Authored by Lance Roberts and Michael Lebowitz via RealInvestmentAdvice.com,

A recent article in the Financial Times sheds a concerning light on U.S. corporate executives. Per the Financial Times:

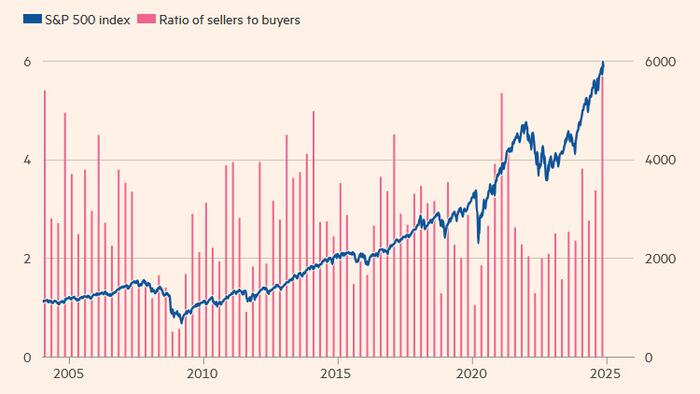

Record numbers of US executives are selling shares in their companies, as corporate insiders from Goldman Sachs to Tesla and even Donald Trump’s own media group cash in on the stock market surge that has followed his election victory.

The rate of so-called insider sales has hit a record high for any quarter in two decades, according to VerityData. The sales, by executives at companies in the Wilshire 5000 index, include one-off profit-taking transactions as well as regular sales triggered by executives’ automatic trading plans. The Wilshire 5000 is one of the broadest indices of US companies.

Insiders sell stock for various reasons, many of which are unrelated to their company’s prospects. Therefore, record selling is not necessarily a dire warning. However, given recent returns, high valuations, the growing use of leverage, and a generally highly speculative environment, insider sales are another warning that markets may underperform expectations in 2025.

In regards to correlating insider sales and market performance, Ben Silverman of VerityData shares the following from the Financial Times article:

“Generally with selling, in terms of predictiveness, insiders are early by about two or three quarters,” he said.

“As they start seeing froth in the market is when they try to generate liquidity more aggressively.”

Trade accordingly…

Loading…