Bonds and stocks were both battered today…

Source: Bloomberg

Which is why we wheeled out the deer!

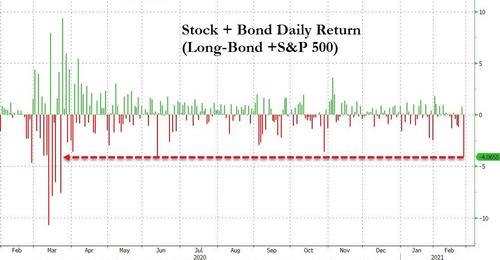

Today was the worst day for equity/bond investors since March 2020…

Source: Bloomberg

Investors puked bonds today as several critical levels were breached…

“This is analogous to a flash crash in Treasuries,” said Arthur Hogan, chief market strategist at National Securities Corp.

“We’re finally seeing yields react to what’s likely to be better economic activity.”

“That really got out of hand…”

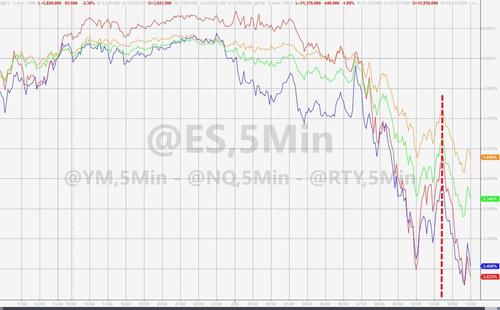

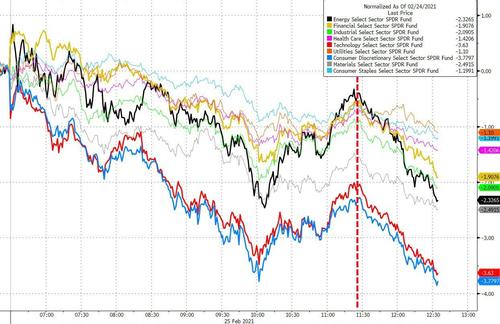

And that surge in yields sparked chaos in stocks. The initial puke saw a modest dead cat bounce but that stalled at 1430ET (margin call time) and stocks chundered into the close led by Small Caps and Nasdaq…

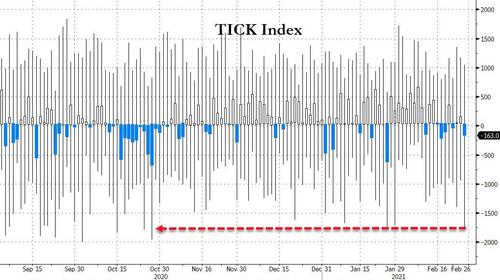

And there was no Powell to save the day as we saw the biggest sell-program sine October…

Source: Bloomberg

All sectors were deep in the red today – even financials!…

Source: Bloomberg

But The Fed desperately tried to talk things down…

-

*FED’S BOSTIC SAYS “I AM NOT WORRIED” ABOUT MOVE IN YIELDS

-

*BOSTIC: FED DOESN’T NEED TO RESPOND TO YIELDS AT THIS POINT

-

*BOSTIC SAYS YIELDS STILL `VERY LOW’ FROM HISTORIC PERSPECTIVE

Roughly translated: “nothing to see here…”

Except that investors now have “an alternative” as 10Y yields have equilibrated with equity dividends (and stocks trading at record valuations by a country mile)…

Source: Bloomberg

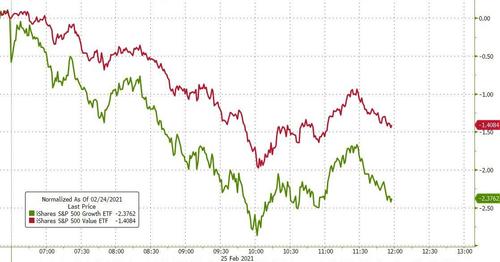

Both growth and value stocks were clobbered today (but the former lagged)…

Source: Bloomberg

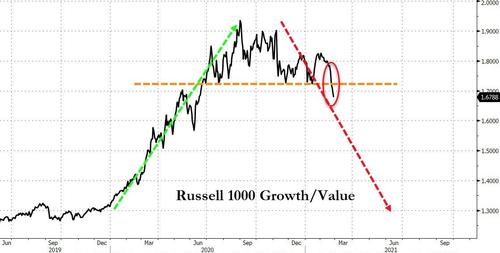

But, the relative underperformance broke a critical support level for growth/value…

