By Peter Tchir of Academy Securities

An Eclectic Mix of Things to Mull Over

Let’s start with the one thing that has annoyed me more than anything else. I kept hearing over and over “what a good report” the jobs report was. That disturbs me, because with some digging, there were a number of issues that we highlighted in Strange Jobs Reports. I accept that my interpretation could be wrong, but some people who I trust (and have been consistently good) pointed out that it was probably worse than I wrote. Something that I found curious (but haven’t verified) is supposedly 11 of the last 12 reports have been revised down (seems odd).

10 of the past 11 months have been revised lower https://t.co/fn139AC4il pic.twitter.com/tfrNWsdZXg

— zerohedge (@zerohedge) January 5, 2024

There was a very good radio interview I listened to with someone from a temporary employment company who pointed out that for the second month in a row, there were losses in temp employment – usually a leading indicator. Oh, and the ISM was awful, but enough ranting! Or, more accurately, enough ranting on that subject, and let’s move on to other things that perturb me.

First the “Normal” Stuff

America the Divided, may well be how we fill in the blank for America the ______ (the 2024 Outlook piece). The election is heating up as we near the primaries and President Biden launched his first campaign commercial. The slogans might sound “unifying,” but from a distance, they seem more likely to be divisive (rather than unifying) at least at this stage.

Paying lip service to Geopolitical Risk. I’m certainly aware of the risk that having such great access to and interaction with our Geopolitical Intelligence Group could be influencing me too much (for a hammer, every problem looks like a nail). But we are not the only ones talking about geopolitical risk. It has been mentioned in corporate report after corporate report (right up there with AI). Certainly, asset managers mention that geopolitical risk could pose the biggest risk to markets in 2024. Yet, for all the talk, I think that it is largely being ignored. Times Have Changed – Position Accordingly, details my thoughts on how geopolitical risk is impacting market signals and correlations. These changes in turn should impact your business decisions and portfolio management.

General Robeson and Peter Tchir were on Bloomberg Radio discussing the Middle East, shipping, and oil (Bloomberg Podcast). Academy was also on Bloomberg TV with our macro take on markets, the economy, and geopolitical risks (Bloomberg TV first 2 segments).

The Non-Strategic Petroleum Reserve

From turning a blind eye to Iran’s sale of oil (well above any sanction limits) to the feeble attempts to exchange oil for free elections in Venezuela, to the disingenuously named Inflation Reduction Act, I cannot help but be concerned. The U.S. (as a nation) has painted itself into a corner and is not doing a good job of getting out of that predicament.

We have tensions in the Middle East. We have competitors for Venezuela’s supply. The finds in Guyana may prove challenging for the U.S. (as opposed to other countries) to access.

“We,” or at least the incumbent politicians, have demonstrated a real fear of inflation. Probably, at least in part, rightfully so, but that fear seems overdone – especially in an era where jobs and pay raises have been plentiful.

There is no way that our adversaries (and even some “friends” like the Saudis) haven’t noticed this depletion and are taking advantage of it when and where they can. It is one reason why I like energy and energy stocks so much.

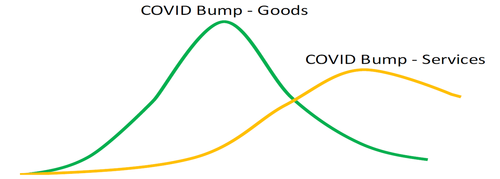

COVID “Bumps”

We argued, quite violently, it seems, that much of the goods inflation was transitory. That not only did you have supply chain issues, but you had consumer behavior radically altered, at least for a little while.

- Government money was sloshing around. Job availability was incredibly high.

- Mobility was high and many were exploring a “new way of life” that “work from home” brought, creating demand in its own right.

- Finally, consumers aren’t stupid, and knew about supply chain issues, so they bought what was available, even if they didn’t need it at the time.

Here is how I see the COVID bump playing out for goods (already discussed) and for services (up next).

We have argued, less violently, but increasingly so, that the services industry experienced a similar bump, but with some key differences!

- It started later for many. In some cases, states or countries precluded certain services from being offered. Even in areas where services were available, individuals had their own comfort level as to when they were comfortable using various services.

- The travel industry was particularly hard hit by COVID, and it was difficult to return to normal after such a dramatic COVID pullback in demand. So, the “supply chain” issues in services like travel were hampered even after they started normalizing.

