By John Kemp, senior energy analyst at Reuters

China’s record-breaking deployment of wind and solar capacity has worsened regional power imbalances, forcing the country to idle increasing amounts of renewable generation when it overwhelms local consumption.

New government regulations aim to reduce the amount of renewable generation that has to be abandoned by increasing long-distance transmission links and better coordinating generation plans across provinces.

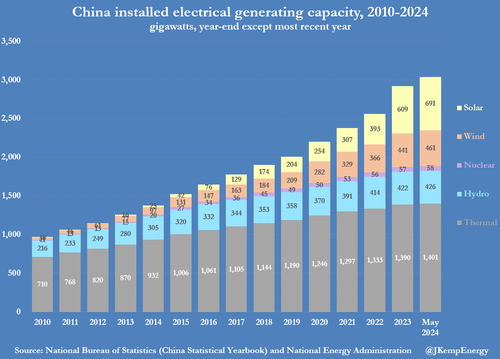

Since the end of 2018, China’s total generating capacity has increased by 1.137 billion kilowatts (kW), compound annual growth of 9%, according to data from the National Bureau of statistics (NBS).

Thermal capacity, mainly from coal-fired plants but some from gas-fired generators, rose by 257 million kW or 4% per year (“China statistical yearbook”, NBS, 2023).

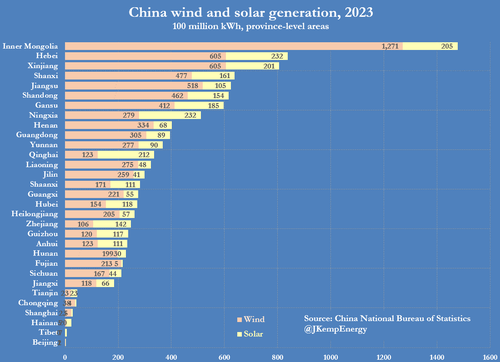

Most capacity additions, however, have come from what the government calls “new energy sources” – wind farms (277 million kW, 19% per year) and solar generators (517 million kW, 29% per year). Increased penetration of intermittent renewables is making it harder to manage a nationwide transmission system that was already struggling with large regional imbalances between generation and load.

The solution to variable wind and solar output is to smooth out fluctuations across a larger number of generators spread over much larger areas of the country, which will require more transmission and better scheduling.

Long-Distance Transmission

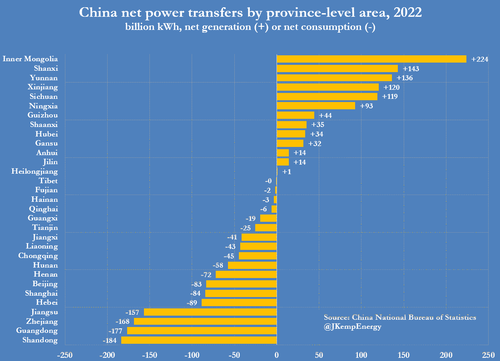

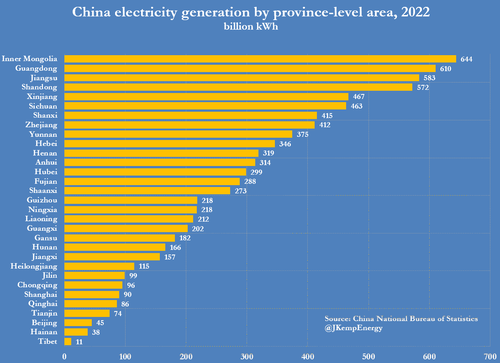

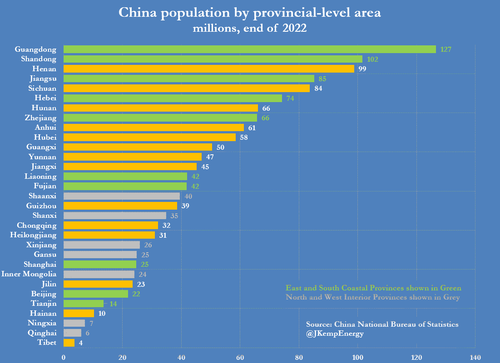

For decades, the country has been characterized by massive west-to-east electricity transfers from interior areas with surplus generation to the massive load centres on the east and south coasts. Ten provincial-level areas in the east and south (Liaoning, Hebei, Beijing, Tianjin, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian and Guangdong) accounted for 50% of national consumption but only 40% of generation in 2022.

