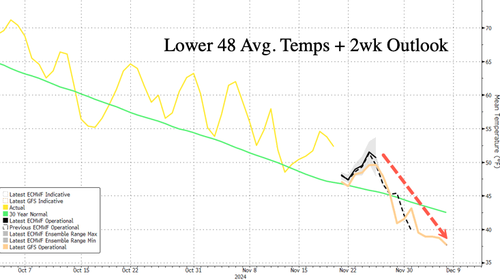

Natural gas futures in Chicago jumped 6% on Thursday, reaching a one-year high as traders price a cold blast across the Lower 48.

Futures for December delivery soared to $3.372 per million British thermal units, up 6% this morning and up nearly 27% since Nov. 8. Prices also touched a one-year.

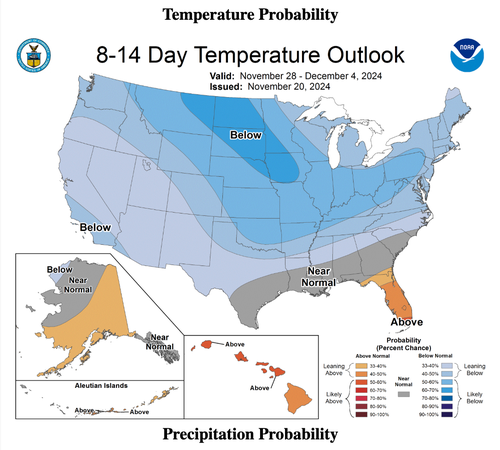

Ole R. Hvalbye, a Commodities Analyst at Skandinaviska Enskilda Banken AB (SEB), told energy news website Rigzone that NatGas soared on “the latest National Oceanic and Atmospheric Administration (NOAA) short-term forecast (6-14 days) predicts colder than normal temperatures spreading from the West Coast, with below-average conditions expected across much of the country, except for the Gulf Coast and East Coast.”

Data from Bloomberg shows that temperatures across the Lower 48 are forecasted to trend below a 30-year average for the next few weeks, indicating that fuel demand will rise as thermostats are turned up.

More weather forecast…

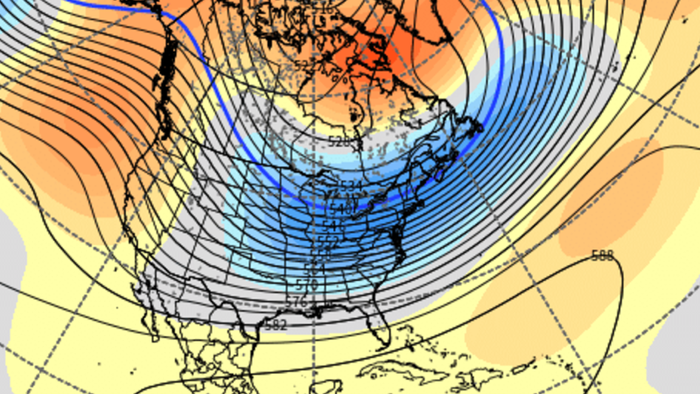

Confidence increasing of a VERY cold pattern developing to end November and start December.

Both the EPS/GEFS is support of a widespread notably below normal pattern for much of the US.

You won’t find a much better upper-level pattern with ridging near Greenland and the N.… pic.twitter.com/uQ2iNN1PxG

— BAM Weather (BAMWX) (@bamwxcom) November 21, 2024

On this note, I suspect the fail of La Niña is playing a major role in preventing the Eastern/SE ridge that has been so dominant to be prevalent.

Stretched polar vortex also setting up in the right spot is a big key too. Fun pattern for #Winter lovers approaching. https://t.co/XUWKsIzKH3

— BAM Weather (BAMWX) (@bamwxcom) November 21, 2024

Plus, there are major snow threats across the Mid-Alantic and Northeast.

Impact SNOW will fall today from Wisconsin, Illinois and Indiana into West Virginia. Snow will fall tonight and tomorrow in western North Carolina, West Virginia, western Maryland, Pennsylvania, New York state and northwest New Jersey. These could be double digits plowable,… pic.twitter.com/jYw4hQqhrM

— Jim Cantore (@JimCantore) November 21, 2024

“Adding to the bullish sentiment, feedgas supply to U.S. LNG export terminals has climbed to 14.07 billion cubic feet per day, the highest level since January 2024, according to BNEF,” Hvalbye added.

The SEB analyst continued, “This marks a significant increase from last week’s average of 13.5 billion cubic feet per day. Additionally, export flows to Mexico are estimated at 6.6 billion cubic feet per day today, highlighting strong demand from the region.”

He said, “Domestic natural gas production in the U.S. is estimated at 101.8 billion cubic feet per day today, slightly below last week’s average of 102.4 billion cubic feet per day.”

“Meanwhile, demand for nat gas across the Lower 48 states has risen to 79.3 billion cubic feet per day but remains below the five-year average of approximately 82.7 billion cubic feet per day,” he noted.

Hvalbye added that the EU gas market will continue to see upward price pressure as global demand for LNG cargoes intensifies during the Northern Hemisphere winter season.

One of the biggest questions for energy traders is how high prices will rise before drillers, who curtailed output earlier this year, begin ramping up production.

Loading…