Humanoid robots are getting their “brains” this year, enabling them to walk factory floors and warehouses and complete repeatable tasks previously handled by humans. We’ve assessed that the greater risk is dual use: these bots are likely to move beyond industrial settings to modern battlefields.

We lean on UBS analysts led by Phyllis Wang for added color on the global humanoid robotics landscape, and the core takeaway is that global shipments are about to ramp up, setting the stage for materially higher penetration as industrial use cases move from demos to real workloads.

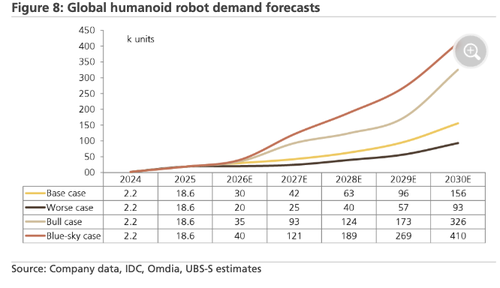

“For 2026, our base case forecast for global humanoid robot demand is 30,000 units. Regardless of total output in 2026, we expect a small proportion of robots which can complete simple tasks autonomously outside entertainment and robot training scenarios, given the gap between robot intelligence and customer needs,” Wang told earlier this week.

He continued, “We flag upside risk to our 2027-28 demand forecasts if robots used in industrial settings make significant progress. While humanoid products are still evolving, several leading OEMs are planning and deploying production capacity.”

“Tesla plans to build a 1m unit Optimus robot production line with production starting at end-2026. UBTECH plans a production capacity of 10,000 units this year, while Boston Dynamics (BD) plans a 30,000 unit capacity in 2028 for its Atlas robot,” he added.

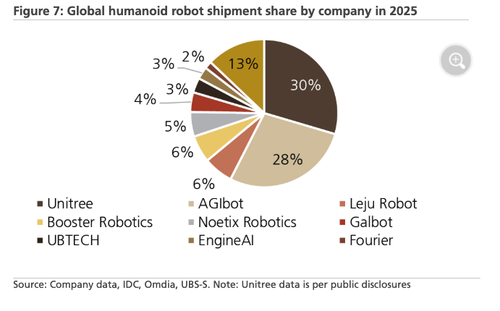

Wang noted that 2025 humanoid robot shipments totaled about 18,600 units, with most shipped by Chinese robotics companies, including roughly 5,000 units each from Unitree and AgiBot, for a combined total of about 10,000.

2025 Shipments by company

Wang marks 2026 as the year humanoid robot shipments begin to ramp up. The surge comes in the 2027-28 timeframe.

Here’s more about his forecast:

We maintain our 2026 demand forecast, but flag upside risks

We maintain our global demand forecast of 30,000 humanoid robot units in 2026. We see upside risks if AI development accelerates or client feedback boosts increased adoption. Our bull case and blue-sky case forecasts for 2026 are 35,000 and 40,000 units, respectively. We flag upside risk to our 2027-28 demand forecasts if robots used in industrial settings make significant progress

Related:

And there’s more:

While Wall Street is fixated on humanoids entering factories and kitchens this decade, we’re one step ahead of the street and highlighting the mounting risks of dual use.

Our assessment is that these bots have already demonstrated utility on factory floors, and efforts are underway to test them on battlefields in Eastern Europe.

Professional subscribers can read the full humanoid robot note on our new Marketdesk.ai portal.

Loading recommendations…