By Tsvetana Paraskova of OilPrice.com

Global oil demand growth is materially slowing down this quarter compared to the third quarter, the International Energy Agency (IEA) said on Thursday, but at the same time, it lifted its 2024 demand growth projection by around 130,000 barrels per day (bpd) from last month’s assessment.

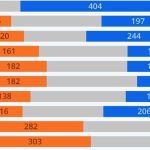

Demand growth is slowing down this quarter, the agency said in its Oil Market Report for December, and revised down its Q4 consumption growth forecast by nearly 400,000 bpd, with Europe making up more than half of the downward revision.

“Evidence of a slowdown in oil demand is mounting, with the pace of expansion set to ease from 2.8 mb/d y-o-y in 3Q23 to 1.9 mb/d in 4Q23,” said the agency, which advocates for a faster energy transition.

“A deterioration in the macroeconomic outlook led to a downward revision in our global oil consumption growth forecast of nearly 400 kb/d in the final three months of the year,” the Paris-based agency said.

Higher interest rates feeding through the real economy and a very soft European demand amid a broad manufacturing and industrial slump were the reasons for the downward revision for this quarter, which also led to the IEA adjusting its 2023 demand growth forecast down by 90,000 bpd. The agency now sees this year’s growth at 2.3 million bpd.

Next year, oil consumption growth “is expected to ease significantly,” to 1.1 million bpd, the IEA said.

But its 2024 demand forecast from today is around 130,000 bpd higher than the estimated growth of 930,000 bpd for next year in the November report.

The IEA also noted that U.S. supply growth “continues to defy expectations.”

According to the agency, “The continued rise in output and slowing demand growth will complicate efforts by key producers to defend their market share and maintain elevated oil prices.”

Unlike the IEA, OPEC continues to expect much higher oil demand growth for 2024—at 2.2 million bpd, for an average of 104.4 million bpd total global consumption next year, unchanged from the November assessment.

“Oil demand is expected to be supported by resilient global GDP growth, amid continued improvements in economic activity in China,” the cartel said in its Monthly Oil Market Report (MOMR) on Wednesday.

Loading…