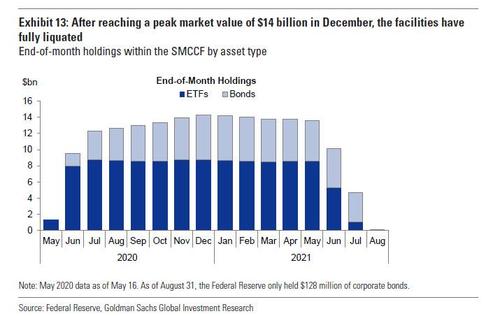

Last March capital markets as we once knew them ceased to exist: that’s when the Powell Fed crossed a Rubicon even Ben Bernanke dared not breach and announced that it would start buying single-name corporate bonds and ETFs under its Secondary Market Corporate Credit Facility (SMCCF) with both IG and HY names eligible for purchases in the process effectively nationalizing the corporate bond market.

Purchases under this facility, which were meant to reassure and stabilize the corporate bond market continued until December, at which point – with stocks at new all time highs – the Fed announced the cessation of its corporate bond purchases and entered the beginning stages of fully winding down the Secondary Market Corporate Credit Facility (SMCCF).

At the time, some market participants worried this might translate into a reduction in liquidity, but with purchases amounting to less than $500 million per week since July 2020 …

… and an overall portfolio holding of just $14 billion, it was unlikely that any material deterioration in market microstructure would take place.

And after all, the Fed’s purchases were merely symbolic: the Fed never wanted to become as BOJ-like whale in the corporate bond market, but merely to signal to the world that it would not allow bonds to drop further and would, if required, buy more. Of course, it was not required as the mere guaranteed backstop by the Fed was sufficient to the get dip buyers out in force.

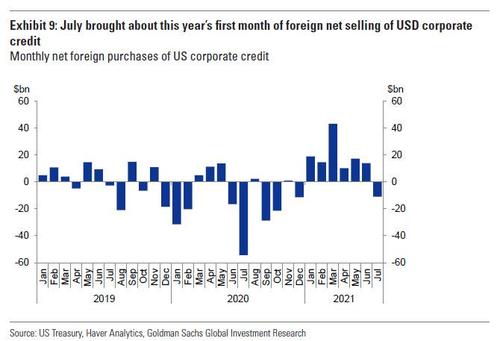

And sure enough, fast forward to the first week of September, when the Federal Reserve has now been able to sell-off the entirety of its corporate bond portfolio with no effect on the market’s microstructure; curiously this also comes at a time when the latest TIC report showed that in Julye foreign investors were net sellers of corporate bonds for the first time this year.

Yet while the SMCCF has now been closed, we continue to think its legacy will live on as a part of the Fed’s policy toolkit with investors forever expecting its reactivation when another macro shock occurs and sends large gyrations throughout corporate credit markets. Or rather “markets” because a world where corporate bonds have no downside is just as centrally-planned as anything China could come up with, and while stonks continue to ramp up for now, there will come a time when everything will crash again and the Fed will once again remind us just how fake price discovery is in a world where the only thing that matters is the Fed’s balance sheet as Citi’s Matt King put it so elquqently in his latest report:

Some of the most interesting research of recent months concerns the “price inelasticity” of markets. Interesting, that is, to academic economists and monetary policymakers. For anyone who’s actually tried trading in markets over the past decade, the idea that prices might be determined more by flows and liquidity and certain large, price-insensitive buyers than by a rational discounting of fundamentals sounds less like a revolutionary insight and more like a statement of the blindingly obvious

As one investor put it to us recently, central bankers seem to be the only market participants left who fail to appreciate the stranglehold their policies have over asset prices: everyone else gave up looking at fundamental value in favour of obsessing over the minutiae of central bank balance sheet line items a long time ago.

While we are currently on autopilot, we expect to be reminded quite soon just how critical the Fed’s liquidity injections are for a binary world where the alternatives are simple: either the Fed prints hundreds of billions every quarter bringing the fiat system ever closer to its death, or we crash.