![]() The First National Bank of Lindsay was forced to cease operations after the Office of the Comptroller of the Currency (OCC) found the institution to be in a perilous financial position.

The First National Bank of Lindsay was forced to cease operations after the Office of the Comptroller of the Currency (OCC) found the institution to be in a perilous financial position.

The OCC found the financial institution to be in an “unsafe or unsound condition to transact business and that the bank’s assets were less than its obligations to its creditors and others,” according to the statement.

“No advance notice is given to the public when a financial institution is closed,” the FDIC said in a separate statement.

As a result, the only office of First National Bank of Lindsay will reopen as a branch of First Bank & Trust Co. on Oct. 21. Depositors of First National will automatically become depositors of First Bank.

Deposits with First National that have been taken over by First Bank & Trust will continue to be insured by the FDIC.

“All customers of The First National Bank of Lindsay will have access to their insured deposits,” the FDIC stated.

“In addition, based on the estimated recoveries of the failed bank assets, the FDIC will make 50 percent of uninsured funds available to those depositors on Monday, October 21, 2024. This amount could increase as the FDIC sells the assets of the failed bank.”

The FDIC asked customers with accounts of more than $250,000 to contact the agency at 1-866-314-1744 for an appointment to discuss their deposits.

First National reported total assets worth $107.8 million and deposits valued at $97.5 million as of June 30. Roughly $7.1 million in deposits exceeded FDIC insurance limits.

The First National Bank of Lindsay is the second bank to fail in the United States this year, following the Republic First Bank in Philadelphia, according to the FDIC.

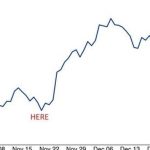

SVB’s failure was followed by the implosion of Signature Bank and First Republic Bank. The crashes triggered concerns about the stability of the U.S. banking sector.

These pressures are unevenly distributed, “with some banks quite well positioned and others under greater stress,” Klaros analysts found.

“While many banks are impacted by these pressures, and the need for more capital and consolidation is clear, relatively few banks currently appear to be at risk of failure,” they said.