The one thing we know is that global central banks have pumped an enormous amount of fast-moving money into the global financial system over the last year – somewhere around $10 trillion, or about a 50% increase in their collective balance sheets. All this hot money has to go somewhere, and besides stocks, some of the money has ended up in housing markets around the world.

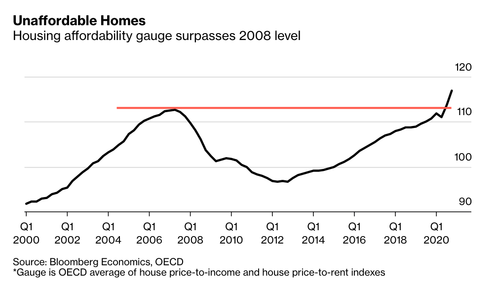

Bloomberg Economics says the run-up in global real estate prices over the last year (thanks to central bankers) has produced a warning signal unlike any other, not seen since right before the 2008 financial crisis.

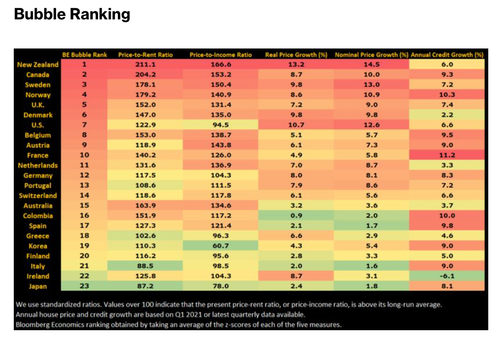

New Zealand, Canada, Sweden, Norway, UK, Denmark, and the US are considered the “world’s frothiest housing markets” based on a handful of factors via a Bloomberg Economics report.

“A cocktail of ingredients is sending house prices to unprecedented levels worldwide,” economist Niraj Shah wrote in the report. “Record low-interest rates, unparalleled fiscal stimulus, lockdown savings ready to be used as deposits, limited housing stock, and expectations of a robust recovery in the global economy are all contributing.”

Bloomberg used five indicators to construct the Bubble Ranking list of the world’s frothiest housing markets, including price-to-rent, price-to-income, real price growth, nominal price growth, and annual credit growth. The analysis revealed that price ratios are higher than they were ahead of the 2008 financial crisis.

The big spurts from the digital printing presses have resulted in housing unaffordable in OECD countries to surpass 2008 levels. The gauge of housing affordability is the average of house price-to-income and house price-to-rent indexes.

Shah warned:

“When borrowing costs do start to rise, real estate markets — and broader measures put in place to safeguard financial stability — will face a critical test.”

… and if the Fed even dares to mention tapering its $120 billion monthly bond-buying programs in this week’s meeting and or maybe at Jackson Hole later this summer, the world’s frothiest housing markets may face downward pressure.