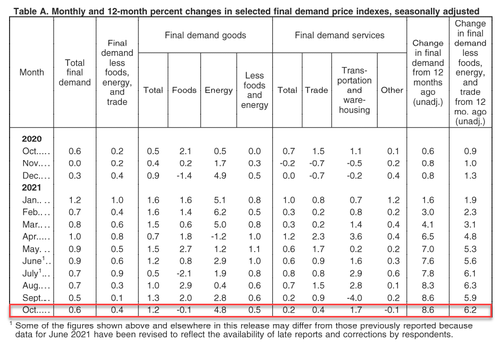

The non-transitory surge in inflation was expected to continue in October with analysts forecasting a 8.6% YoY rise in producer prices, and they nailed it (PPI +0.6% MoM as expected). That is a record high for headline PPI YoY at +8.6%…

Source: Bloomberg

The surge in prices is dominated by Energy and Transportation costs…

One-third of the October advance in the index for final demand goods can be traced to prices.

for gasoline, which rose 6.7 percent. The indexes for diesel fuel, fresh and dry vegetables, gas fuels, jet fuel, and plastic resins and materials also moved higher.

Over 80 percent of the October increase in prices for final demand services can be traced to margins for automobiles and automobile parts retailing, which rose 8.9 percent.

The indexes for apparel, footwear, and accessories retailing; truck transportation of freight; food and alcohol retailing; hospital outpatient care; and machinery and equipment parts and supplies wholesaling also moved up. In contrast, prices for securities brokerage, dealing, investment advice, and related services fell 6.6 percent. The indexes for fuels and lubricants retailing and for portfolio management also declined.

The gap between PPI and CPI continues to run at record highs, meaning either consumers are about to be crushed or margins are going to collapse (which is odd because margins are actually at record highs)…

Source: Bloomberg

Finally, the ‘pipeline’ for inflationary impulses in final demand PPI looks very scary

Source: Bloomberg

The question is – would a Fed Chair Brainard ever do anything to halt the surge in inflation?