- There was less money sloshing around by the time services got into full swing. Let’s admit it, 2023 should be labeled as the Summer of Vacation. It also happened to be the summer that America really discovered Europe and overseas travel.

If I am correct about the difference, I think that we are in the early stages of declines in service usage. That will hit the economy hard.

QQQ – Or When Passive Isn’t So Passive

The top 7 companies (one stock has two share classes, so I counted both classes) totaled over 55% of the weighting in QQQ. Now, primarily due to a reweighting methodology, the top 7 companies are 38% of the index. Still a hefty chunk and an index skewed towards the titans, but that is a pretty significant drop. The methodology (I think more than market moves) also changed the top 7 companies in the index, with one dropping out and one entering.

Let’s just say for a moment that you want to “bet on a reversal” of some of last year’s moves. Maybe you want to bet on small caps. For many, you could express it in futures (which has the same changes), or you could express it in ETFs (easier for many). If you thought, for example, that the Nasdaq 100 and the Russell 2000 would converge (I encouraged that trade until recently), it would seem to make some sense. Yet, all your charts going back to the changes in the Nasdaq in December will be heavily skewed by the top 10 stocks, which represented a far bigger portion of the index than it does now!

Let’s say, and I think this is interesting, you owned the Magnificent “Pick a Number” stocks. Some number of the biggest tech companies. If you periodically hedged that position with Nasdaq 100, you had potentially a 55% overlap. It is far less than that today.

Some of the biggest names in tech have struggled since late December (underperformed from early November to outright negative performance in some cases starting late December). Presumably, the rebalancing had an impact (QQQ alone is $225 billion as of Friday – not an insignificant number in a market that I view as being less liquid at any depth, than the frantic, algo driven, markets would make you believe).

I cannot help but wonder what other shenanigans this reweighting is potentially having on portfolios?

In any case, if the Magnificent “Pick a Number” falter, it won’t impact the Nasdaq 100 like it would have last year.

Maybe it is nothing, but it seems strange enough to me to warrant consideration. Especially when you are talking about strategies and positioning that involved the behemoths in terms of market capitalization. If “hedges” are less effective, will we see more outright selling?

Who Will Buy Treasuries Ever Again?

If feels like it was just a few months ago when:

- We watched every Treasury auction as a harbinger of doom (they haven’t stopped issuing, just no one pays much attention).

- We talked about Chinese TIC data and the dwindling holdings (they are still reducing their holdings at a steady clip, but no one cares).

- Every missile shot in the world seemed to cause immediate fears about the U.S. budget deficit (they are still being shot and the cost will add up, but that isn’t today’s problem).

- As we issue debt at higher yields, our overall cost of debt increases, further increasing the risk of deficits and increasing the proportion of tax revenue spent on budget service. This is still happening, though new issue yields aren’t as bad as they were. However, most longer-dated debt is replacing debt with lower coupons – and about 65% of debt with high coupons is owned by the Fed at their limits. It takes years to increase (or decrease) the average coupon and it is still happening.

- DC is dysfunctional and divisive but will keep spending money. No comment.

Oh, it was just a few months ago! This is probably the biggest reason why I can’t get comfortable betting on a “flight to safety” trade. I just don’t think that we are done with these legitimate fears, and something will trigger them again (probably bad price action, since price action more often than not instills the narrative, rather than responds to the narrative).

Bitcoin ETF’s

I will be so happy when these are finally approved! I think that there are something like 14 applications for Bitcoin “spot” ETFs (that is the terminology when things like “cash” ETF or “physical” ETF don’t work because Bitcoin is neither cash nor physical).

I’ve understood the amount of hype surrounding this from the existing holders of Bitcoin. It will apparently open up a whole new wave of buyers. There is so much excitement that many firms are “backing” a bitcoin ETF, which must indicate a Wall Street (or at least an ETF manager) love affair with Bitcoin. All that may be true, but I’m leaning towards this being a massive “sell the news” opportunity. Apparently, that is consensus (though I think that it is consensus in terms of voices, not money put to work, and money put to work is all that matters when looking for contrarian views).

One thing that is very different about the chase for the Bitcoin ETF is the Greyscale Bitcoin Trust (ticker GBTC). This is not an ETF, but in my opinion, it is the main reason why everyone who can is trying to get a Bitcoin ETF.

