First Republic Bank’s stock crashed in premarket trading in New York following a statement issued on Sunday night that sought to ease investor worries about its liquidity situation in the wake of the failures of Silicon Valley Bank and Signature Bank.

Shares of the regional bank are down 60% in the premarket. The lender said in a statement late Sunday that it had more than $70 billion in unused liquidity to fund operations from agreements that included the Federal Reserve and JPMorgan Chase & Co.

“The additional borrowing capacity from the Federal Reserve, continued access to funding through the Federal Home Loan Bank, and ability to access additional financing through JPMorgan Chase & Co. increases, diversifies, and further strengthens First Republic’s existing liquidity profile,” the bank said, adding that more liquidity is available through the Fed’s new lending facility.

“The plunge in its shares is classic market psychology at work, with investors starting to question the credentials of any lender that may be remotely in the same category of Silicon Valley Bank,” Bloomberg’s Ven Ram wrote.

We pointed out over the weekend, “as a result of the SVB failure – one look at what is already taking place at some smaller, vulnerable banks such as this First Republic Branch in Brentwood should be sufficient to see what comes tomorrow if the Fed makes the wrong decision today.”

I’ve never seen a bank run in Brentwood Los Angeles in over 40 years — this is at first republic bank branch. People standing in rain pic.twitter.com/k31PqqpyO3

— pjb.eth (@Dr_PhillipB) March 11, 2023

Despite the emergency lending program announced by the Fed and Treasury on Sunday to increase the availability of funds to meet bank withdrawals and prevent runs on other banks, fears have not been alleviated as other regional banks continue to experience significant pressure.

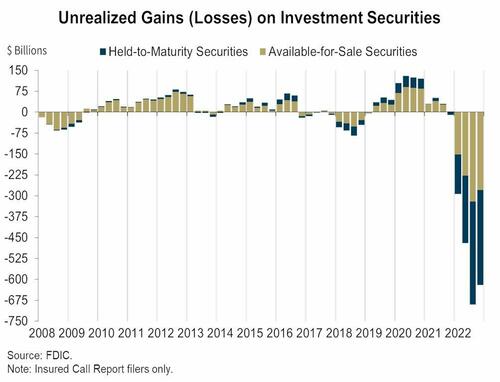

And why would that be? Well, as we outlined, “banks which are sitting on some $620 billion in unrealized losses on all securities (both Available for Sale and Held to Maturity) at the end of last year, according to the Federal Deposit Insurance Corp.”

If the Fed’s goal was to shore up wavering confidence in the banking system by announcing the alphabet soup of bailout facilities, the BTFP lending program — well, it hasn’t worked yet this morning:

- PacWest Bancorp’s stock tumbled 27%

- Western Alliance Bancorp’s shares slid 17%

- Charles Schwab’s shares lost 6.7%

- Bank of America’s stock fell 4.4%

- Citizens Financial Group’s stock declined 2.7%

- Wells Fargo’s stock slid 2.3%

$25BN? They think $25BN will stop this bank run???

“With approval of the Treasury Secretary, the Department of the Treasury will make available up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP.”

— zerohedge (@zerohedge) March 12, 2023

The current question on everyone’s mind is whether the measures taken by the Fed are sufficient in preventing further depositor panic at other regional banks.

Then there’s this: “There’s no doubt in my mind: There’s going to be more. How many more? I don’t know,” William Isaac, the former chairman of the Federal Deposit Insurance Corporation, told Politico on Sunday. “Seems to me to be a lot like the 1980s,” he added.

ETA until market realizes $25BN is nowhere near enough and futs react appropriately?

— zerohedge (@zerohedge) March 12, 2023

… and Cramer strikes again.

FRC is new focus… very good bank

— Jim Cramer (@jimcramer) March 10, 2023

Loading…