Shares of European banks plunged on Monday, as yields on European bonds dropped on the implosion of Silicon Valley Bank could force central banks across the Western world to either slow the pace of interest rate hikes or even pivot if more regional banks fail.

Credit Suisse Group AG is one bank that caught our attention this morning. The shares of this troubled bank, trading in Switzerland, plunged as much as 15%, hitting a new record low. This decline was due to concerns about the bank’s ability to recapture client funds, revive its investment banking business, and manage ongoing legal and regulatory investigations.

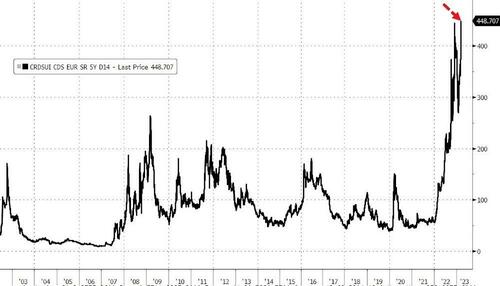

The selling pressure on Credit Suisse shares returned thanks to the collapse of SVB, sparking a crisis of confidence throughout the banking industry in the Western world. As a result, the Zurich-based lender’s five-year credit default swaps jumped to a record high of 448 basis points, data compiled by Bloomberg show.

And it’s not just Credit Suisse, whole financial sector is seeing CDS spreads widen.

Credit Suisse’s demise and shares falling to a record low come as the bank faces a long list of challenges. Just last week, shares hit a new low after it announced it would postpone the release of its annual report at the request of the Securities and Exchange Commission.

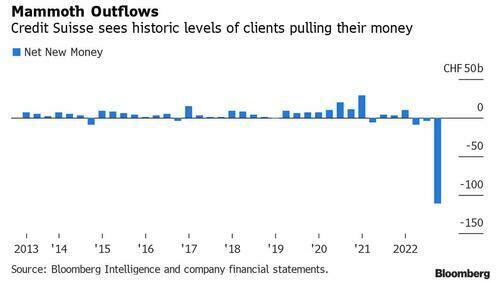

Another concern is whether the bank can survive, given the substantial outflows from its wealth management division.

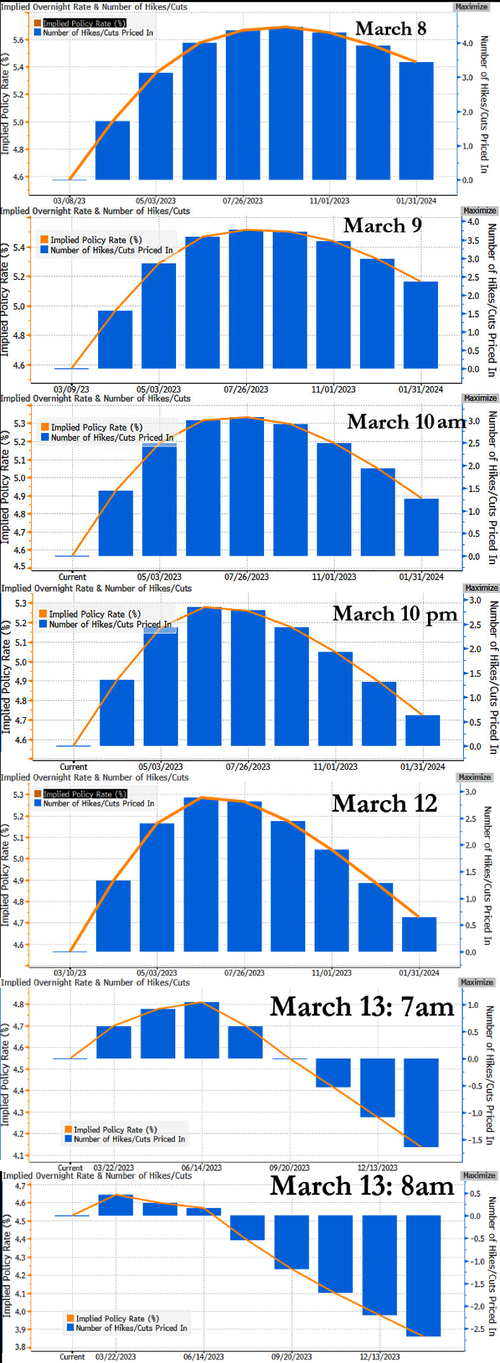

So much for aggressive interest rate hikes in Europe.

*TRADERS SEE ONLY 50% CHANCE OF HALF-POINT HIKE BY ECB THIS WEEK

— zerohedge (@zerohedge) March 13, 2023

As for US regional banks, and to prevent a wave of failures, rate traders have priced out hikes for the rest of the year as some of the first cuts could arrive in the second half of the year.

Will the Fed’s rescue of SVB be sufficient to revive confidence in the banking sector?

ETA until market realizes $25BN is nowhere near enough and futs react appropriately?

— zerohedge (@zerohedge) March 12, 2023

Loading…