Dear Mrs. Lagarde, You’re Wrong (Twice)

During Christine Lagarde’s first press conference as ECB President she dropped a couple of statements that simpoly need to be addressed for their “error”-ness…

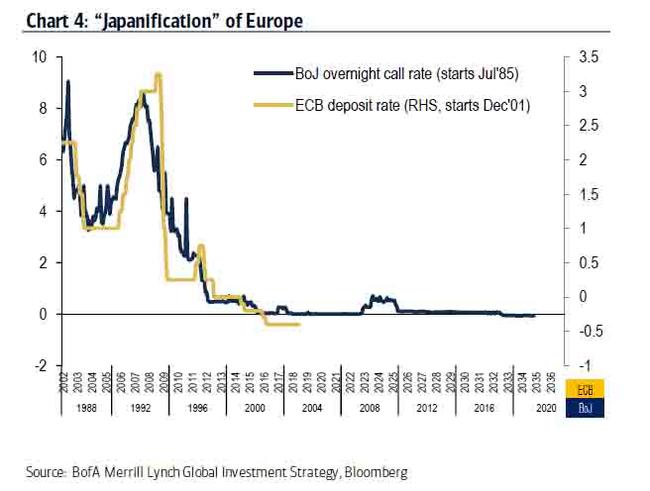

First, the former IMF head proclaimed confidently that “the Euro are is not seeing Japanification.”

We beg to differ…

And second, Lagarde confidently told the listening audience that “negative rates seem to work” even though she admitted that “the ECB is very aware of the side effects.”

The question is “working” for whom?

Source: Bloomberg

As a reminder, Europe’s banking CEOs disagree…

Oswald Gruebel, who served as Credit Suisse CEO from 2004 to 2007 and as UBS Group AG’s top executive from 2009 to 2011, has slammed ECB policy in an interview with Swiss newspaper NZZ am Sonntag.

“Negative interest rates are crazy. That means money is not worth anything anymore,” Gruebel exclaimed.

“As long as we have negative interest rates, the financial industry will continue to shrink.”

The ECB’s imposition of negative interest rates have created an “absurd situation” in which banks don’t want to hold deposits, rages UBS CEO Sergio Ermotti, arguing that this policy is hurting social systems and savings rates.

Additionally, Deutsche Bank CEO Christian Sewing warned that more monetary easing by the ECB, as widely expected next week, will have “grave side effects” for a region that has already lived with negative interest rates for half a decade.

“In the long run, negative rates ruin the financial system,” Sewing said at the event, organized by the Handelsblatt newspaper.

Another cut “may make refinancing cheaper for states, but has grave side effects.”

While Lagarde has previously claimed that the benefits of deeply negative rates outweigh the costs (reaffirming today that “a highly accommodative policy is warranted for a prolonged period of time”) few economists believe another cut at this level would actually help the economy. According to Sewing, all it would achieve is to further divide society by lifting asset prices while punishing Europe’s savers who are already paying 160 billion euros ($176 billion) a year because of negative interest rates.

“What’s really worrisome: central banks have hardly any tools left to effectively mitigate a real economic crisis,” Sewing said.

“They have already cranked open the money tap – most of all the European Central Bank.”

Who can blame them when you look at their share prices.

All of which reminds us that “…when it’s serious you have to lie…”

Tyler Durden

Thu, 12/12/2019 – 09:13