Following March’s modest rise in Housing Starts and Permits, analysts expected reality to catch up with the homebuilder market in April (just as we saw in the NAHB sentiment survey slumping to 2 year lows). Housing Starts and Building Permits both dropped in April but the picture was mixed with Starts falling just 0.2% MoM (against -2.1% MoM exp), but that was due to a huge downward revision in March Starts from +0.3% to -2.8% MoM?!

Building Permits tumbled 3.2% MoM (more than the expedcted 3.0% MoM drop) with only minimal revisions to March.

Source: Bloomberg

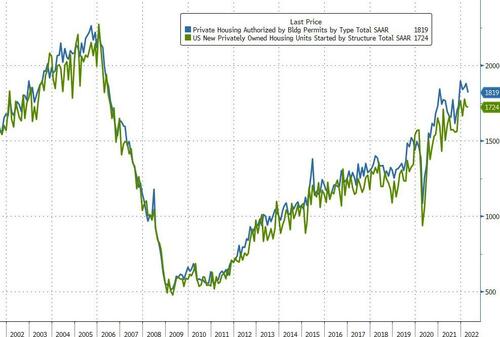

Overall Start and Permits appear to be rolling over…

Source: Bloomberg

The average for a 30-year loan rose to 5.3% last week, up from 2.94% a year prior and the highest since 2009, Freddie Mac data show.

“The housing market is facing growing challenges,” Robert Dietz, chief economist at the NAHB, said in a statement.

“Building material costs are up 19% from a year ago, in less than three months mortgage rates have surged to a 12-year high and based on current affordability conditions, less than 50% of new and existing home sales are affordable for a typical family. Entry-level and first-time home buyers are especially bearing the brunt of this rapid rise in mortgage rates.”

Finally, given the collapse in mortgage applications (purchases now crashing, following refi apps crash), we suspect the collapse in the new home construction business is just beginning (judging by the spread to forward-looking building permits)…

Source: Bloomberg

And Powell will only make things worse… “Soft landing” my arse!