Beijing may be cracking down on the peer-2-peer loan industry, but industrious Chinese have found a new way to borrow and lend money under even “shadier” circumstances.

With the cost of living rising, there is a brand-new trend in China’s financial services that have taken the country by storm: Chinese millennials are borrowing excessive amounts of money and exchanging naked photos as collateral.

ABC reports that LexinFintech Holdings Ltd.’s e-commerce platform Fenqile allows millennials to buy automobiles, iPhones, jewelry, and even a wide variety of snacks all on credit with payback installments.

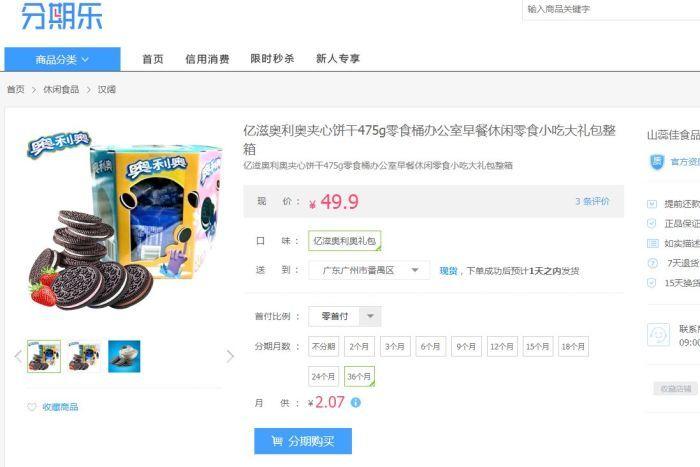

For example, a box of Oreo biscuits can be acquired for 50 yuan ($10) and paid back in monthly installments of 2.07 yuan ($0.41) over three years. Customers of the microloan website can expect annual interest rates of over 20% (advice: don’t try this at home).

Dorrit Chen, Euromonitor International’s Consumer Finance analyst in China said millennials spend much differently than their parents. While their parents saved, millennials prefer the buy-now-pay-later scheme. “This trend is not only happening in metropolitans, but also [being taken up by] young generations from small towns,” Chen said.

“Ant Check Later — the [loan service] affiliate of Alibaba — as one of the most popular online credit service providers is a case in point,” Chen added. “[It] offers credit from 500 yuan ($100) to 50,000 yuan ($10,000) based on big data analysis from their Alipay account history.”

But what is most surprising, or rather alarming, is that according to ABC some of these microloan websites use “nudie selfies” as loan collateral. A 10 gigabytes batch of naked selfies of Chinese college students was recently leaked online.

These pictures of 161 female students showed their naked bodies while holding government photo IDs. It was alleged that an illegal microloan website had asked for the images to secure payday loans.

Many of the victims were young female college students, many from China’s rural, impoverished regions.

Some of these lenders used WeChat or QQ to target their victims. The 161 college students “borrowed between $1,000 to $2,000 with interest rates up to 30%. The victims were threatened to leak the naked photos to their friends and family if they did not repay the loan,” said ABC. And even more shocking, is that some of these millennials were sent into the sex industry to repay their debts.

China’s Central Public Security Comprehensive Management Commission referenced one case where Bing Chen, a resident in eastern Nanjing city, received a nude photo of his daughter, Xue Chen, via a text message from an illegal lender.

Xue Chen reportedly sent several nude pictures to the lender to receive a 4,000 yuan loan ($800), which jumped to 100,000 yuan ($20,000) in under six months, according to the Commission.

During that period, Xue Chen was forced to send more nudes photos and even videos to extend the due date of her repayment.

The Commission started cracking down on “naked loan services” in late 2016. The situation has improved, as China’s financial regulators have enforced new laws that have shut down many illegal microloan websites, but many more remain as there will always be demand for loans in China and if desperate enough, people will do anything to get the needed funds.