Update (1405ET):

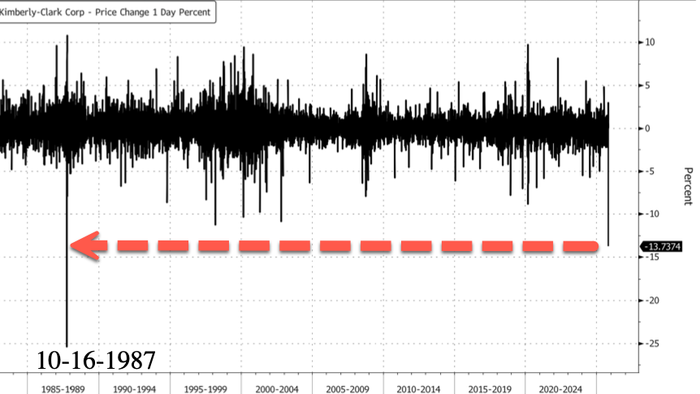

Kimberly-Clark shares remain down around 14.5% in late-afternoon trading. If the losses hold into the close, it would mark the company’s steepest one-day drop since October 16, 1987, or just days before the Black Monday crash on October 19, 1987. Earlier, the Kleenex maker unveiled plans to acquire Tylenol producer Kenvue in a $48.7 billion cash-and-stock deal. The announcement sent Kenvue soaring, up 20%.

Shares of Kimberly-Clark are at their lowest point since late 2019.

Wall Street analysts are divided on the proposed merger between Kimberly-Clark and Kenvue. Some expect short-term pressure on the stock, while others praised the merger as “strategically transformative”…

Commentary from Wall Street desks (courtsey of Bloomberg):

RBC Capital (Nik Modi)

Says the deal is strategically transformative for Kimberly-Clark in the long run as it adds significant positive diversification to its business mix

“We believe it will take investors some time to process the long-term implications and would expect KMB shares to come under pressure today and likely trade sideways until investors get more context around recent KVUE regulation/litigation headlines as well as confidence that Kimberly-Clark can turn Kenvue’s business around“

Vital Knowledge (Adam Crisafulli)

“KVUE brings some iconic brands into the KMB umbrella, and the ~$21/shr purchase price isn’t extremely expensive (this only gets KVUE back to where it was trading in Sept.), especially considering ~$2B in synergies, but KMB investors will be wary of the deal given the mounting legal risks facing Tylenol”

Says the consumer staples industry has struggled for several quarters due to macro pressures. KVUE has experienced particular strain given company-specific challenges, such as management turnover and scrutiny from the White House

Bloomberg Intelligence (Diana Gomes)

Says Kimberly-Clark’s cash-and-stock offer for Kenvue reinforces the view that any recovery in Kenvue sales is based on an aggressive step-up in investment, which would act as a further drag on mid-term profit

“Another Kenvue organic sales miss in 3Q and lack of overlap in over-the-counter and beauty limits realization of synergies, pegged at 8% to combined operating expenses”

* * *

Consumer products company Kimberly-Clark Corporation announced it will acquire Tylenol maker Kenvue in a cash-and-stock transaction valued at nearly $49 billion, marking one of the largest consumer health mergers in history.

Kimberly-Clark revealed in a press release that the deal values Kenvue at 14.3x its latest twelve months (LTM) adjusted EBITDA. In return, Kenvue shareholders will receive $3.50 in cash and .14625 Kimberly-Clark shares per Kenvue share, for a total of about $ 21.01 per share. The deal is valued at $48.7 billion.

The deal is expected to close in 2H 2026. Upon completion, Kimberly-Clark shareholders will own 54% of the combined company, while Kenvue shareholders will own 46%. Both boards have unanimously approved the acquisition. JPMorgan Chase is providing committed financing for the deal.

The merger unites two mega consumer-product giants, creating a global health and wellness powerhouse with top brands, including Kleenex, Huggies, Tylenol, Neutrogena, Listerine, and Band-Aid, that reach consumers worldwide.

Here’s the justification for the merger:

-

Combines Kimberly-Clark’s commercial execution and digital marketing capabilities with Kenvue’s science-backed innovation and healthcare professional networks.

-

Expands global footprint across key growth categories in personal care and health.

-

Enhanced R&D and quality investments to accelerate product innovation and address evolving consumer health needs.

-

Kimberly-Clark CEO Mike Hsu will continue leading the merged company, supported by senior executives from both firms.

Based on Kimberly-Clark’s current projections, the merger would generate 2025 annual net revenues of about $32 billion and adjusted EBITDA of about $7 billion.

All sounds great, but this comes at a time when Tylenol faces political scrutiny via the Trump administration, warning mothers to avoid giving their newborns acetaminophen.

Related:

In markets, Kimberly-Clark shares tumbled 15%, while Kenvue shares jumped 20%.

The question now is whether government regulators will approve the deal, especially given President Trump’s recent comments surrounding Tylenol.

Loading recommendations…