CME Group is drawing up plans for what could become the first-ever futures contract tied to rare earths, according to three people familiar with the matter, offering governments, companies and lenders a potential tool to manage exposure to a market long dominated by China, according to Reuters.

The proposed contract would track neodymium and praseodymium (NdPr), typically traded together and used to produce permanent magnets found in electric vehicle motors, wind turbines, drones and fighter jets. While discussions are ongoing, no final decision has been made. Liquidity remains a concern, as rare earth trading volumes are small compared with most established metals markets.

Rival exchange operator Intercontinental Exchange has also examined launching rare earth derivatives, though two sources said its efforts are at an earlier stage. CME declined to comment, and ICE did not respond to requests for comment.

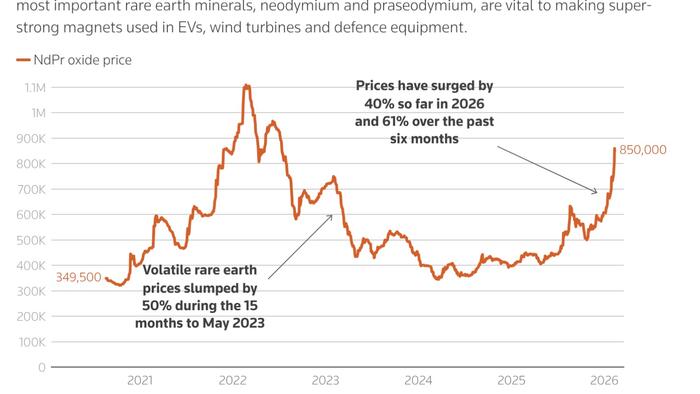

Reuters writes that volatile pricing has been a major obstacle for Western rare earth projects seeking funding. Banks have been wary of backing new mines and processing facilities because producers lack reliable ways to hedge against sharp price swings. According to Shanghai Metals Market data, NdPr prices in China have surged roughly 40% this year to their highest levels since mid-2022, after sliding by half in the 15 months through May 2023. Currently, benchmark prices are set in China and reflected in assessments by agencies including Fastmarkets and Benchmark Mineral Intelligence.

China controls about 90% of processed rare earth supply, complicating Western efforts to diversify sourcing. Rare earths — a group of 17 elements essential to electronics, defence systems and the energy transition — have become a strategic priority. The U.S. recently introduced a $12 billion strategic stockpile and formed a preferential trade bloc with allies focused on critical minerals. Last July, Washington agreed to a multibillion-dollar package with MP Materials that included a 15% stake and a price floor linked to NdPr.

A futures contract could help both producers and industrial buyers, including EV manufacturers, manage price risk more effectively. “It’s such a key missing piece of the puzzle for the industry right now,” one source said.

CME, already active in lithium and cobalt futures markets, recently reported quarterly profit ahead of Wall Street forecasts, with average daily trading volumes climbing 7.5% to a record 27.4 million contracts.

Loading recommendations…