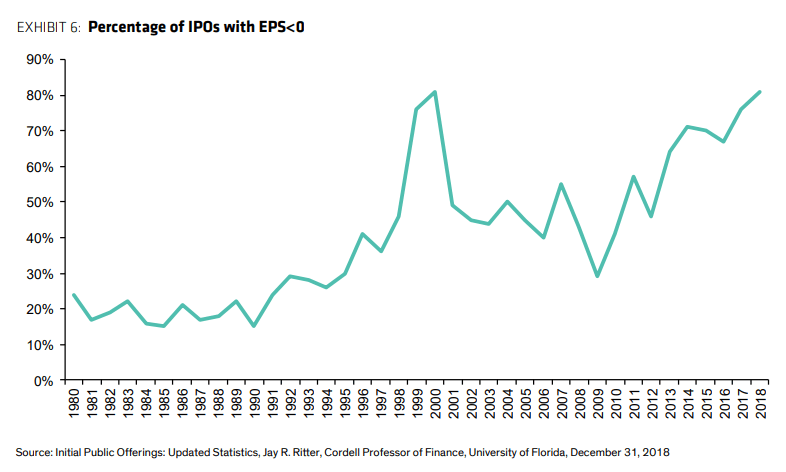

No wonder investors are chasing after money losing IPOs like it’s 1999:

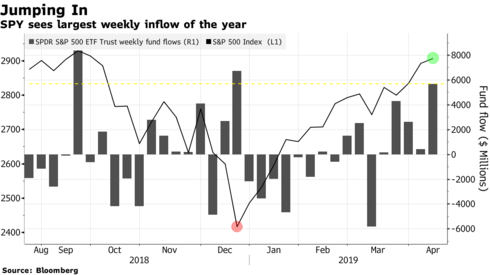

And are piling in their cash after a 24% rally off the lows:

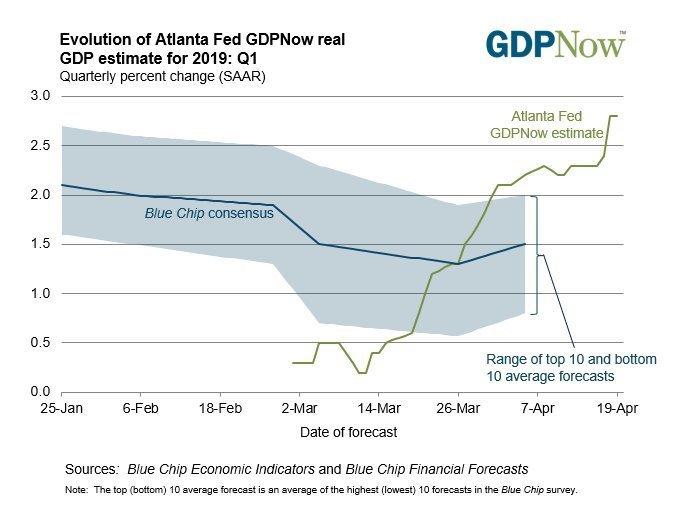

After all Q1 GDP is flying higher to unforeseen levels.

The Atlanta Fed’s GDP forecasting model, always having an adventurous relationship with reality, is now forecasting a 2.8% GDP print for Q1, following a 0.4% projection just 6 weeks ago:

Looks like Alan Greenspan is right. Get a big rally in $SPX and suddenly your GDP looks much better.

This is how awesome things are and setting up for the Combustion case I outlined, or the melt-up case as Larry Fink has suggested.

Yes, things are truly awesome except that they are not, but rather there’s a big mismatch in everything. Amongst all this awesomeness the Fed has halted all rate hikes and doesn’t forecast one until sometime in 2020.

Here with unemployment at 3.8% and unemployment claims at 50 year lows:

The Fed funds rate has never been this low into an expansion cycle this long. Not even close.

Things are so awesome the Fed couldn’t even manage a rate level half that of previous cycles before succumbing the market pressures in December and, by doing so, they may have ended up blowing this bubble even larger.

There’s so much money desperately seeking yield it’s apparently akin to an out of body experience. Yes, people say the darnedest things during bubbles.

Another big mismatch of course are markets themselves. If debt, yield curves and inflation don’t matter then one would think all ships would benefit from the rising tide in everything. But this does not appear to be the case:

Small caps are below their February highs and the banking sector is below its March highs. I suppose the financial sector and small caps no longer matter either. But unless these sectors can play catch up in a hurry this may all end up prove to be a fallacy.

