Authored by Marcus Wong, EM market strategist who writes for Bloomberg

Emerging-market equities are looking more fragile as valuations appear out-of-sync with earnings, especially given the increasingly bleak narrative surrounding virus cases and U.S.-China trade tensions. Something akin to a Jenga game nearing its end, with players wondering which move will be the one to bring everything crashing down.

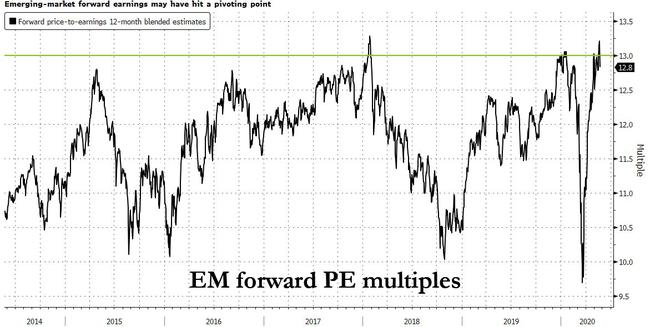

EM valuations appear close to a historical pivoting point, given the MSCI gauge is more than 13 times forward earnings on a 12- month blended basis. The index corrected on four occasions over the past five years when valuations approached or breached that level.

Lofty S&P 500 valuations offer little reassurance for EM stocks, meantime. The outperformance in U.S. equities has been supported by unprecedented intervention from the Federal Reserve, especially via corporate bond buying. With the exception of rich emerging-nations such as South Korea, most developing-nation central banks have been less ambitious with stimulus, perhaps constrained by concerns for their currencies and perceptions of debt-monetization.

Investors continue to pull out from EM ETFs for a record 13th consecutive week, and the bulk of the cumulative $21.9 billion in outflows hit equity funds.

While new virus cases in the developed world have mostly stabilized, key developing nations are catching up. Brazil overtook the U.K. on May 18 as the nation with the third-highest number of virus cases globally. Russia is second only to the U.S., which still has the most coronavirus cases.

Poorer developing economies are dealing with an impossible dilemma — the trade-off between causing starvation and deepening poverty via lockdowns, versus allowing a wider outbreak for the pandemic. With lockdown fatigue setting in, more nations are opting to save people’s livelihoods — risking a resurgence of infections.

Although emerging-market currency volatility has eased, it is still close to the highest in almost 20 months compared to developed-market counterparts.

There is also the risk of rising emerging-market inflation due to food price risk, as my colleague Simon Flint points out. Developing nations are particularly vulnerable to the impact of nationwide lockdowns and border shutdowns, given to weaker food supply chains and a relative scarcity of cold- storage facilities.

Most observers expect another emerging-market stock sell-off this year, probably by September, according to a Bloomberg survey of 61 investors, strategists and traders conducted in April. And those questions were posed and answered before President Donald Trump escalated his war of words with China.

The re-emergence of U.S.-China trade tensions could not have come at a worse time, underscoring concerns that political rhetoric will heat up ahead of November’s U.S. elections. In the near term, China’s announcement of its intention to impose a new security law in Hong Kong has already resulted in threats of sanctions from the U.S. America is due to release a report on Hong Kong Human Rights on May 25.

With the drumbeat of negatives getting louder by the day, it may only be a matter of time before developing-market equities unravel in an unruly manner.