Robinhood: After A Terrible IPO Year, Is It Ripe For A Buyout?

Submitted by QTR’s Fringe Finance

Two weeks ago, I wrote about why I was nibbling shares of a name that I thought was a potential buyout candidate in the future and how I planned on adding more shares if the price of the company’s stock fell lower. Last week, I’ve found a semi-similar situation.

In addition to last week’s writeup, there’s now a second name that I am entertaining as a potential buyout candidate, should it fall much more.

As one of my readers was quick to point out at the bottom of my recent writeup pitching it as a potential buyout candidate, it wasn’t a “Benjamin Graham-style” pitch for a buyout that was based on earnings. It was based on synergies, top line growth and competitive forces in what is still a mutating industry (retail and e-commerce).

It wasn’t a name I was looking at FCF and earnings for to justify my reasoning. I was looking at comparative P/S ratios for other names in its industry and was realizing that:

-

The industry is likely going to continue to consolidate

-

Nobody really focuses on what this company did specifically and that it would make for a good option for any other type of name in its industry that wants to expand their foothold

Today’s idea, Robinhood Markets (HOOD) is obviously also not a “Benjamin Graham-style” idea. Its financials are ugly, but it’s in an industry that is aggressively consolidating and is led by investment banks that are much larger than it is and companies like the $150 billion Charles Schwab.

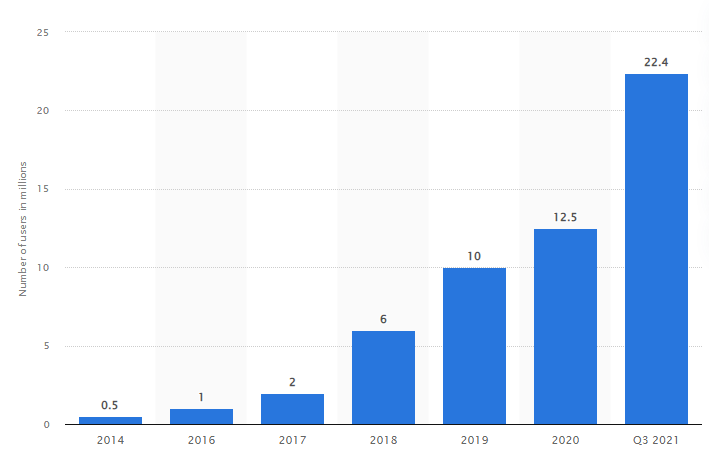

Consolidation in the industry has been plentiful. Ameritrade, which had about 11 million users at the time, was recently bought out for $22 billion by Schwab. eTrade, which had about 22 million users at the middle of this year, was recently bought out for $13 billion by Morgan Stanley.

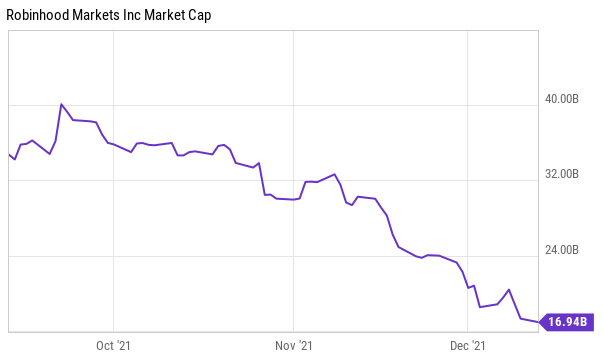

If you think that Robinhood is at the forefront of a “new generation” of investing, its $16 billion market cap:

…with its more than 22 million total funded accounts and 18.9 million MAUs, starts to potentially look interesting to bigger players in the industry.

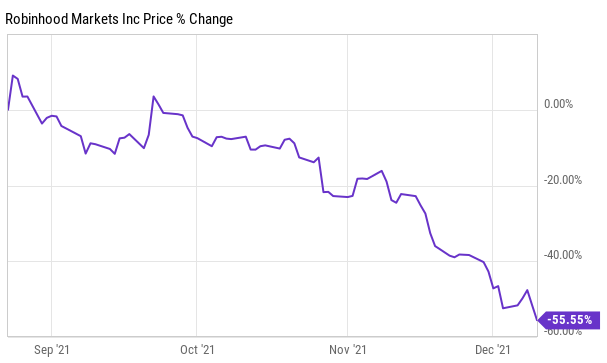

Remember, I was harshly critical of Robinhood just 3 months ago in October, calling the name a short while it was near $40 and while ARK’s Cathie Wood was still “buying the dip” that wasn’t really even a dip. I wrote:

Robinhood had trouble finding a bid at its $37/share valuation when it went public and, since then, has done nothing but reported Q2 earnings that included a warning about a slowdown in trading activity, either setting the stage for a rougher Q3 or sandbagging.

Between the valuation skyrocketing in the midst of poor earnings and the outstanding risks, Robinhood makes for what I believe to be an obvious short leg of this pair trade.

