Risk on, risk off.

One day after traders were greeted by a sea of green – on potential world war news – we are back to the sea of red as global stocks struggled and safe haven bets were back in play on Friday with German bond yields plumbing record lows after the latest dismal Chinese data dump sparked fears about the health of the global economy and concerns of a new U.S.-Iran confrontation intensified (which, by the way, was somehow bullish for risk yesterday).

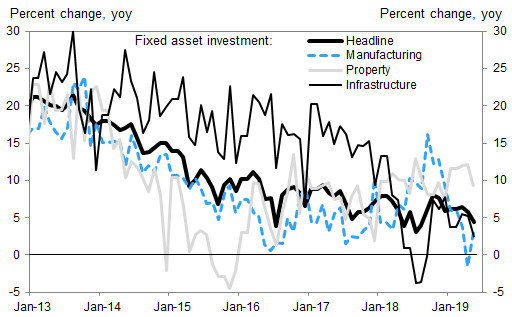

Beijing May activity reported overnight was very weak and painted a fairly gloomy picture of the world’s second largest economy as the trade war with the United States starts to bite. May industrial output growth slowed to a more than 17-year low, the weakest since since 2002, and well below expectations, while fixed-asset investment also fell short of forecasts. Retail sales growth accelerated and surprised to the upside however.

The full breakdown:

- Industrial Output for May: 5.0%, est. +5.4% (range +5.1% to +6.4%, 35 economists), down from +5.4% last month.

- May retail sales +8.6% y/y; est. +8.1% April +7.2%

- Jan.-May fixed-asset investment excluding rural households +5.6% y/y; est. +6.1% (range +5.2% to +6.5%, 34 economists). Jan.-April +6.1%

Commenting on the data, Goldman said “May activity growth was very weak” noting that IP month-over-month annualized growth was around 2.6% based on our seasonal adjustment, which was higher than April but still at a weak level. The shifting Labor Day holiday distorted IP, and to a lesser extent FAI, data on the downside, but the impacts were limited as there was a difference of only one vacation day which could not fully explain the extent of the data weakness. The impacts of shifting holidays tend to be larger on retail sales data. April retail sales data was exceptionally weak and the reversal of the distortion was the main driver of the rebound in retail sales in May. The slowdown in property transactions year-over-year growth was partially due to an unfavorable base effect, but sequentially transactions also cooled in April-May as the government marginally tightened property policies in a few cities such as Changsha, Xi’an, Beijing etc.

As a result, expectations for more stimulus in China continue to grow as the Sino-U.S. trade dispute threatens to escalate into a full-blown trade war that many fear could push the global economy into recession.

“The Chinese data was disappointing, especially the industrial output numbers,” said Chris Scicluna, head of economic research at Daiwa Capital Markets. “That’s given bond markets additional momentum.”

The dismal Chinese data saw yields on German 10-year Bunds — one of the safest assets in the world — fall to fresh record lows, the yield dropping as low as -0.27%.

U.S. Treasury yields were also grinding lower, last seen just above 2.06%, the same level they hit one week ago when the dismal jobs print virtually assured a rate cut by the Fed. Safe-haven bond yields have already fallen in recent days amid rising speculation about monetary easing by major central banks. Meanwhile, Spain bond yields have fallen for the first time below 0.5%.

Speaking of Europe, the Stoxx 600 Index fell as much as 0.8%, hitting a session low, with 18 out of 19 sectors dropping, led lower by tech and banks. The Tech sector index was biggest drag on the Stoxx 600, down 1.9%, on contagion from U.S. chip giant Broadcom, which cut guidance and warned of a slowdown in demand due to trade tensions and the U.S. ban on Chinese tech and mobile phone company Huawei Technologies. European tech shares led the indexes lower, with semiconductor companies Infineon, AMS, STMicroelectronics, Siltronic and Dialog Semiconductor all dropping between 2%-3% after Broadcom outlined the impact of a total halt in sales to Huawei.

