Authored by Kevin Muir via The Macro Tourist blog,

In all my time studying markets, I can’t recall a single instance when the split between “pros” and “retail” has ever been higher.

What do I mean by that?

Well, amongst the professionals who manage money for a living, there seems to be a universal bearishness regarding the outlook for the stock market in the coming months. But wait! I can hear the push-back already – there are plenty of bulls out there spouting their optimistic forecasts all over the financial news networks. And yes, that is correct. However, these are almost all perma-bulls. When Reformed Broker Josh Brown whispers sweet-nothings about stocks it means squat as he is always bullish. On the other side of the coin, when Peter Schiff howls about the coming equity market collapse, it’s simply another day of the week that ends in the letter Y. To get a sense of the true sentiment amongst professionals, you need to ignore the perma-bulls and bears – instead focus on the group who actually change their opinion based on circumstances.

Professional sentiment

There is little doubt that amongst these professionals almost everyone is bearish. They might not be forecasting another 1987 market crash, but there are precious few who believe this rise is justified by fundamentals and due to continue. The pain from last year’s December swoon is too fresh in their minds.

Whether it is CNBC-regular Dennis Gartman worrying about the prevalence of money-losing IPOs;

Or this quite-funny tweet about the possibility of a “melt up”;

There are practically zero professionals who believe this rally has legs and will continue to blast through to new highs.

Want some actual data as opposed to anecdotes?

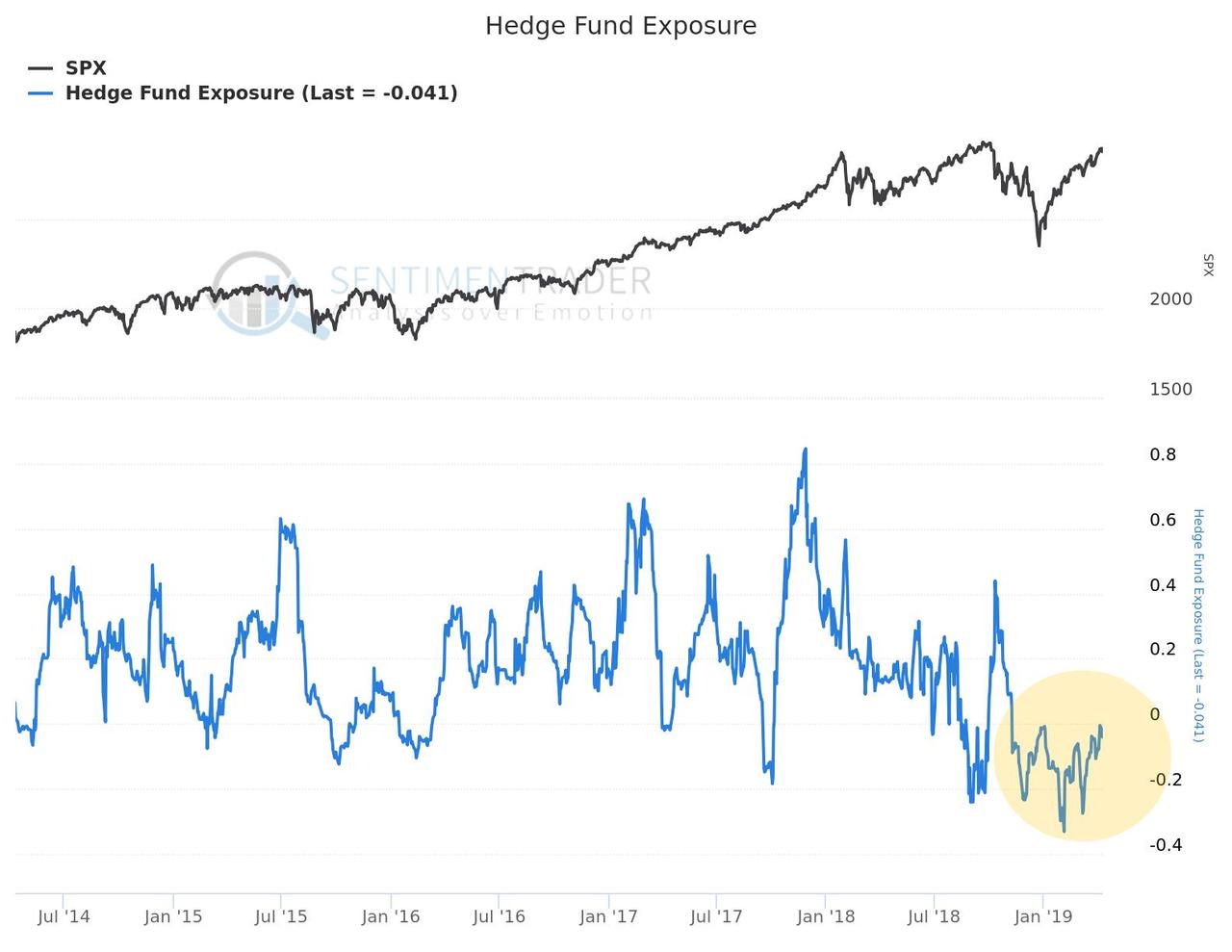

How about this chart from Sentiment Trader that measures hedge fund exposure to the equity market:

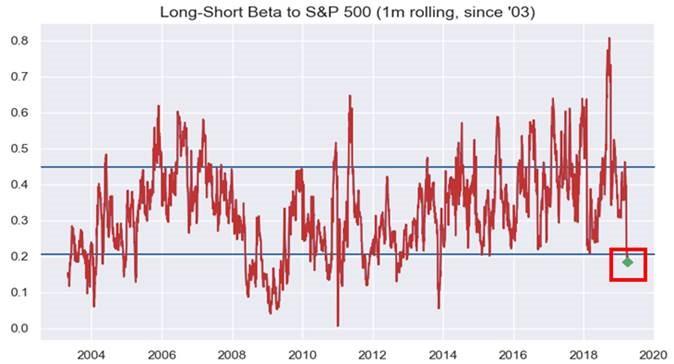

And it’s not just Sentiment Trader’s data that is showing hedge funds underweight equities. Nomura strategist Charlie McElligott has recently highlighted the extreme low beta reading from long-short funds.

There is little doubt in my mind that the more sophisticated of an investor you are, the more likely you are to be bearish up here.

And who would blame anyone for this skepticism?

Since the infamous Christmas-Eve-bottom, the S&P 500 is up on a stick. In less than four months, it has risen almost 25%!

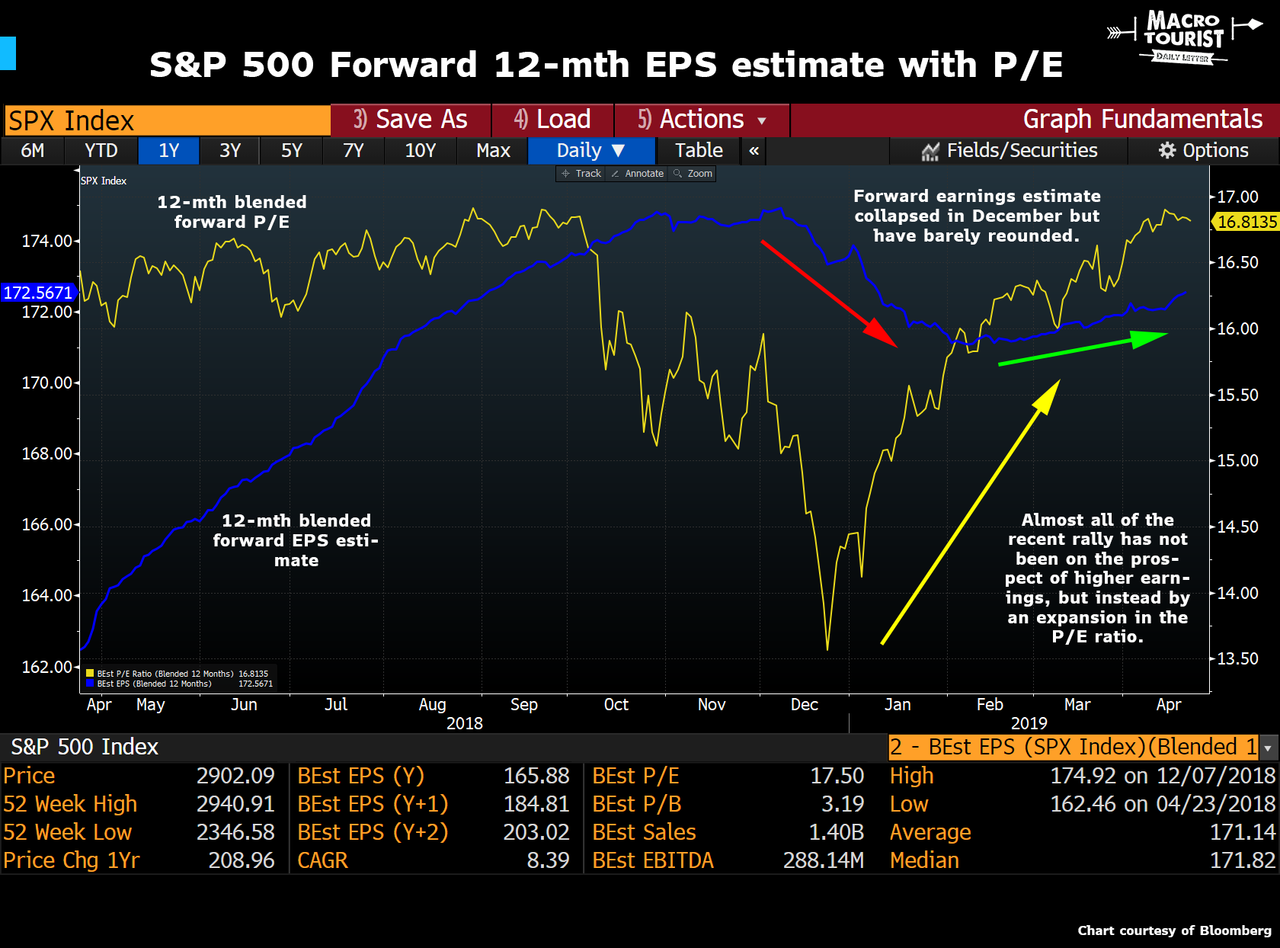

It’s easy to see why the professionals are bearish. This whole rally has not been on the back of sharply rebounding earnings, but instead almost exclusively the result of an expanding forward P/E ratio.

Let’s see – stocks severely overbought with fundamentals clearly not keeping up with price action, no wonder the pros are fading this rally.

Retail sentiment

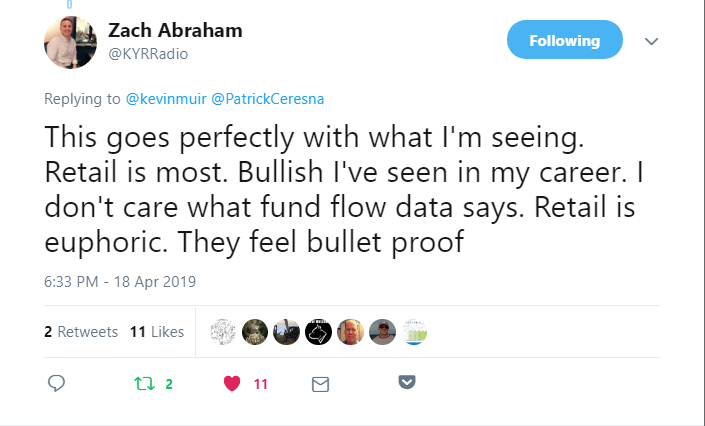

What about retail? Although I don’t have a lot of interaction with retail, I will rely on my buddy Zach Abraham’s comments about the froth steaming through this segment of the market:

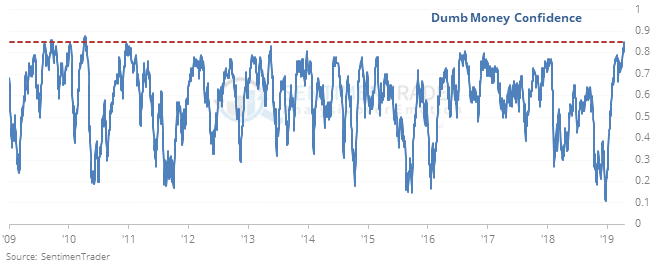

Lest you think this is once again just anecdotal evidence, I point you back to Jason Goepfert’s great site SentimenTrader.com where his recent blog post outlined that “dumb money” was as optimistic as it has been for over a decade:

There are similar sentiment readings in a variety of other retail indicators that corroborates this conclusion. Retail investors are chasing stocks like a group of 45-year Moms spotting Simon LeBon outside a Duran Duran concert.

Clashing views

This leaves us in an awkward position. The professionals are bearish and believe this rally should be sold.

Yet retail is hoovering up stocks like a brand-spanking-new triple-action model with the red trim and all the options.

In the old days it would make sense to go with the professionals – after all they do this for a living.

But in this age of limited alpha, I believe the choice is not nearly as clear.

Ironically, the weak hands are no longer retail and they are not nearly as “dumb” as Wall Street believes. Retail investors don’t have the pressure of monthly return comparisons. They don’t have consultants threatening to pull money at the first sign of underperformamce.

This might sound absurd, but I would rather be on the side of retail. I know that would mean buying stocks up here at plus 25%. As a professional trader, that’s almost the same as a Michelin-Chef putting ketchup on a steak, but remember – the best trades are often the hardest.

Regardless of where you come down on this debate, be aware that this is truly a peculiar period. The two sides are as far apart as I have ever seen. One of them will be spectacularly wrong. I know it’s tempting to come down on the side of the professionals. Just be careful as trading is seldom as easy as taking advice from this group – after all, don’t forget that Erlich Bachman is also a pro.

https://platform.twitter.com/widgets.js

Source link