By contrast, six remote and sparsely populated northern and western areas (Inner Mongolia, Xinjiang, Shanxi, Shaanxi, Gansu and Ningxia) accounted for 18% of consumption but 25% of generation.

Chartbook: China regional electricity transfers

In response, China’s State Grid Corporation has constructed a network of ultra-high voltage transmission lines to move power thousands of kilometres from surplus areas in the west and north to deficit areas in the east and south.

In the process, China has become the world leader in ultra-high voltage transmission to move electricity over long distances while minimising line losses and is exporting its expertise around the world.

Inner Asia’s Energy Abundance

China’s northern and western areas are some of the least populated and poorest parts of the country, but rich in energy resources, traditionally coal but now increasingly gas and renewables.

The north and west contains the country’s most important coal deposits and has become a major centre of pit-head generation, with some electricity used locally by heavy industry, and the rest transmitted east and south.

Inner Mongolia, Shanxi, Shaanxi and Xinjiang alone accounted for 81% of coal mine production and 25% of all thermal generation in 2022, according to data from the NBS.

In a quirk of fate, the arid and windswept northern and western plains and deserts are also the best sites for giant wind farms and solar parks.

Inner Mongolia, Shanxi, Shaanxi and Xinjiang together with neighbouring Gansu, Ningxia and Qinghai accounted for 42% of all wind and solar generation last year.

But the addition of so much wind and solar generation in a region already saturated with coal-fired power threatens to overwhelm the transmission system.

During peak periods of wind and solar generation, there is not enough population and industry in these areas to absorb all the output, and not enough long-distance transmission capacity to move the surplus east and south.

More Transmission And Planning

In 2016, the national utilisation rate for new energy sources fell to a record low of 84%, prompting the central government to launch a “Clean Energy Absorption Action Plan” to reduce the waste of renewable resources. The plan focused on improvements in local distribution, long-distance inter-provincial transmission, and energy trading to reduce the curtailment of new energy generation.

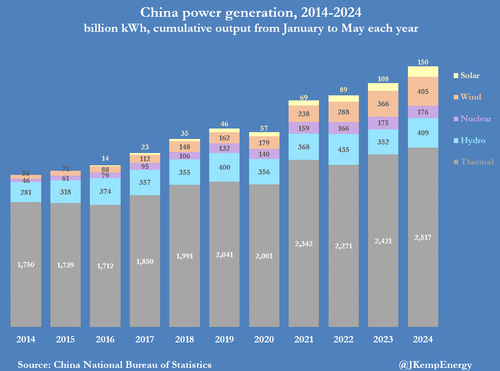

By 2023, the utilisation rate for wind power had climbed to a remarkable 97.3% and solar had reached 98%, according to the state-run news agency Xinhua.

With rapid deployment of renewable capacity, however, the problem of abandonment is re-emerging, with wind utilisation down to 96.1% and solar down to 96% in the first five months of 2024. Sliding utilisation has prompted an alert from the National New Energy Consumption Monitoring and Early Warning Center (“Solving the pain points and difficulties of new energy consumption”, Xinhua, July 1, 2024).

The response is likely to be similar, with renewed emphasis on integrating renewables at local level and more transmission capacity to move surplus power across provincial boundaries. In the last two years, central government policy statements have repeatedly focused on the need for better coordination of transmission and generation between provinces.

Creating A Truly National System

In a sign of the importance attached to the issue, the Communist Party’s Politburo held a group study session on new energy technology and energy security on February 29, 2024. The session, bringing together top central and regional leaders, included a discussion on boosting “the grid’s capacity capability to integrate, distribute and regulate clean energy.”

President Xi Jinping stressed need for “coordinated development of the energy sector” (“Xi stresses high-quality development of new energy”, CPC International Department, March 2, 2024).

In many ways, China’s long-distance ultra-high voltage transmission system is an extraordinary engineering achievement, likely to be copied in other parts of the world as more and more renewables are connected to grids. It has enabled a remarkable penetration of intermittent renewables, as well as hydroelectric generation, into the national power system while maintaining or improving reliability. As a result, wind and solar producers supplied 15% of all generation in the first five months of 2024, up from 7% in the same period in 2019.

In some ways, however, China is still struggling to forge a truly integrated nationwide system from fragmented provincial-level utilities that pursue their own priorities. If government plans to achieve even higher renewables penetration are to be achieved, there will have to be much closer links and more coordination between different types of generators and across far wider areas.

Loading…