“The sales warning from Broadcom is also weighing on markets this morning as it suggests that both semiconductor and auto sectors are under pressure worldwide,” said Market Securities strategist Christophe Barraud in Paris, adding that expectations for a rebound were now shifting from the second half of this year to 2020. “Given both these sectors are key for world trade, it’s not good news for trade.”

The Stoxx banks index slumped 1.1% as European curves continue to flatten; defensive utilities sector is the only sector that posts gains, up 0.3%

Earlier in the session, Asian stocks swung between gains and losses, with markets in the region mixed. While Japan’s Topix Index gained 0.3%, shares in Hong Kong and China dropped. In its third-day of losses, the Hang Sang Index fell another 0.7% as calls increased for the city’s leader to delay an extradition bill. China was the the region’s worst-performer, with the benchmark Shanghai Composite falling 1% after the abovementioned ugly economic data dump hit overnight. India’s S&P BSE Sensex Index declined 0.5% amid cash-crunch woes.

Over in the US, index futures were in line for a lower open, with the S&P e-mini pointing to a 0.2% fall.

With the week ending, all eyes now turn to the Fed’s June 18-19 meeting which will show investors if the U.S. central bank’s monetary policy stance matches market expectations for a near-term rate cut. A Reuters poll showed a growing number of economists expect the Fed to cut interest rates this year although the majority still expect it to stay on hold.

“There is a large degree of uncertainty going into next week’s FOMC (Federal Reserve Open Committee) meeting as market reaction will differ significantly depending on whether the Fed hints toward easing policy,” said Shusuke Yamada, chief Japan FX and equity strategist at Bank Of America Merrill Lynch. “A wait-and-see mood is likely to begin prevailing in the markets ahead of the FOMC.”

Elsewhere, growing worries about a new U.S.-Iranian confrontation after two attacks on two oil tankers in the Gulf of Oman on Thursday added to the unhappy mood, resulting in an oil price surge. Washington blamed Iran, but Tehran bluntly denied the allegation. But U.S. and European security officials as well as regional analysts left open the possibility that Iranian proxies, or someone else entirely, might have been responsible. The attacks set crude prices on a roller coaster ride, with Brent futures slipping 0.2% to $61.18 per barrel. Brent surged 2.3% on Thursday after the Norwegian- and Japanese-owned tankers both experienced explosions.

In the latest development, the US Navy Destroyer USS Mason was en route to the area where the 2 oil tankers were attacked, while it added it has no interest in engaging in new conflict in the Middle East and that it is ready to defend US interests as well as freedom of navigation. Furthermore, the US released video footage of Iranian military removing an unexploded mine from the Japanese tanker that was attacked in the Gulf of Oman. Iran categorically rejected the US unfounded claim regarding tanker attacks according to Iranian mission to the UN, while there were also comments from Iran Foreign Minister Zarif that US allegations against Iran without evidence shows the B team is moving to Plan B of sabotaging diplomacy.

In FX, the safe haven yen advanced after data showed China industrial output slowed in May to its weakest pace since 2002. The dollar’s index against a basket of six major currencies was little changed initially, but spiked to session highs after China warned the US not to get involved in Hong Kong matters. The Swedish krona led gains in the Group-of-10 currencies after Swedish inflation rose faster than expected, while the euro stayed close to $1.13 where hefty expiries rollover Friday. The euro was steady at $1.1282 while the greenback inched down 0.2% to 108.19 yen. The Australian and New Zealand dollars fell on Friday as bets on interest rate cuts undermined demand and Group of 20 meeting later this month sidelined investors.

Expected data include retail sales, industrial production and University of Michigan Consumer Sentiment Index. No major company is scheduled to report earnings.