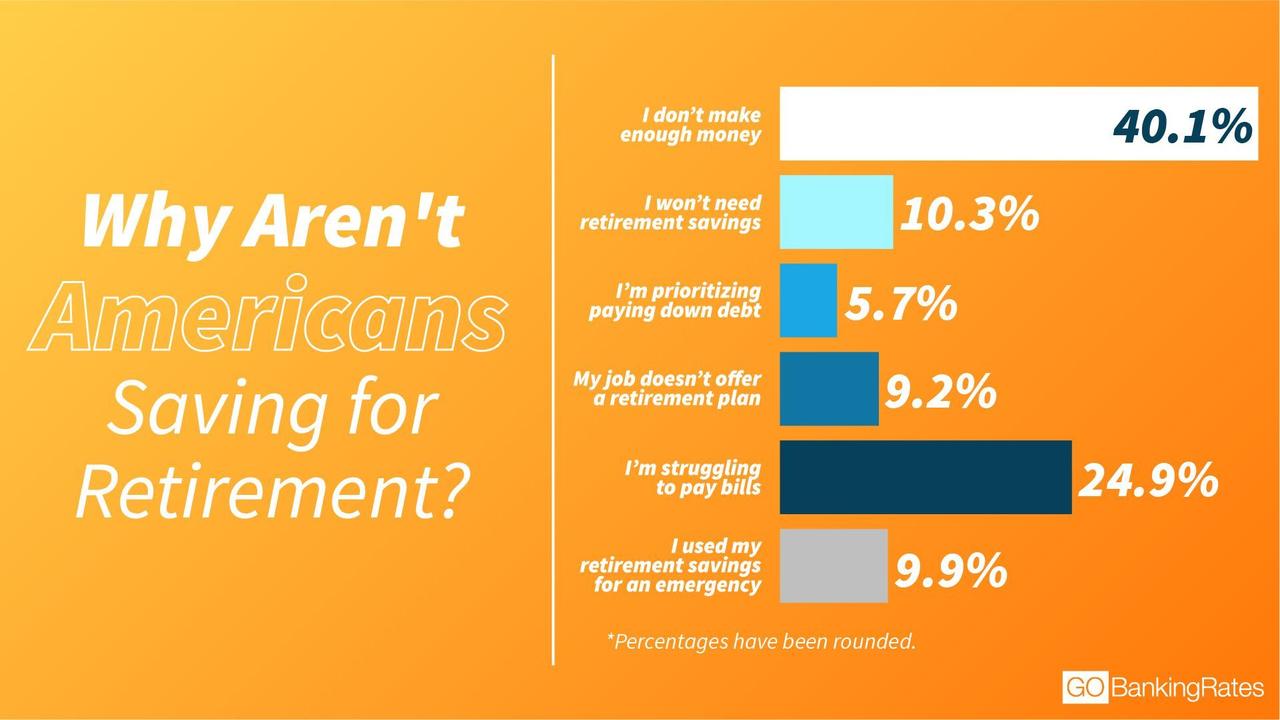

And while consumer discretionary stocks are flying to new all time highs they can’t help hide the reality that nearly half of all Americans are financially (what’s the technical term?) totally screwed:

“About 42 percent of Americans have less than $10,000 saved for when they retire, according to a study by GoBankingRates”.

This is how awesome things are:

They either don’t make enough money, are struggling to pay bills, their jobs don’t offer retirement plans or they blew their savings due to an emergency.

Good thing inflation is dead. Yes, that’s sarcasm.

I could expand on the subject, but I trust everyone gets a sense of the mismatch in fantastical narratives, the price action in markets and the reality on the ground. If the economy is as great as markets indicate the Fed should have no problems raising rates. If the signals parts of markets send is false and the rally construct is simply based on cheap money, buybacks and a dovish Fed, then the Fed itself may have ignited the final bubble run. Out of sheer desperation no less. Scared of the bubble bursting they inflated it even further. Well done.

Yet for all the melt-up talk markets in reality have stalled. Last week $SPX closed down 2 handles on the week although hot pockets such as tech have moved on to higher prices. As markets are now close to all time human history highs on the heels of a dovish Fed new highs seem a lay up to embrace the bubble in full, but technical concerns keep mounting. It is these signals that leave room for an entirely different reality to emerge.

For a discussion of the technicals please see the video below:

[youtube https://www.youtube.com/watch?v=qMYYI1IRV2E]

* * *

To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

https://platform.twitter.com/widgets.js

Source link