Shares of Pfizer tumbled in premarket trading in New York after the pharmaceutical company announced a forecasted revenue slump next year. The dismal outlook falls below the average estimates of analysts, attributed to sliding demand for Pfizer’s Covid vaccines and other related products.

Pfizer wrote in a press release titled “Pfizer Provides Full-Year 2024 Guidance” that full-year 2024 revenues are expected to be in the range of $58.5 to $61.5 billion, below the $62.9 billion analysts surveyed by Bloomberg expected. It expects annual earnings of $2.05 to $2.25 a share, far below analysts’ $3.21 average estimate.

The revenue guidance for next year also includes an estimated $8 billion from its Covid vaccine Comirnaty and its antiviral Paxlovid, along with approximately $3.1 billion from Seagen and about $1 billion from the reclassification of its royalty income from other (income)/deductions into the revenue.

“Pfizer’s product portfolio remains strong. In 2024, Comirnaty and Paxlovid are expected to deliver combined revenues of approximately $8 billion and our remaining portfolio of combined Pfizer and Seagen products is expected to achieve year-over-year operational revenue growth in the range of 8% to 10%,” stated Dr. Albert Bourla, Pfizer Chairman and Chief Executive Officer.

Bourla continued, “In addition, we expect our cost realignment program to deliver savings of at least $4.0 billion by the end of 2024, which puts us on a path to potentially regain our pre-pandemic operating margins.”

PFE shares are down 7% in premarket trading. Year-to-date, shares are down 44%, touching lows not seen since 2016.

Bourla told investors on a recent conference call: “We are acutely aware that all these uncertainties are making it difficult to project the future revenues of Pfizer — and are also affecting our stock price.”

Similar concerns have sent shares of Moderna tumbling while broader markets trend higher.

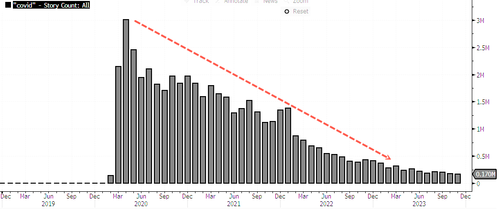

Headlines for “Covid” across US media have tumbled.

The pharma-industrial complex is under severe pressure to find new avenues of growth as Covid revenues plummet. Only another pandemic can turnaround the industry.

Loading…