Market Snapshot

- S&P 500 futures down 0.3% to 2,891.25

- STOXX Europe 600 down 0.5% to 378.55

- MXAP down 0.07% to 155.50

- MXAPJ down 0.5% to 507.16

- Nikkei up 0.4% to 21,116.89

- Topix up 0.3% to 1,546.71

- Hang Seng Index down 0.7% to 27,118.35

- Shanghai Composite down 1% to 2,881.97

- Sensex down 0.5% to 39,551.96

- Australia S&P/ASX 200 up 0.2% to 6,554.00

- Kospi down 0.4% to 2,095.41

- German 10Y yield fell 2.1 bps to -0.262%

- Euro up 0.04% to $1.1280

- Italian 10Y yield fell 7.6 bps to 1.989%

- Spanish 10Y yield fell 4.6 bps to 0.497%

- Brent futures down 0.2% to $61.22/bbl

- Gold spot up 0.8% to $1,352.75

- U.S. Dollar Index up 0.1% to 97.13

Top Overnight News from Bloomberg

- President Donald Trump is still waiting for a response from Chinese President Xi Jinping about meeting to restart trade talks, economic adviser Larry Kudlow said while warning Beijing may face consequences it if refuses the invitation

- The Trump administration blamed Iran for attacks on two oil tankers near the entrance to the Persian Gulf, escalating tensions between the two rivals despite denials from officials in Tehran and a lack of public evidence for the U.S. claim. U.S. releases video it says is of Iran removing mine from ship

- Rivals to be Britain’s next prime minister are holding private talks over joining forces in an attempt to stop the pro-Brexit favorite, Boris Johnson, running away with the contest, people familiar with the matter said

- China’s industrial output growth slowed to the weakest pace since 2002, highlighting the headwinds the economy is facing as it grapples with the tariff war with the U.S.

- Hong Kong girded for another mass march against a China- backed extradition bill Sunday, as the city’s leader, Carrie Lam, faced new calls to withdraw the legislation after clashes between protesters and police

- Allies of Hong Kong leader Carrie Lam began questioning her tactics as lingering tensions prompted lawmakers to postpone debate on a controversial extradition bill until at least next week

- White House Press Secretary Sarah Huckabee Sanders is leaving the Trump administration after a turbulent tenure marked by attacks on the media, dissemination of false information and the near-disappearance of the daily press briefing

Asia equity markets traded mixed as they awaited Chinese Industrial Production and Retail Sales data, where retails sales beat on expectations, nevertheless Asia-Pac indices remained mixed as risk-off sentiment prevailed. ASX 200 (+0.2%) was lifted by strength in commodity-related stocks but with gains capped due to weakness in the largest weighted financials sector amid anticipation of a lower rate environment and with AMP shares heavily pressured after it received compliance orders from the financial regulator APRA. Nikkei 225 (+0.4%) was also underpinned by the mining sectors which saw Chiyoda as the biggest gainer, while Sony shares were also bolstered after activist investor Loeb called on the Co. to spin off its semiconductor business. Elsewhere, Hang Seng (-0.7%) was subdued and Shanghai Comp. (-1.0%) was indecisive amid trade uncertainty and after the PBoC’s efforts resulted to a net weekly injection of CNY 65bln vs. last week’s CNY 320bln net drain. Finally, 10yr JGBs followed suit to the recent upside in T-notes, while the BoJ was also present in the market with today’s Rinban operation heavily concentrated in the belly of the curve.

Top Asian News

- Indonesia on Alert as Court Hears Prabowo’s Election Challenge

- As Trade War Hits, China Factories See Slowest Growth Since 2002

- Japan Display Is Likely to Miss Friday Deadline for Bailout

- Turkey Work Underway to Counter U.S. Sanctions, Official Says

Major European indices are mostly lower [Eurostoxx 50 -0.4%], with the exception of the SMI (+0.2%), as the region temporarily side-lines the prospect of Fed rate cuts and succumb to the risk-off sentiment as a result of rising US tensions with China, Russia, Germany, Iran, Turkey and India. Sectors are largely in the red with defensive stocks faring better, gains in the healthcare sector are keeping the SMI afloat. Meanwhile, IT names plumbed the depths with the sector heavily underperforming after a warning from Broadcom regarding a slowdown in global chip demand. As such, Infineon (-5.1%), STMicroelectronics (-4.0%), Dialog Semiconductor (-3.1%), ASML (-3.0%) and ASM (-2.7%) are all near the foot of the Stoxx 600. On the flipside, Scor (+2.6%) and Royal Mail (+2.0%) are in positive territory amid positive broker moves.

