Submitted by QTR’s Fringe Finance

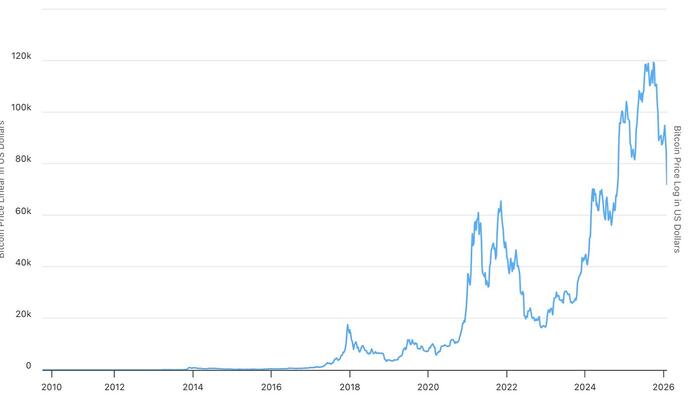

Bitcoin has a way of faking its own death, and this past week delivered another such instance with theatrical flair. After flirting with the once-unthinkable level of $120,000, the world’s most famous digital asset promptly face-planted to around $62,000 at its recent lows on Thursday.

Even for crypto, a 50% drawdown in months isn’t just a bad couple weeks. In a nascent asset like Bitcoin it’s always a bit of a spiritual test. More than that, this drawdown looks and feels like yet another Bitcoin “moment of truth,” the kind that forces believers and skeptics alike to confront what this asset really is—and what it isn’t.

For veterans of Bitcoin, the pattern is familiar. Exuberance builds. Headlines turn breathless. Group chats fill with laser-eye emojis. Then, without warning, gravity reasserts itself. Prices collapse. Influencers go quiet or get ornery on social media. Everyone suddenly remembers that “number go up” is not, in fact, a law of physics. But then Bitcoin always does — back to new highs over and over.

These moments of truth are supposed to be Bitcoin’s specialty. The “maxis,” sometimes proudly, sometimes ironically—have spent more than a decade preaching the same sermon. Volatility is not a bug, it’s a feature. Pain is purification. Weak hands must be shaken out. Michael Saylor once famously framed volatility as “Satoshi’s gift,” a kind of built-in psychological stress test designed to separate true believers from tourists. If you can’t stomach 50% drawdowns, you don’t deserve the upside. That’s the doctrine. Eat a dick, Sharpe ratio.

This time, though, the crash is being framed slightly differently by skeptics. Peter Schiff, Bitcoin’s longtime nemesis and professional eye-roller, has been quick to argue that this is not just another routine purge. In his view, this is not another dress rehearsal. He thinks it is the bubble finally popping after years of supposedly “mass” adoption.

Sure, he’s said this a lot over the years but unlike previous cycles, Bitcoin hasn’t been lurking in the shadows of Reddit forums and obscure exchanges. Over the past two years, it has marched directly into the mainstream. ETFs, retirement accounts, major banks, payment platforms, corporate treasuries, political campaigns—crypto didn’t just knock on the front door of the U.S. financial system. It moved in and started rearranging the furniture.

Which brings us to why “it’s different this time”.

Under Donald Trump, the United States has effectively gone all-in on crypto in ways that would have seemed absurd not long ago. Trump has openly branded himself as the “crypto president.” His campaign accepted crypto donations. Pro-crypto advisors and donors gained influence. Regulatory agencies softened their tone. Enforcement actions slowed. Bitcoin and digital assets were reframed less as speculative toys and more as strategic financial technologies.

At the same time, Wall Street embraced Bitcoin. Spot ETFs opened the floodgates for institutional money. Pension funds dipped their toes. Wealth managers added “digital assets” to client portfolios. CNBC began treating Bitcoin price movements like weather reports. You didn’t need to be edgy or rebellious to own BTC anymore. You just needed a brokerage account. Even Vanguard caved…

So if adoption was the rocket fuel, a fair question now is: how much is left in the tank?

That’s the core of the bearish argument. If nearly everyone who wants Bitcoin in the United States already has easy access to it, then where does the next wave of buyers come from? When your barber, your dentist, and your aunt’s financial advisor all know how to buy BTC, you’re not early anymore. You’re late-stage. If demand has peaked, then the recent crash isn’t just noise. It’s the market quietly admitting that the story may be running out of new chapters.

In that scenario, the downside could be ugly. Not just another dip-and-rip cycle, but something more structural. A slow bleed. A loss of cultural relevance. A gradual realization that Bitcoin might survive, but mostly as a niche asset rather than a world-changing revolution. Gold bugs would feel vindicated. Crypto Twitter would feel tired. Venture capital would move on to the next shiny thing…probably some AI-related bullshit.

Yet the bulls are not packing up.

As I ridiculed wrote last week, recurring financial media rash Tom Lee continues to argue that Bitcoin is still in the early innings of global monetization. My buddy Larry Lepard has also talked up targets in the $200,000 to $250,000 range, suggesting that monetary debasement, debt crises, and currency instability will eventually funnel massive capital into scarce digital assets. From this perspective, the recent collapse is just another pothole on a very long highway. Adoption in the US may be maturing, but the rest of the world is still warming up. Sovereign debt problems, geopolitical tensions, and distrust in central banks aren’t going away. If anything, they’re multiplying.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life: Get 50% off forever

In this telling, the current selloff is simply another rehearsal in Bitcoin’s long-running play: “How Many Times Can We Kill It Before It Actually Dies?” So far, the answer is “a lot.”

Still, even optimists are starting to acknowledge an uncomfortable reality. There doesn’t seem to be much untapped mainstream adoption left in America. The regulatory environment is friendlier than it’s ever been. The political branding is pro-crypto. The financial infrastructure is built. If Bitcoin can’t thrive in this environment, it’s hard to argue that a better one is just around the corner. When the so-called “crypto president” presides over a 50% drawdown, it raises questions.

Which brings us back, once again, to Bitcoin’s moment of truth.

From here, the paths diverge sharply. One possibility is a serious crash with no meaningful recovery, a slow deflation of the crypto dream that leaves Bitcoin alive but diminished. Another is a long, grinding crypto winter—years of sideways trading, fading hype, shrinking communities, and endless “this is accumulation” posts that age poorly. The third is the familiar miracle: confidence returns, liquidity floods in, narratives reboot, and Bitcoin charges back through old highs like nothing happened, leaving doubters to explain why they sold at $62,000.

History suggests Bitcoin is very good at humiliating both its critics and its fans, often in alternating cycles. Right now, it’s humiliating the optimists. In a year, it might be mocking the skeptics. Or it might finally decide to grow up and become boring, which would be the most shocking outcome of all.

For now, the only certainty is this: this really does feel like another defining moment of truth for Bitcoin. The volatility that maxis call a gift is still very much in circulation. And like most gifts that arrive wrapped in panic and red candles, it’s not entirely clear whether anyone actually wants it.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier. I am an investor in Mark’s fund.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Loading recommendations…