Source: Bloomberg

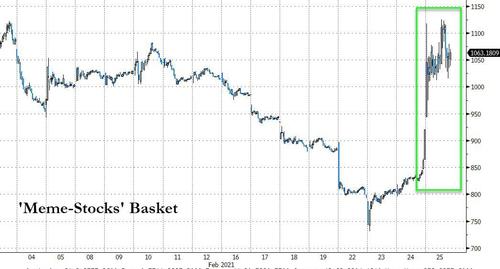

GME ripped…

On another gamma squeeze (major super-short-dated OTM Call buying)…

Source: Bloomberg

Sparking hedge fund liquidations…

Source: Bloomberg

As the Meme Stocks soared…

Source: Bloomberg

The entire stock market is crashing and you cannot convince me it’s not because of the Reddit stocks #DDTG pic.twitter.com/LqoNCcg3yj

— Dave Portnoy (@stoolpresidente) February 25, 2021

ARKK was crushed again…

Along with TSLA…

FANG Stocks tumbled…

Source: Bloomberg

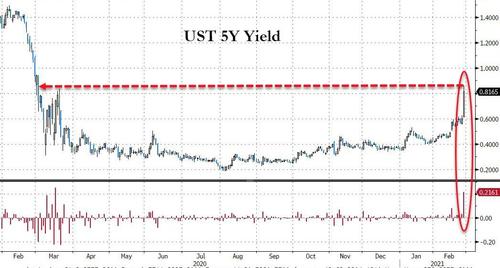

Treasuries were a bloodbath today as CNBC’s Rick Santelli called the 7Y auction the “worst auction ever” and it was th ebelly that massively underperformed…

Source: Bloomberg

YES – that is a 22bps spike in the 5y/7y segment! Pushing 5Y above the March spike highs…

Source: Bloomberg

10Y Yields also exploded higher as the auction debacle struck (surging from 1.47% to 1.61%) before ‘someone’ stepped in. Late day saw yields pushing back out…

Source: Bloomberg

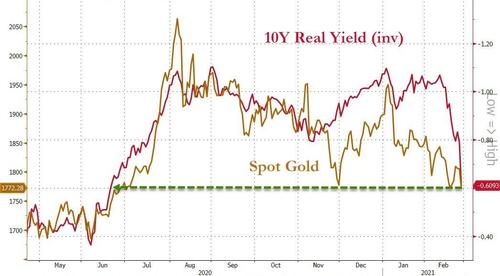

Real yields continued to surge – to their highest since June 2020…

Source: Bloomberg

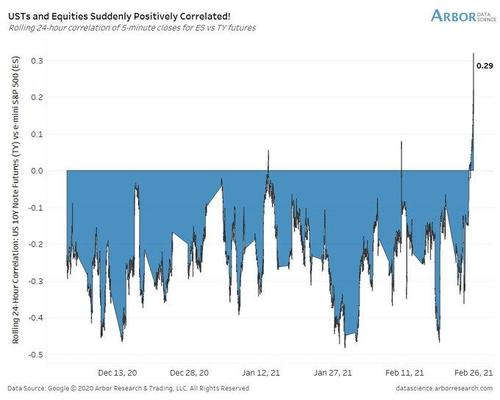

Risk Parity was hammered today. This was the worst day for RP funds since March 2020…

As equity-bond correlation surged unusually positive…

And VIX screamed back above 30…

So a quick summary – WSB’rs squeezed the hell out of hedge funds – causing chaos – and now they are back and this time it is Risk-Parity funds, which are must more intrinsic to the overall levels of markets..

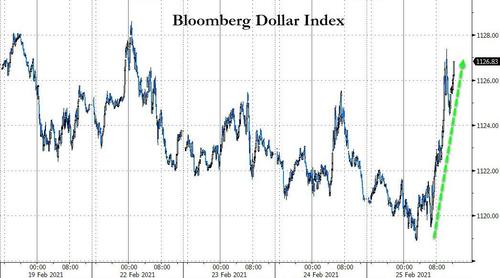

The dollar surged higher as bonds and stocks dumped…

Source: Bloomberg

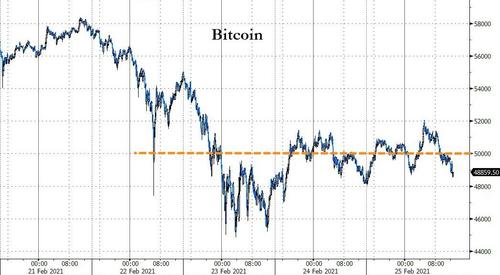

And crypto was surprisingly stable…

Source: Bloomberg

Bitcoin continues to oscillate around $50k…

Source: Bloomberg

Gold fell back below $1800…

But oil tracked bond yields higher (or vice versa) with WTI back above $63…

Finally, we note that one side of the market is pricing in some serious Fed hawkishness going forward (especially relative to The Fed’s own forecasts)…

Source: Bloomberg

Trade accordingly.