Top European News

- Kier Tumbles After Report Some Credit Insurers Withdraw Cover

- Buffett’s Berkshire, Engie Drive Europe’s Bond Sales Bonanza

- Finance Chiefs Agree on Euro-Area Budget But Skirt Funding

- Spain’s Sabadell Is Said to Weigh Sale of Consumer Finance Unit

In FX, the Dollar index continues respect resistance above the psychological 97.000 level (on a closing basis) and ahead of the recent range top at 97.370, as safer currency havens outperform amidst heightened geopolitical and global trade tensions. Moreover, the Dollar remains capped by growing expectations that the Fed will flag a rate cut next week following a run of macro data pointing to a more pronounced slowdown in the economy and benign inflation that that challenges the transitory theory put forward by Powell and other at the last FOMC gathering. On that note, impending retail sales and ip reports could cement an ease in July if not this month. DXY currently relatively contained within a 97.154-96.942 range.

- JPY/SEK – The Yen has nudged back up towards 108.00 vs the Buck, and is only really lagging behind Gold in the aforementioned risk-off climate plus the Swedish Krona in the G10 stakes due to firmer than forecast CPI and CPIF metrics that keeps the Riksbank on track to raise the repo. However, Usd/Jpy is still encountering underlying bids ahead of the big figure and may also be propped by decent option expiry interest between 108.00 and 108.15 (1 bn). Back to Scandinavia, Eur/Sek has extended post-inflation data declines through technical support at 10.6500 (10 DMA) and briefly below 10.6400 vs 10.7100+ at one stage.

- NZD/AUD – The major losers yet again, and with the Kiwi now underperforming after NZ manufacturing PMI only just held above the 50.0 threshold. Nzd/Usd has slipped under 0.6550 towards 0.6525 and Aud/Nzd is pivoting 1.0550 even though the Aussie has relinquished the 0.6900 handle and chart support a pip below amidst another round of more aggressive RBA policy easing calls (NAB now predicting 3 cuts in 2019 from 2 previously and RBC reckons the OCR will be lowered to 0.5% by May next year).

- EUR/CAD/CHF/GBP – All lower against the Greenback as well, albeit to a lesser extent compared to the Antipodean Dollars and to varying degrees. The single currency is retreating further from 1.1300 where massive expiries run off (4.4 bn) and the Loonie has reversed to test support ahead of 1.3350 having lost some of Thursday’s oil-powered momentum as crude prices simmer down after the post-tanker attack spike. Meanwhile, the Franc has pared gains across the board with Usd/Chf at the upper end of a 0.9966-26 band and Eur/Chf back above 1.1200 on SNB reflection (renewed and reemphasised convictions to keep NIRP or even cut deeper and continue intervention). Elsewhere, Cable has is now pivoting 1.2650 with independent bearish impulses from the ongoing UK political hiatus and resultant suspension of any real Brexit developments, but BoE Governor Carney may provide some additional impetus later.

- EM – No respite for the Lira it seems as Usd/Try rallies through 5.9000 to 5.9300+ and not far from chart resistance around 5.9500, including a 50% Fib of the retracement from last month’s highs to earlier June lows. The latest catalyst, warnings from Turkey’s Foreign Ministry that any US sanctions will be reciprocated.

