Another day, another illiquid chopfest in stocks… Small Caps outperformed on the day but late day weakness took The Dow, S&P, and Nasdaq red before a last second bid lifted them green…

Interestingly energy stocks rallied today, despite oil prices sliding significantly, Staples continued to lag…

Source: Bloomberg

VIX continue to be pressured lower into tomorrow’s FOMC meeting (hedge unwinds amid macro derisking?)

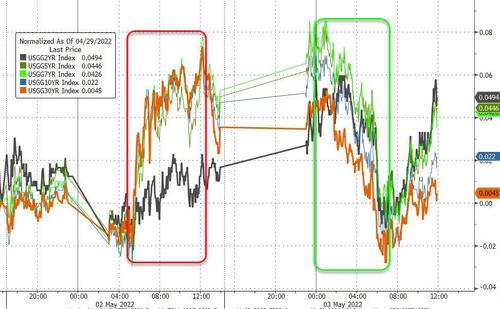

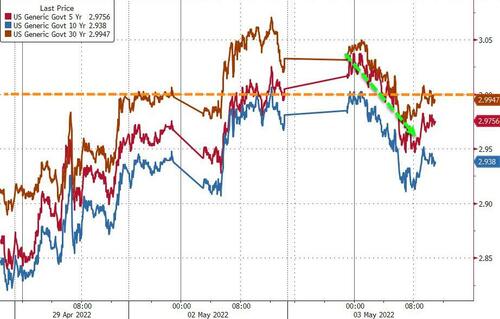

Treasuries were bid today, erasing much of yesterday’s losses as the long-end outperformed…

Source: Bloomberg

As Bloomberg notes, the recent brief flirtation with 3% in Treasury 5-, 10- and 30-year bonds drew in real-money buyers, according to brokers that saw the flow. The purchases were particularly heavy in 10-years, multiple brokers add. Size was described as healthy Monday with the buying continuing today.

Source: Bloomberg

Simply put, as we noted last week, TINA is dead and bonds are an alternative now. In fact, bonds are the most attractive relative to stocks since 2011…

Source: Bloomberg

The yield curve (3s10s) flattened today, nearing inversion once again…

Source: Bloomberg

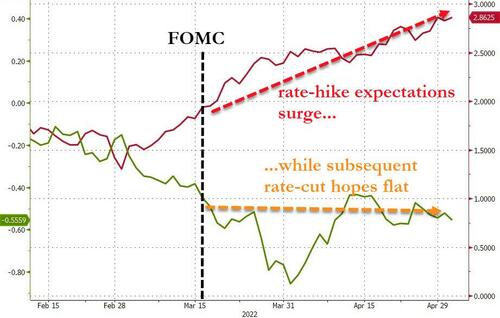

Heading into tomorrow’s Fed meeting, the 50bps hike is fully priced into STIRs (and odds of a 75bp hike in June are rising). In fact, since the last FOMC Meeting (where they hiked 25bps),

Source: Bloomberg

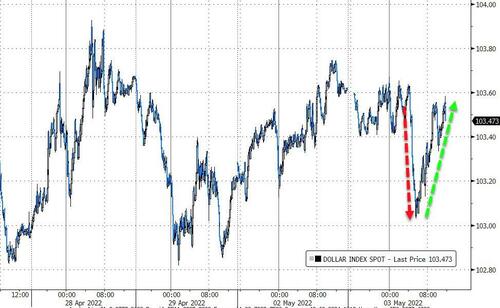

The dollar was flat on the day, recovering the puked losses this morning…

Source: Bloomberg

Meanwhile the Ruble is trading at its strongest against the dollar since March 2020…

Source: Bloomberg

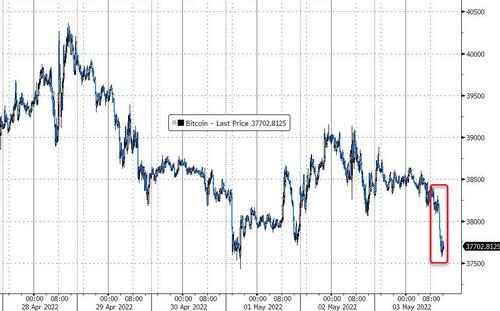

Cryptos were clubbed like a baby seal again with bitcoin back below $38k…

Source: Bloomberg

Gold managed some gains today, but remains well below $1900 still…

Oil prices reverted back lower today, erasing yesterday morning’s panic-bid…

Finally, and perhaps most notably on the day, NatGas surged back above $8, to its highest level since 2008…

Source: Bloomberg

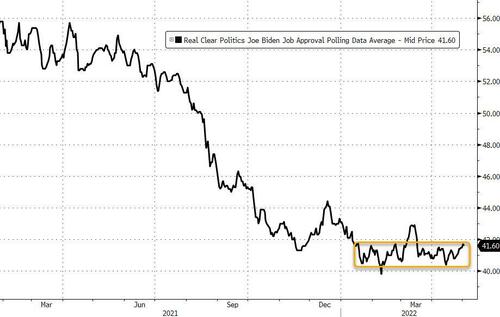

How is Biden going to explain shipping it all to Europe to Americans facing soaring energy bills: “shared sacrifice for the sake of global democracy” we assume? We wonder how well that will ‘poll’ with his base?

Source: Bloomberg

…and how will that base feel after The Fed hikes rate 10 more times this year?