Traders can commiserate with the following assessment of recent market action from Deutsche Bank’s Craig Nicol, who this morning writes that “it feels hard to get much of a pulse on the market at the moment with this week in particular feeling like some of the summer lull and illiquidity factors are starting to weigh.”

Confusion indeed reigns because despite 13 all time highs in the past 16 sessions, it sure doesn’t feel like a euphoric market when breadth is collapsing and just a handful of stocks are pushing indexes to new highs. Meanwhile, with trillions in excess liquidity sloshing around and the Fed still injecting $120BN every month, woe to anyone who shorts stocks, especially any name that becomes the meme stock short squeeze du jour.

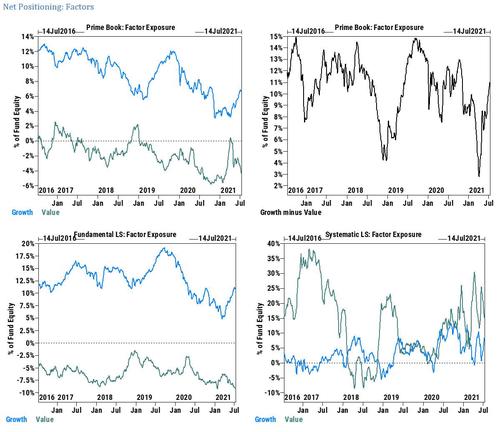

Amid this confusion it is therefore hardly surprising that hedge funds are cashing in (and hitting the Hamptons and St Barts). According to the latest Goldman Prime Analytics chartpack, the one prevailing them is accelerated degrossing as the 2 and 20 crowd scales down gross exposure as they lose conviction in this period of transition from value to growth (and soon, back to value), even as they remain net long for the most part.

As Goldman’s PB team notes, here are the five top themes they are currently watching:

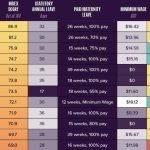

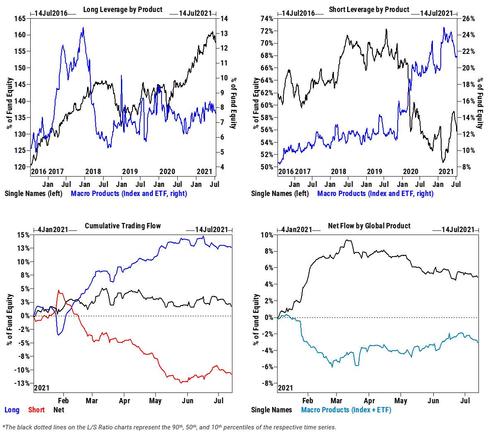

- Hedge funds have reduced Gross leverage for four straight weeks, led by Fundamental LS managers whose Gross exposure is now in the 21st percentile vs. the past year.

- But Net leverage is relatively unchanged (and remains high) as both long and short exposures have come down in Single Names as well as Macro Products.

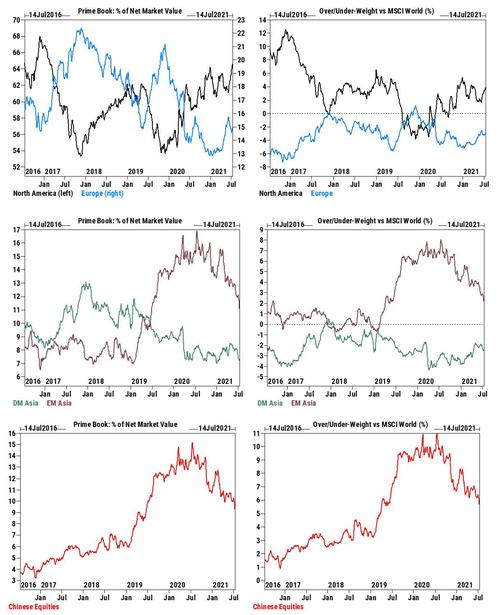

Managers are now the least O/W Chinese equities since Jun ’19, driven by continued rotation out of offshore listings (link) on the back of heightened US-China tension and policy fears.

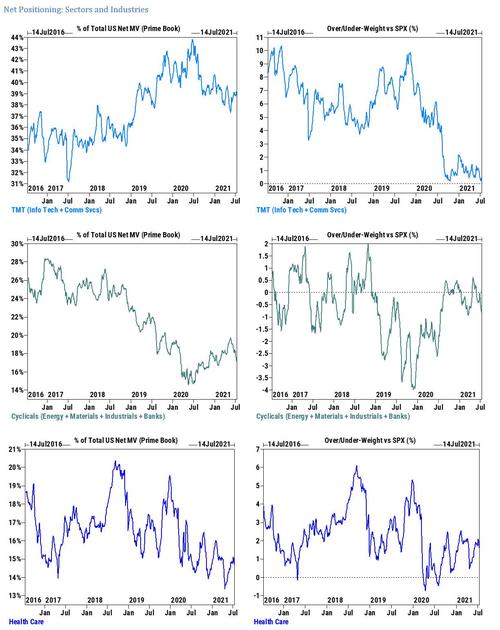

- Positioning movements by region (into US), sector (into TMT), and factor (into Growth) all point to increased expectation of a cyclical slowdown in 2H ‘21. That said, the latest QuickPoll survey results show that the broader investor community is still split 50/50 on the transitory vs non transitory market narrative.

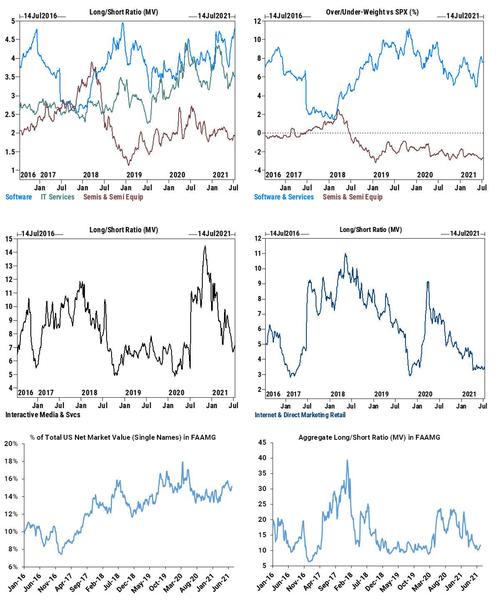

Software – not Internet nor Semis – has been the dominant driver of the recent increase in US TMT positioning, consistent with the observation from GS TMT Specialist Pete Callahan, while the L/S ratios in several Consumer Disc subsectors – all trending up in recent weeks – suggest higher confidence in the strength of the US consumers and select reopening plays.