The energy complex is poised for a weekly loss as the two tanker attacks off the coast of Oman only provided brief reprieve for the declining prices, with trade woes and rising US supply outweighing concerns in the Middle East. This morning also saw the release of the IEA monthly report in which the agency cut their outlook on oil demand growth by 100k BPD, which is in-fitting with the OPEC (70k BPD) and EIA (160k BPD) downgrades to oil demand growth for 2019 released earlier in the week. The report also noted that OPEC supply in May fell to the lowest since 2014 due to Iranian sanctions, in which Iranian oil production fell to the lowest since the 1980s. WTI and Brent are lower on the day and currently pressured by the continuation of the risk aversion. Elsewhere, gold has continued to advance as the yellow metal benefits from the risk-off sentiment, with prices now above the key USD 1350/oz ahead of strong trend-line resistance at USD 1358.50/oz. The rally in gold has spilled into other precious metals with silver hitting one-week highs and platinum gaining almost 1%. In terms of base metals, copper remains subdued amid the broad risk tone whilst Dalian iron ore touched new record highs as Chinese steel mills kept demand steady for the metal

US Event Calendaar

- 8:30am: Retail Sales Advance MoM, est. 0.6%, prior -0.2%; Retail Sales Ex Auto and Gas, est. 0.4%, prior -0.2%

- 9:15am: Industrial Production MoM, est. 0.2%, prior -0.5%; Manufacturing (SIC) Production, est. 0.1%, prior -0.5%

- 10am: U. of Mich. Sentiment, est. 98, prior 100; Current Conditions, est. 109, prior 110; Expectations, est. 92, prior 93.5

- 10am: Business Inventories, est. 0.5%, prior 0.0%

DB’s Jim Reid concludes the overnight wrap

Bloomberg have a competition on their terminals to predict every match in the Cricket World Cup. Unbeknown to me, my co-authors Craig and Quinn entered. I didn’t realise it was on until too late. Craig, like myself, is a cricket fan. Quinn is an American who knows nothing about cricket and a week or so ago made himself a laughing stock on our team by predicting that around half the games in this tournament would be ties. For those not familiar with one day cricket, a tie probably occurs every several hundred games. However two weeks into the tournament Quinn is near the top of the leaderboard as what we didn’t appreciate is that many of the games he marked as a tie would be rained off and giving him technically the correct answer. He has therefore had an uncanny knack of predicting our awful weather this past week. So for those that want a UK weather forecast, please have your umbrella to hand between these dates as Quinn has predicted another series of ties around then: June 22-26.

Predicting the daily swing in oil prices is proving to be one of the main challenges in markets at the moment. Indeed one day after Brent dipped -3.72% and to a five-month low, it recovered much of these losses in a single swing yesterday after bouncing back +2.37%. The catalyst was the attacks on tankers in the Gulf of Oman, the second attack in a month near the Strait of Hormuz chokepoint, which has led to fears that accelerated hostilities in the region are to return. The US Secretary of State blamed Iran for the attacks, in comments that President Trump subsequently retweeted, and overnight the US released a video demonstrating Iran’s involvement, saying an Iranian boat removed an unexploded mine from a US ship. US officials also suggested that a military response has not been ruled out. Separately, data from the US Energy Information Administration showed that in March, the US imported the lowest amount of crude oil from OPEC countries since March 1986, continuing a decade-long trend of lower US crude oil imports from the OPEC countries.

Unsurprisingly anything linked to oil benefited yesterday. The S&P energy sector rose +1.25% which carried the S&P 500 to a +0.41% gain, while the NASDAQ and DOW closed +0.57% and +0.39% respectively. The STOXX 600 finished +0.16%, with the DAX outperforming (+0.44%). Despite the geopolitical noise, the VIX traded fairly flat at 15.75. Interestingly, govies were actually better bid too with 2y and 10y Treasuries ending -4.7bps and -3.0bps lower respectively, sending the former to its lowest level since December 2017. So the simultaneous equity and rates rally was back in full force. In Europe 10y Bund (-0.5bps) and OAT (-0.2bps) yields edged lower, but the real action was in the periphery. Spanish 10y yields slid -3.1bps to a new all-time low of 0.537%, while BTPs rallied -7.7bps following strong demand at the 20-year auction. The latter move came despite increased political tension in Italy, where Deputy PM Salvini reportedly told his supporters to “be ready” for a possible early election.

