By Vishwanath Tirupattur, global head of Quantitative Research at Morgan Stanley

Over the past few weeks, risk markets have been buffeted by volatility from a wide array of sources. It was around a month ago that the regulatory reset in China and near-term funding pressures on select property developers roiled global markets, as investors fretted over the systemic implications for global growth. A mixed US jobs report along with sharply higher commodity prices intensified the debate around stagflation. Rhetoric from multiple central banks has been increasingly hawkish. The combination of these concerns has resulted in substantial market gyrations. Relative to a month ago, the S&P 500 Index declined by about 4% before recovering to up 6%. The shape of the Treasury yield curve has twisted and turned. The benchmark 10-year Treasury interest rate went from around 1.30% to around 1.70%, and market pricing of the timing of a Fed rate hike has come in sharply.

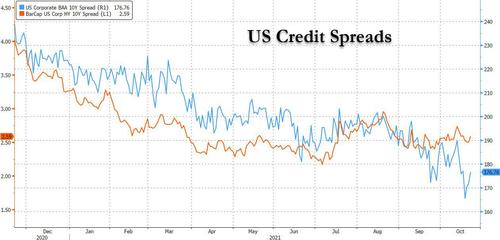

Amid these substantial moves, corporate credit markets on both sides of the Atlantic have largely stayed calm. Credit spreads in investment grade, high yield and leveraged loans across the US and Europe have hovered near 52-week tights, with surprisingly limited volatility.

Credit market beta relative to equity markets remains very low. Market access for companies across the credit spectrum has remained robust, as indicated by strong issuance trends, running at or ahead of the pace a year ago. What explains this stark difference between credit and other markets? The answer boils down to meaningfully improved credit fundamentals and elevated balance sheet liquidity, leading to a decidedly benign outlook for defaults over the next 12 months, if not longer.

Our credit strategists, Srikanth Sankaran and Vishwas Patkar, have highlighted that the balance sheet damage from COVID has been reversed. At the end of 2Q, gross leverage in US investment grade credit had declined sharply to 2.4x, back to pre-COVID levels. Net leverage is now below pre-COVID levels, while interest coverage has risen sharply to a seven-year high.

The trends in the high yield sector are even more impressive and the improvement broad-based, driven not just by the rebound in earnings but also negative debt growth. At 3.87x, the median leverage of high yield companies in our coverage universe for 2Q21 is down 0.5x Q/Q and 0.89x Y/Y. After four consecutive quarters of declines from the 2Q20 peak, median leverage now sits below the pre-COVID trough. That 71% of the issuers are reporting lower gross leverage Q/Q reflects the broad-based improvement.

Encouragingly, the size of tail cohorts has also begun to normalize – the share of issuers reporting 6x+ leverage is down 7 percentage points on the quarter. On the median measure, debt balances were 3.9% lower Y/Y while LTM EBITDA was 17.5% higher. Median interest coverage increased in the quarter to 4.68x (+0.52x Q/Q), with a solid 82% of issuers posting improved coverage. Cash-to-debt ratios remained close to record highs at 15.6%. Even in LBO land, while 2021 has been a bumper year for acquisition activity, with transaction multiples and debt multiples at record highs – usually a source of concern for leveraged loan and high yield bond investors – unprecedented equity cushions have resulted in a better alignment of sponsor and lender interests, helping to alleviate concerns.

These improvements in credit fundamentals explain the low-beta behavior of credit versus equity markets. Earnings and margin concerns matter for credit investors, too, but the intensity and breadth of balance sheet repair matter more. Furthermore, given the sharp rally in stocks, equity cushions in capital structures have increased and leverage as measured by debt-to-EV has declined.

What are the implications for investors? A lot, of course, is in the price. With credit spreads near the tight end of the spectrum, we are more likely to see them widen than tighten.

Indeed, the base case expectation of our credit strategists is for modestly wider spreads. However, the strength in credit fundamentals suggests that the outlook for defaults is benign and likely below long-term average realized default levels. Thus, we prefer taking default risk to spread risk here, leading us to favor high yield over investment grade and, within high yield, loans over bonds. For the more sophisticated investor seeking double-digit returns, the best expression of this view would be through equity tranches of collateralized loan obligations (CLO). Structural leverage as opposed to repo leverage, cash flows that are front end-loaded, multiple embedded refinancing options, all combined with the expectations of benign defaults, make CLO equity tranches a particularly interesting opportunity.