But today’s price for Robinhood – in the teens – is an actual dip. The stock is trading at almost a 50% “discount” to its IPO price and more than 50% off its highs back in August.

In October, I explained that despite the fact that Cathie Wood was “buying the dip” in Robinhood that the stock was still vastly overpriced and that I felt it belonged in the high $20 range:

In this case, I believe Robinhood belongs trading closer to a high $20/low $30 handle (again, its overvalued IPO was $37, there’s a huge retail bid in the company and it’s been nothing but bad news since).

It has overshot that mark by an order of magnitude, now trading under $20 per share.

Don’t get me wrong, however – the risks to owning Robinhood are serious:

-

The company does not make money and looks like it may not any time soon. Despite revenues increasing 35%, in Q3 2021, its net loss was a monstrous $1.32 billion compared to $11 million the year prior. In other words, this is in many ways a risky bet that someone is going to swoop in and “save” Robinhood by buying them out because owning their client base and software is more important than waiting to try and deal with some type of bidding war as the stock goes materially lower.

-

Most of Robinhood’s trading volume lately has come from crypto, which has been extremely volatile and may even wind up simply being a multi-trillion dollar air pocket. Crypto activity declined from record highs in the prior quarter, the company announced during its Q3 2021 report, which was another reason the stock sold off so aggressively.

But at a $16 billion market cap, I’ve re-evaluated the name. I definitely don’t want to be short here anymore, and the long thesis is starting to look like a not totally out of whack risk/reward.

Some of you may point out that a lot of the criticisms I had about the name in October – that the payment for order flow model is risky and that a lot of its business relies on crypto while its financial results have been ugly – still apply. You are 100% right and these concepts should be taken into account when considering a long position in the name.

This is a cash losing business run by a kid that I don’t particularly like with a somewhat questionable business model that can’t seem to elude controversy. Not generally an ideal long candidate…

Having said that, let’s talk about potential upside.

You may have noticed over the last year or two the only thing the brokerage industry has done is consolidate. Robinhood forced a lot of this change with its zero dollar commission model and names like Ameritrade and eTrade were both bought out.

This type of ongoing race for clients and hunger for consolidation in a extremely competitive industry leads me to believe that appetites for acquisitions must still be high and there have to be some people looking at Robinhood as a potential acquisition at a certain price.

Normally if the climate in the industry wasn’t as aggressive, I’d suggest that people may let it fall further and buy it out on the cheap, or maybe even in bankruptcy. But, I think that the climate for consolidation and acquisitions in the industry is too robust for people to let it plunge that far. I could be wrong, and that is worth taking into account.

By acquiring Robinhood, not only do you get access to arguably the most popular mobile app for trading, but you get the company’s clients and you get the “industry standard” when it comes to the no commission model. This means that if you ran a brokerage and wanted to theoretically start to try and re-introduce a commission model, starting with Robinhood would be a good place to “set the standard”.

Even without an acquisition, I think if Robinhood brought in a banker as CEO and kicked Tenev to the curb, investors would celebrate and take the company a bit more seriously. The company has yet to do this, but it remains one of the few arrows it has in its quiver.

Look, I don’t really care for management, nor do I care for the company‘s financials that much. This isn’t a Benjamin Graham style buyout situation where the company looks cheap on an earnings basis at all. This is an extremely speculative idea for a buyout that carries with it risk of the company stock moving significantly lower, due to there not being any type of floor of free cash flow or earnings.

But for right now, it actually might look appealing to a traditional brokerage that wants to expand its mobile footprint, expand its reach to retail clients and expand its crypto offerings.

That is why, as the price of Robinhood moves lower, I’m going to look at it more and more seriously. I am no longer short the name as I was around $40 per share. I remain long Virtu (VIRT), the other leg of my previous pair trade. I still think this stock should be valued between $30 and $40. I also started a small long position in Robinhood over the last couple of days and will look to add more aggressively proportionate with how much further the stock moves lower. As HOOD’s market cap approaches $10 billion, I think it becomes “cheap” to own its brand equity, software, crypto trading and its client base – even with its dogshit financials.

The bottom line is the company doesn’t make money and carries with it a lot of risk. These aren’t usually the types of names that I like – I am more often than not concerning myself with value. But, in this case, I think if the company gets much cheaper it’s going to look like an opportunity for a competitor with a much larger market cap to just come in and scoop them up.

—

This has been a free preview of paid subscriber content. If you enjoy, as always, Zerohedge readers get a 20% discount to my blog at any time, that lasts forever, by clicking here: Get 20% off forever

My Disclaimer: I bought a small long position in HOOD over the last week or two and will continue to add if it moves lower, perhaps using LEAPS. I also own some short dated calls. I may add any name mentioned in this article and sell any name mentioned in this piece at any time. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Mon, 12/20/2021 – 05:00

Source link