One of the drivers for the rally in European bonds has been expectations for more accommodative policy from the ECB. DB’s Mark Wall has updated his forecasts in this note to reflect the latest macro information and the recent update to DB’s Fed call. In short, two trends are developing in ways that will push the ECB toward easing: escalation in the trade wars and a change in the relative monetary policy stance now that the Fed looks likely to cut rates this year. Mark now expects the ECB to cut its deposit facility rate at the September meeting, and anticipates 2020 growth to decelerate to 1.0% as a result of the anticipated slowdown in US growth. Similarly, DB’s China team has revised down their 2019 and 2020 growth forecasts by 0.1 and 0.2pp respectively, to 6.2% and 5.8%, also mostly as a function of lower expected US growth. If the trade war evolves as we expect, the PBoC is likely to ease rates policy and allow the yuan to weaken to as far as 7.3 versus the dollar. Zhiwei’s full China update is available here .

This morning in Asia equity markets are mostly trading lower. Although Japanese markets have pared back opening losses to trade higher, with the Nikkei +0.29%, elsewhere the story is less positive. The Hang Seng (-0.57%) is currently on track for a third consecutive move lower, while the Shanghai Comp (-0.26%) and the Kospi (-0.25%) have also lost ground. We should note that we’re still due to get China’s May activity indicators data. Bloomberg suggests that the data is out at 8am BST. For what it’s worth, fixed asset investment and industrial production are both expected to hold steady, however retail sales is expected to rise in year over year terms. This will probably dictate much of today’s mood. The other breaking news overnight that we’re just seeing is the AFP news agency reporting that French finance minister Le Maire has said that EU ministers have agreed to President Macron’s proposal for a Eurozone budget, although with no other information at present the question for markets will be how substantive this agreement actually is. President Macron has been previously disappointed by the reluctance of a number of northern European countries to set up a Eurozone budget as large as he’d like.

Back to yesterday and while there wasn’t a great deal of other news to digest for markets, we did have the first Conservative Party leadership contest which revealed overwhelming support for Boris Johnson in his bid to become the next PM. He took 114 votes with Jeremy Hunt a reasonable way back in second place at 43 votes. Gove, Raab, Javid, Hancock and Stewart all made it through to the next round which is due to take place next Tuesday, and where candidates will need to secure 33 votes (10% of the total). Brexiteers Leadsom and McVey were eliminated yesterday along with Harper. The BBC’s political editor Laura Kuenssberg tweeted last night that Health Secretary Hancock was “mulling over” whether to continue in the race, having come in 6th place with 20 votes. It’s clear from the first round that Johnson is the clear frontrunner and although history tells you frontrunners often don’t win the Tory leadership race it’s hard to see him being toppled outside of an “event” that derails his campaign. Sterling bounced a bit following the results before closing a touch weaker at -0.10%.

In US politics, no developments were immediately market-moving, but the White House did say that “we’re moving in that direction” with regards to a Trump-Xi meeting at the G20. Top economic advisor Larry Kudlow said that “President Trump has indicated his strong desire for a meeting (…) if the meeting doesn’t come to bear, there may be consequences.” So that event, set to start two weeks from today, will be key. Away from the China conflict, the passage of the USMCA deal (to replace NAFTA) still looks precarious, as Canadian Foreign Minister Freeland said that talks are “on the right track” but stopped short of giving a timeline for ratification.

As for the data, in the US the latest weekly claims reading ticked up to 222k and a little more than expected to a five-week high. The import price index meanwhile declined more than expected in May, by -0.3% mom at both the headline and core level. Previous dollar strength appeared to explain much of the weakness in non-petrol prices.

Prior to this, in Germany there were no final surprises in the May CPI report where the headline reading was confirmed at +0.3% mom and +1.3% yoy. Elsewhere, industrial production for the Euro Area in April was confirmed as declining -0.5% mom, as expected.

To the day ahead now, where this morning we’ll get the final May CPI revisions for France and Italy. Bisecting that data is the China May activity indicators while in the US this afternoon the main highlight should be the May retail sales report, while May industrial production, April business inventories and the preliminary June University of Michigan consumer sentiment survey are also due. Away from that we’re due to hear from the BoE’s Carney this afternoon.