by ZeroHedge News

As the real estate market continues to break records, a cabal of institutional investors has been tossing gasoline on the fire – buying up properties hand-over-fist as middle-American renters watch their dreams of home ownership fade at the hands of pension funds and other financial behemoths.

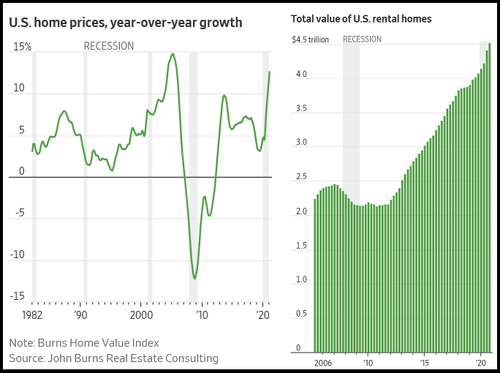

“You now have permanent capital competing with a young couple trying to buy a house,” according to real estate consultant John Burns, whose firm estimates that in many of the country’s hottest markets, roughly one 20% of homes sold are bought by someone who never moves in.

“That’s going to make U.S. housing permanently more expensive,” said Burns, who thinks home prices will climb as much as 12% this year, on top of last year’s 11% rise.

“Limited housing supply, low rates, a global reach for yield, and what we’re calling the institutionalization of real-estate investors has set the stage for another speculative investor-driven home price bubble,” his firm concluded – finding Houston to be a favorite location for investors, who have accounted for 24% of home purchases in the area.

The coronavirus pandemic sparked a race for home-office space and yards. Occupancy rates reached records and rents are rising with home prices. The ecosystem of companies that service, finance and mimic the mega landlords is booming.

Burns counted more than 200 companies and investment firms in the house hunt: computer-assisted flipper Opendoor Technologies Inc., money managers including J.P. Morgan Asset Management and BlackRock Inc., platforms such as Fundrise and Roofstock that buy and arrange for the management of rentals on behalf of individuals and builder LGI Homes Inc., which now reports wholesale home sales to bulk buyers in its quarterly results. –WSJ

In one example, a bidding war broke out over a D.R. Horton complex in Conroe, Texas – after the homebuilder put the entire subdivision up for sale. After a “Who’s Who of investors and rental-home firms flocked to the December sale,” the winning bid of $32 million came from an online property-investment company, Fundraise LLC, which manages over $1 billion for around 150,000 individuals, according to the Wall Street Journal.

D.R. Horton ended up booking roughly twice what it typically makes selling houses to middle-class homebuyers according to the report.

“We certainly wouldn’t expect every single-family community we sell to sell at a 50% gross margin,” said CEO Bill Wheat at a recent investor conference.

What does this mean for the average American family?

Read the full article at ZeroHedge News.

Having problems receiving our newsletters? See:

If our website is seized and shut down, find us on Minds.com and MeWe, as well as Bitchute and Rumble for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

The Most Important Truth about the Coming “New World Order” Almost Nobody is Discussing

It’s Time to Choose Sides: Do You Even Know What Side You Are On?

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

Unmasking Who is Behind the Plandemic and Rioting to Usher in the New World Order

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Published on June 12, 2021