Q4 earnings season has officially begun, and once again it has done so on the right foot, with JPMorgan – which as a reminder is the bank that started QE4 in October by triggering the repo market crisis in September – reporting quarterly earnings that as has been traditionally the case for the past year, beat on the top and bottom line.

JPM reported Q4 revenue and EPS of $29.21BN and $2.57, both solidly beating expectations of $27.96BN and 2.30, respectively. JPM’s revenue rose a total of 9%, up $2.4 billion, even though net interest income declined $0.2BN Y/Y, as non-interest revenue increased a whopping $2.6 billion in Q4. And while expenses also rose, they did so at a muted pace, with the company’s total expenses rising $0.6BN to $16.3BN. Thanks to a benign base effect, with the company’s earnings disappointing in Q4 2018, EPS was up a whopping 59 cents from $1.98 a year earlier.

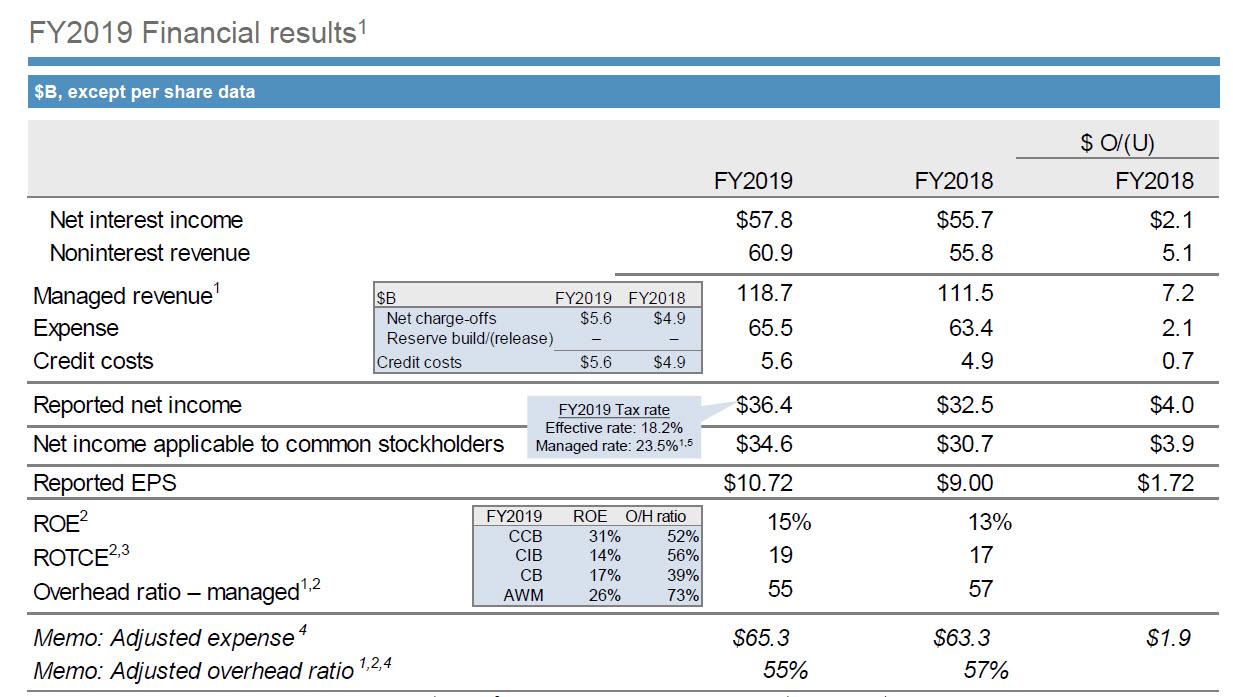

For the full year, JPM said profit jumped 21% in the fourth quarter, pushing annual earnings to a record $36.4 billion.

The good news continued on the provisions front, where JPMorgan reported a provision for credit losses for Q4 that beat the average analyst estimate: at $1.43BN, the Q4 provision for credit losses was down -7.8% y/y and below the estimate of $1.53 billion.

