By Michael Every of Rabobank

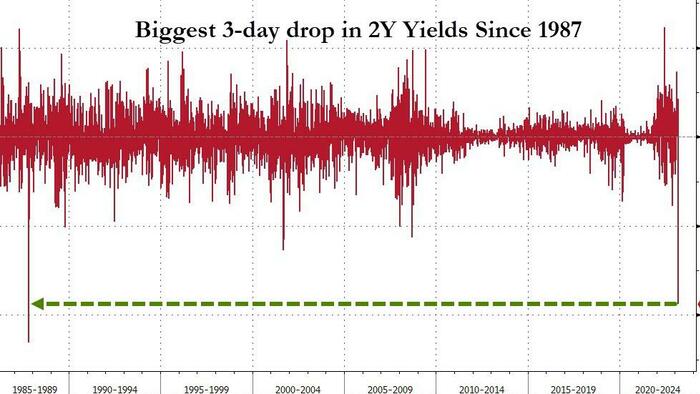

Total panic, with 2-year US bond yields falling the most in one day since Volcker, eclipsing declines seen post-2008, 9/11, and 1987. That’s what we got yesterday despite President Biden saying the banking system was fine, the Fed saying the same, the FDIC backstopping depositors, and every bank analyst saying there is no systemic risk. Regardless, small banks were hammered not just in the US but globally, large banks given a kicking to boot, and everyone bought bonds.

The utter chaos we are seeing is ostensibly because of an asset-liability mismatch at a few small US banks, which regularly fail without garnering any attention. Then again, Ken Griffin of Citadel says “US capitalism is breaking down before our eyes.” Ironically, given the ostensible crisis trigger is the Fed raising rates while certain CFOs opted not to hedge, bond yields are now tumbling at such a pace that anyone short now faces a bloodbath. Do they get a bailout by not having to mark to market? If not, why not? One starts to see what Citadel are talking about.

There are now even market calls that the Fed will not only not go the previously expected 50bps in March, nor 25bps, nor pause, but actually cut rates 25bp. Moreover, all other central banks without the same non-systemic banking issues as the US are apparently going to follow suite. That’s with headline US inflation out today quite likely to run hot (expectations are 0.4% m-o-m, 6.0% y-o-y headline, 0.4% m-o-m, 5.6% y-o-y core), and with the last payrolls print of 311K and unemployment still close to a five-decade low at 3.6%.

We’ve previously discussed the different levels of equilibrium interest rates various parts of the economy require, but more broadly the financial economy that produces ‘assets’ is not the real economy that produces goods and services. The first is in trouble because of rising rates and a lack of hedging. The second is not doing as well as some might say either: but is seeing high inflation. If rates are not to address this then, as a political realist, there is nothing to stop inflation other than saying “what goes up must come down”. And, of course, assets can then only go up.

Maybe central banks will pivot. If so, don’t expect me, or markets, to take anything they say seriously again. More likely, there is a mismatch between the financial-economy’s screaming and what central banks think the *real* economy requires. It’s a good job nobody needs to hedge interest rate risk for a year, he said sarcastically, because there’s a lot more volatility ahead.

Indeed, taking a global view, as this Daily tries to do, the Fed and other central banks don’t just face a difficult balancing act between inflation and financial stability but a new ‘trilemma’ of inflation, financial stability, and national security.

The Pentagon says “production equals deterrence,” not ‘more financial assets and apps, stat!’ Yet as China announces a Middle East pow-wow with the Gulf Cooperation Council and Iran, CNY is bought as a safe haven(!), and Xi calls for the PLA to become a ‘great wall of steel’, the Pentagon’s likely budget surge to $900bn still doesn’t cover fortification in the Indo-Pacific or a naval build-up. National security critics point out US rhetoric of liberalism vs. autocracy and economic containment of China without matching military readiness could be like cornering a wounded animal. Even The Economist has joined the list of financial press warning that ‘America and China are preparing for a war over Taiwan’. The very fat tail risks should be clear.

Let me stress, this is not to flag a war. This Daily has only tried to do that once, over Ukraine, when markets refused to accept it might happen, and matter. However, it is to point out that even the Fed is not operating against a geopolitical backdrop of business as usual.

Relatedly, Australia, the UK, and the US all just underlined their deepening economic and political connections via the AUKUS defence pact, further details of which are that Australia will spend A$368bn over the next three decades to build 8 nuclear-powered submarines in Adelaide. As the Sydney Morning Herald puts it: “Almost $400 billion, even over three decades, is not peacetime spending in anybody’s book – a fact that government ministers concede privately.” Indeed, one can start to add the economies of the UK and Australia to the US (and Japan) as they try to jointly match China’s lead in physical production. In short, the shift away from financialisation, if seen, is going to be a joint one.

True, that’s a long journey. The UK tried a fiscal splurge last year and even the Bank of England, let alone markets, said no, triggering any LDI crisis (though note well that the BOE has raised rates a lot since then anyway). The Brits are also more embroiled in culture wars than any preparation for real ones. On which, ‘Match of the Day’ host Gary Lineker is to return after having been forced to temporarily step back over a tweet he made comparing UK immigration policy to the Nazis. A man involved in the Hand of God affair may have stepped into a Hand of Godwin one, but he emerged the winner after his co-presenters and even some footballers said “if he goes, we go.” They may all be multi-millionaires, but that was a labour-militancy zeitgeist the corporate-box prawn-sandwich-eaters in BBC management had not expected to see.

Putting this all together, it’s not just that calls for Fed cuts look far too premature, or even that the Fed will keep hiking until they break things. It’s that perhaps they are *aiming* to hike until they break some things that need to be broken. By the way, SVB was the prime conduit for Chinese start-ups to get US funding. Not anymore it isn’t.

Logically the only way to resolve the US trilemma of inflation, financial stability, and national security is to further weaponize the US dollar, as long underlined here as a likely emergent option – and one now being presented to West Point by @UrbanKaoboy.

That also involves higher rates to back a strong dollar policy – and capital controls and tariffs, both being floated in various circles.

That requires measures to prevent financial instability while allowing rates to rise higher.

Then there is the issue of how to fund the Pentagon on an even larger scale longer term: which is where AUKUS spreads the burden, with Europe to follow(?)< and maybe even more acronyms to finance it. We have already started down both of these roads.

There is a ‘mismatch of the day’ (and the decade) between that big picture geopolitical-geoeconomic reality and those who shout ‘pivot!’ while only look at very small screens.

Loading…