As of Friday, GBTC had a market value of $25 billion. The expense ratio, as published on Bloomberg, is 2%. That one security, therefore, generates about $500 million in fees! QQQ at $225 billion has fees listed as 0.2%. So before actual costs (which I presume are higher for GBTC), GBTC generates more income than QQQ! SPY, at $478 billion, has an expense ratio of 0.095%, so it also generates less than $500 million in fees. I suspect that GBTC alone is competitive with some much larger ETF suites, which is why so many are going after this obvious pie!

I cannot think of an ETF launch (in recent memory) where you could just point to one asset and say, “if I can just get X% of that AUM, I’m doing extremely well!” That I think is a big motivator.

GBTC is interesting in its own right, because it can trade at a premium or discount to NAV. There is a methodology to increase the shares outstanding, typically done when it is trading at a significant premium to NAV (likely indicating excess demand for GBTC). That was done and is how GBTC got so large.

GBTC averaged around a 40% discount to NAV for much of the first 5 months of 2023. 40%! That discount to NAV has narrowed to 5.5% as of Friday – great for anyone who stuck with GBTC as not only did Bitcoin appreciate, but the gains from the discount to NAV closing were extremely good as well!

But presumably, if an ETF that will trade close to NAV becomes available, investors would prefer that to something that can trade at meaningful discounts. In “normal” times, equity ETFs have almost no variation and credit products can deviate 1% or so depending on the availability of the create/redeem arb and the quality of the Net Asset Value calculation (not as straightforward for credit). I’m assuming that due to how Bitcoin trades, there will be some deviation even in the ETF NAV versus trading price, but it will be much more manageable (and not as one-sided) as the trust vehicle in place.

The provider of GBTC is one of the applicants for an ETF (or at least that is my understanding). So, in my opinion, the first “battle” will be to divvy up the GBTC pie, with people trying to get money out of that. I wonder, at this point, how many of the GBTC holders own that versus being short Bitcoin, in anticipation of being able to get out at flat? If that is true, the pie might be smaller than everyone looking to ride the ETF wave realizes.

I’ve heard that some ETF providers have lined up large crypto holders to swap their crypto into the ETF (once launched). That is interesting from an AUM standpoint but should do nothing for Bitcoin price (once the headlines of “billions enter Bitcoin ETF in first weeks of trading” have run their course). It just transfers the holding format, rather than creates real demand. If Bitcoin is so great, and you already figured out how to custody it yourself, why would you use an ETF? It seems almost bizarre – Bitcoin is great, the future of money, it trades 24/7, etc., but do I prefer to hold it in ETF form?

I think that money will transfer from other ways of holding Bitcoin into ETFs, but that seems more of an admonishment of holding Bitcoin (the costs, the risks, the liquidity) than anything else.

Will some new money come in? Sure, without a doubt marketing will ramp up and there are still some people who want Bitcoin but haven’t figured out how to buy Bitcoin. Though I suspect that number is far less than when the Bitcoin futures launched, and they do not seem (to me) to be a resounding success (if they were, we’d probably be hearing a lot less about “spot” bitcoin ETFs).

The people most excited about the bitcoin ETF seem to be HODLers of Bitcoin (my gut is that they have ramped up their holdings in anticipation of ETFs unleashing a wave of demand) and the media (who want something else to talk about). I don’t have many conversations with people (with money) that indicate there is some massive pent-up demand for Bitcoin ETFs. Some, yes, massive, no. Maybe RIAs will all allocate 1% to it, but that remains to be seen.

I view the Bitcoin ETF as much more about Wall Street seeing a pie that they can get their hands on (so why not) rather than heralding in some new wave of acceptance of crypto. And let’s be honest (and cynical), why else would I pay attention and write about it, if there wasn’t a chance that it might evolve back into something I have to incorporate into my daily work!

Bottom Line

Verbatim from Thursday.

- I’m the most bullish I’ve been on energy and energy stocks in sometime (probably toss all commodities into that mix).

- I’m the most bearish I’ve been on equities and am targeting 4,500 on the S&P 500 sooner rather than later.

- Credit spreads will widen in sympathy with equities, though this is largely an equity valuation and “set-up” problem (the set-up being the conditioning to lower yields = higher stocks) so credit should outperform equities quite handily here.

- On bonds, maybe, just maybe, we get some “flight to safety” trade, so I’m only mildly bearish on bonds right now, but will sell any rally in bonds as I think that the problems facing the bond market (from geopolitical risk) will outweigh the “traditional” safety bid.

Lots to think about as we start 2024, and none of my “little tidbits” do anything to make me more comfortable with risk, just more reasons to remain cautious on everything.

Loading…