Commenting on the results, CEO Jamie Dimon said that “while we face a continued high level of complex geopolitical issues, global growth stabilized, albeit at a lower level, and resolution of some trade issues helped support client and market activity towards the end of the year.” More importantly, the man who singlehandedly launched QE4 said that “the U.S. consumer continues to be in a strong position and we see the benefits of this across our consumer businesses.”

Looking ahead Dimon also said that he continues “to make large investments in technology, including AI, cloud, digital and payments, as well as other investments in innovation, talent, security and risk controls.”

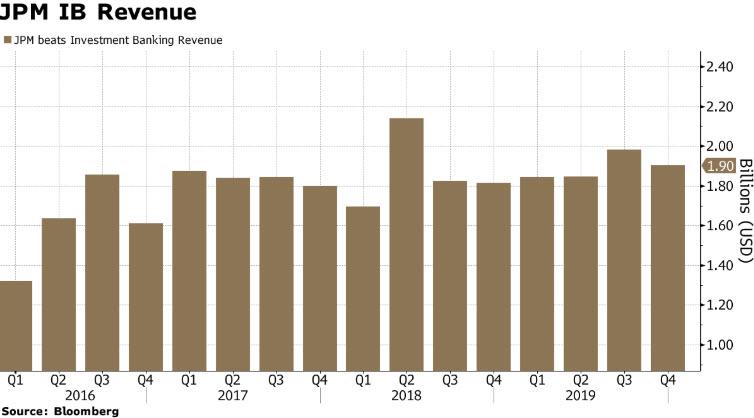

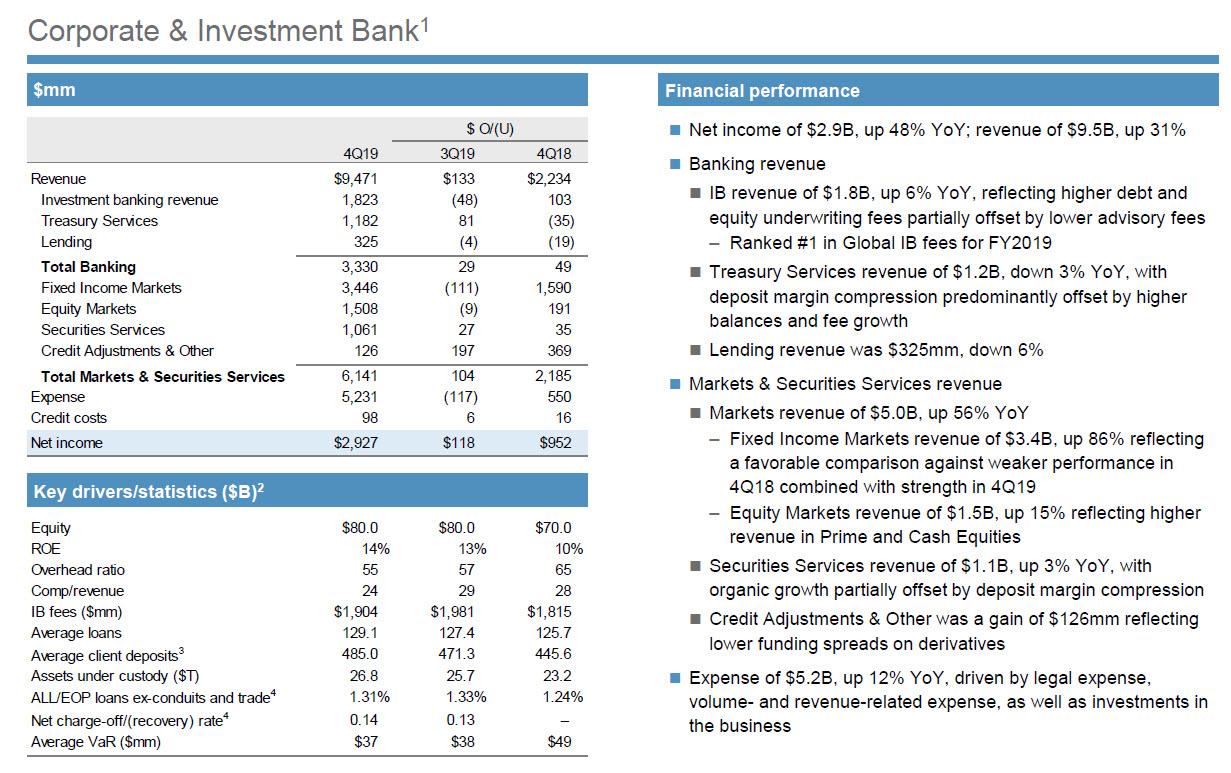

While there was little to note in the bank’s Consumer and Community Banking, and Commercial Banking revenues, of which the former posted a modest gain and the latter dipped Y/Y, the action once again was in JPM’s Corporate and Investment Bank, which surged higher in Q4, with total revenue surging 31% or $2.2BN Y/Y, representing virtually all of the Y/Y total revenue increase, to $9.47BN.

The breakdown between banking and markets was as follows:

