‘Good news’ was definitely ‘bad news’ this week as US macro data generally surprised positively…

Source: Bloomberg

…with both growth and inflation surprises soaring…

Source: Bloomberg

Not exactly the kind of data that supports a dovish Fed and the market has notably reduced its expectations for rate-cuts…

Source: Bloomberg

Interestingly, the ‘Trump Trade’ actually survived pretty well this week (Republican policy basket vs Democratic policy basket)…

Source: Bloomberg

But, Powell’s comments were a giant rug-pull for the market over all with all the US majors having a horrible week…

…Nasdaq’s worst week in the last ten…

The Nasdaq puked back to the same level it was at the last OpEx…

Energy and Financials were the only sectors to end the week green while tech and healthcare were clubbed like a baby seal…

Source: Bloomberg

Mega-Cap Tech stock have erased all the post-election gains…

Source: Bloomberg

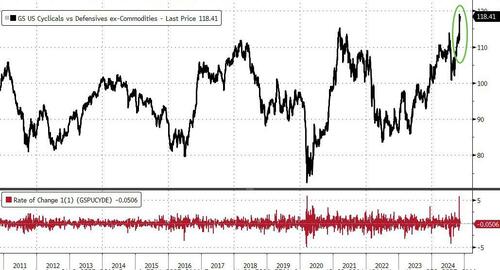

Cyclicals remain well bid against Defensives still too…

Source: Bloomberg

‘Most Shorted’ stocks puked hard this week – the worst week since early August as last week’s short-squeeze ran out of ammo…

Source: Bloomberg

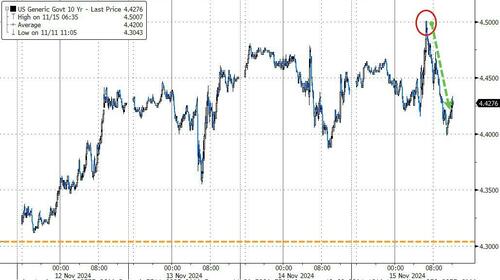

Treasury yields were all higher on the week led by the long-end, but trading was very volatile…

Source: Bloomberg

The 10Y Yield touched 4.50% at the highs today and reversed – the first time it has reached that level since May 2024…

Source: Bloomberg

It wasn’t just bonds and stocks that were hit, gold suffered its worst week since Jun 2021, falling back to two-month lows…

Source: Bloomberg

The dollar rallied for the seventh straight week top its highest since Nov 2022…

Source: Bloomberg

Bitcoin had another biog week – the best two-week run since March – hitting new record highs and holding above $91,000…

Source: Bloomberg

Bitcoin is also nearing a record high in terms of gold too…

Source: Bloomberg

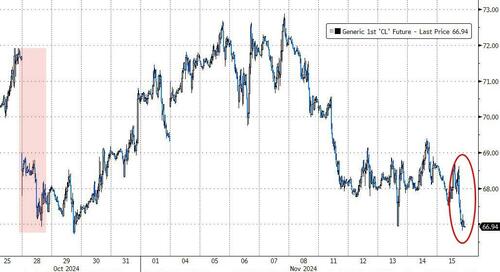

Crude oil prices tumbled on the week back to post-Israel-Iran ‘optics’ battle lows…

Source: Bloomberg

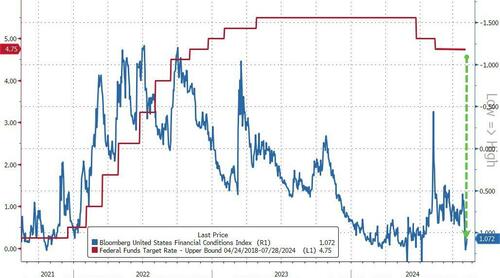

Finally, here’s why The Fed is fucked… With The Fed funds rate still at 4.75% and the trajectory of cuts diminishing rapidly, US financial conditions are basically as ‘loose’ as they were before the rate-0hiking cycle started…

Source: Bloomberg

‘Animal Spirits’ and re-inflation imminent – ‘Proper fucked’…

Loading…