Pam and Russ Martens have been detailing the massive bank bailouts under the repo market that took place in 2019 in a series of articles for Wall Street on Parade over the last week-plus.

The corruption and deceit are clearly there, but outside of the Martens, the media has ignored the recent data the New York Federal Reserve was legally required to produce. More importantly, the information provides some insight into how weak the economy’s fundamentals have been for a long time.

In 2008, the period known as the Great Recession began when the Fed doled out $3.144 trillion in repo loans to big criminal banks to bail them out. Between Sept. 17 of 2019 and July 2 of 2020, the repo loans totaled a whopping $11.23 trillion, over 3.5-times as large as 2008’s loans.

The Martens write: “The Fed’s emergency repo operations began as overnight loans. But then the Fed began regularly offering 14-day term loans in addition to the overnight loans. Then it began to add even longer-term loans.”

Only banks known as “primary dealers” on Wall Street can get these Fed loans, and they total only 24 trading houses. And the same bad actors in 2008 are the same today including J.P. Morgan Securities, Bank of America Securities, Cantor Fitzgerald, Citigroup Global Markets, Deutsche Bank, Goldman Sachs, and Nomura Securities International. Those were the largest borrowers.

“Those Fed revelations, that had been withheld from the American people for two years, should have made front page headlines in newspapers and on the digital front pages of every major business news outlet. Instead, there was a universal news blackout of the story at the largest business news outlets, including: Bloomberg News, The Wall Street Journal, the business section of The New York Times, the Financial Times, Dow Jones’ MarketWatch, and Reuters,” the Martens’ write.

As the Martens point out, the New York Fed actually owns Citigroup, Goldman Sachs, and JPMorgan Chase. So, the Fed actually owns failing banks but can hand out our money and print money debasing our currency to bail themselves out.

“‘Federal incest’ is an excellent phrase to add to the Wall Street/Fed lexicon,” the Martens’ write. “It particularly comes to mind when we think of the former Chair of the Fed, Janet Yellen, who went straight from her perch at the Fed to grabbing millions in speaking fees from the banks the Fed was in charge of supervising.”

The Martens’ attempted to get comments from four of the banks bailed out. All ignored the request with the only response coming from Citigroup stating they “decline to comment on this open market operations data.”

“This strongly suggests that one or more banks are going to claim they were not required to disclose these tens of billions of dollars in emergency loans from the Fed – for a financial crisis that has yet to be explained and which came months before the first case of COVID-19 was reported by the CDC on January 20, 2020 – because they were not really taking emergency loans at all, but were simply being white knights helping the poor beleaguered Fed with its open market operations,” the Martens’ write.

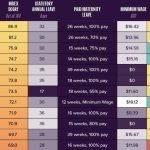

The Martens’ added: “Unfortunately, that limp excuse has a mountain of facts and easily-produced charts to quickly sap its staying power. First of all, the Fed is not required to release its routine open market operations. It is only required to release the names of the banks involved in emergency loan operations. Secondly, as the chart below shows, this was the first time since the financial crisis of 2008 – the worst since the Great Depression – that the Fed had initiated its emergency repo loans. The stark difference between the bar graph for 2008 and the bar graph for 2019 casts aside any notion that there was not a serious financial problem in the fall of 2019.”

This is criminal, but from the media to politicians, they are ignoring it.

“Despite this acknowledgment that derivatives played a central role in the worst financial crisis in 2008 that the U.S. had seen since the Great Depression, neither the Fed, nor Congress, nor the banking regulators have stopped these banks from holding tens of trillions of dollars of derivatives with questionable counterparties on the other side. Even worse, in the U.S., the derivatives are held at the federally-insured banking units of the megabanks, which are holding deposits for moms and pops across America,” the Martens write.

This information personifies the reality that America has been fully embracing Keynesian economics. The economic numbers are a façade, regardless of which party occupies the White House. We’re living on the drug of easy money, and we need to stop feeding our addiction.

Alasdair Macleod writes for Gold Money:

“It is increasingly difficult to see a way out of these difficulties, and the Keynesian hope that economic growth will deal with the debt problem is simply naïve. In 2010, respected economists (Carmen Reinhart and Kenneth Rogoff) concluded that at a government debt to GDP rate of over 90% it becomes exceedingly difficult for a nation to grow its way out of its debt burden. With advanced economies averaging a ratio of 125%, Japan and Greece at over 200%, and some Eurozone nations at over 150%, there are debt traps almost everywhere ready to be sprung.”

“In highly indebted fiat currency economies, there can only be one outcome: once one falls into a crisis, the others will follow with accelerating currency debasements leading to the destruction of faith in their currencies as well. And with a government core debt ratio to GDP of 125%, the US with its dollars is up there with the others to be destabilised, being over-owned by foreigners, and transmitting risk to all currencies that regard the dollar as its principal reserve currency.”

“It can only be concluded that as we enter a new year the adjustment to market reality is likely to be more violent than anything seen in the 1970s.”

Content syndicated from TheLibertyLoft.com with permission.