- IB revenue of $1.82B, up 6% YoY, and just below the $1.84BN expected, “reflecting higher debt and equity underwriting fees partially offset by lower advisory fees.” At the same time, the bank reported Treasury Services revenue of $1.2B, down 3% YoY, with deposit margin compression predominantly offset by higher balances and fee growth. Finally, lending revenue was $325mm, down 6%. Here is the breakdown of IB revenue by segment:

- Advisory: $702 million (-3.44% YoY)

- DCM: $820 million (+11% YoY)

- ECM: $382 million (+10% YoY)

- The standout was JPM’s FICC within its Markets and Securities segment, with markets revenue up a whopping 56% to $5BN, thanks to a massive 86% surge in Fixed Income Markets, to $3.4B, “reflecting a favorable comparison against weaker performance in 4Q18 combined with strength in 4Q19.” Of course, a lot of this surge was thanks to last year’s dismal Q4 performance, but even compared to expectations JPM smashed results, with Wall Street expecting $2.44BN in FICC, $1BN below the $3.45 billion reported.

- Separately, Equity Markets revenue was $1.51B, up 15%. and also beating estimates of $1.41BN, “reflecting higher revenue in Prime and Cash Equities.” JPM also reported Securities Services revenue of $1.1B, up 3% YoY, with organic growth partially offset by deposit margin compression. Meanwhile, “Credit Adjustments & Other” was a gain of $126mm reflecting lower funding spreads on derivatives.

On the cost side, FICC expenses of $5.2B were up 12% YoY, or $550MM higher, “driven by legal expense, volume- and revenue-related expense, as well as investments in the business.”

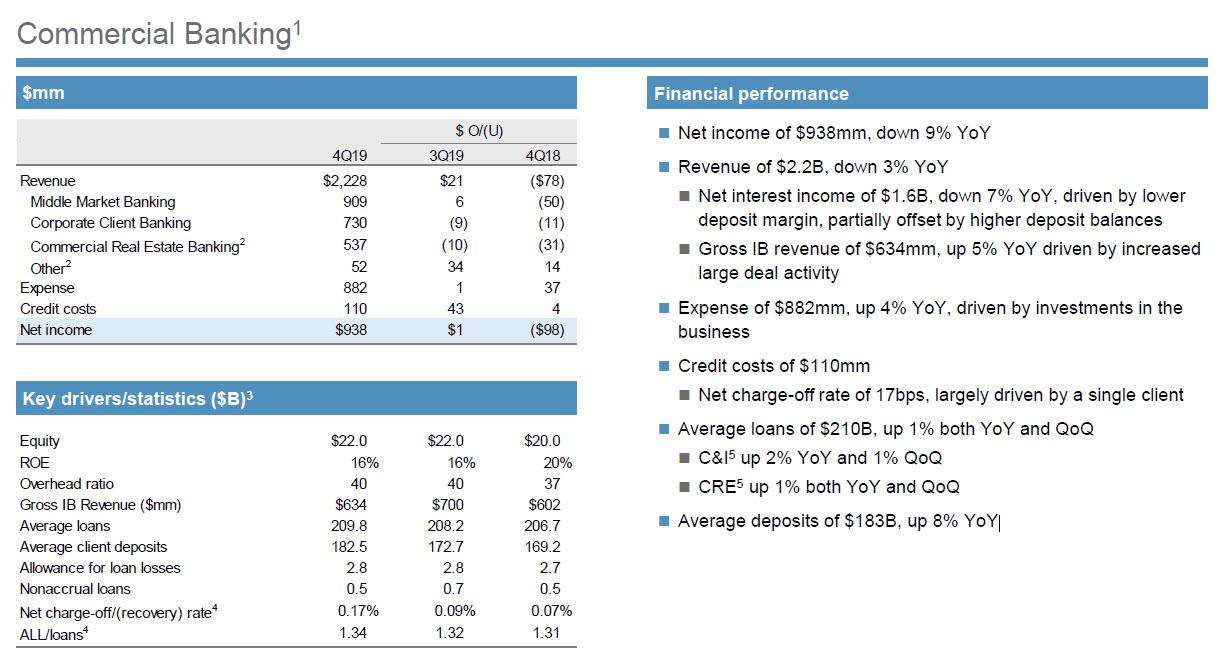

Offsetting the FICC euphoria, JPM’s Commercial Banking group had a quarter to forget, with Net income of $938mm, down 9% YoY on revenue of $2.2B, also down 3% YoY. Net interest income was $1.6B, down 7% YoY, driven by lower deposit margin, and partially offset by higher deposit balances. Meanwhile, gross IB revenue of $634mm, were up 5% YoY driven by increased large deal activity. Some more details:

- Average loans of $210B, were up 1% both YoY and QoQ

- C&I up 2% YoY and 1% QoQ

- CRE up 1% both YoY and QoQ

- Average deposits of $183B, up 8% YoY

Despite the revenue weakness, commercial banking expenses of $882mm, were up 4% YoY, “driven by investments in the

business.” And with credit costs hitting $110mm, it is notable that JPM announced that its net charge-off rate of 17bps, was “largely driven by a single client.” We expect questions in the conference call to address who this client was.

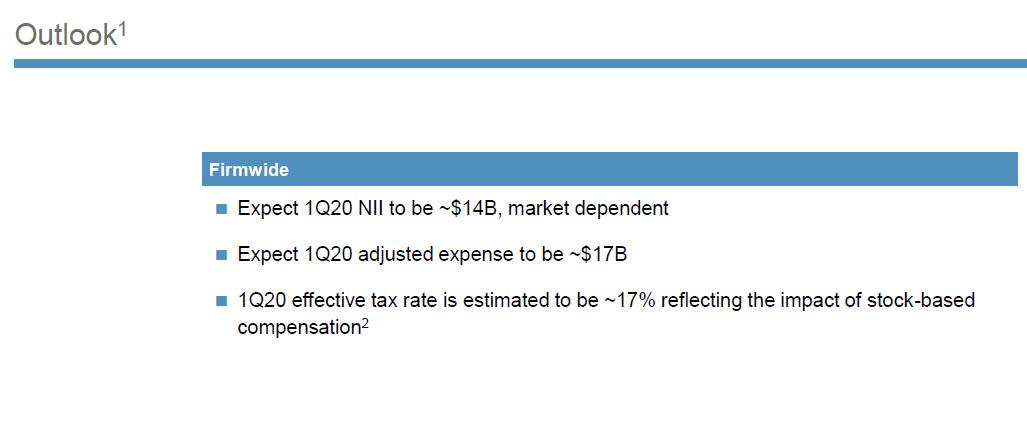

Finally, looking ahead, JPM said that it expects Q1 2020 Net Interest Income to be $14.00BN, just above the $13.95BN expected, so the bank hopes to see some commercial bank stabiliziation after the modest weakness in Q4.

Full Q4 earning presentation below (pdf link)