The demand for clean energy metals will grow by more than 400% by 2030, according to the Energy Transitions Commission (ETC).

Supply, however, is not on track to keep up with this surging demand.

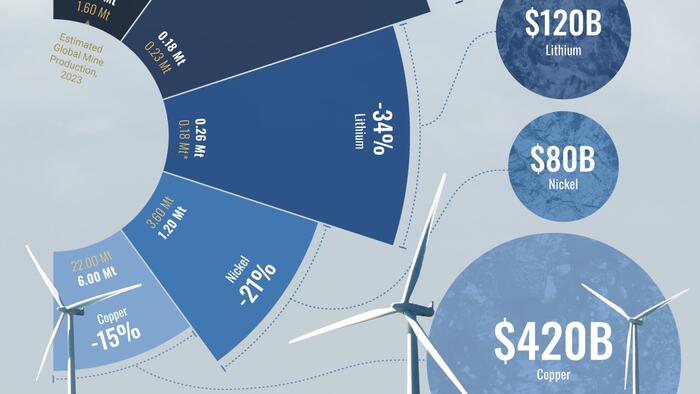

Visual Capitalist partnered with Appian Capital Advisory to visualize what these supply gaps may look like by 2030 and the mining investment needed to balance these deficits. The analysis uses data from the ETC and U.S. Geological Survey.

What Are the Critical Energy Transition Materials?

Building a clean energy future isn’t just about technology—it’s about materials. The transition to renewable energy will require a vast array of raw metals, such as:

-

Natural graphite and cobalt: Critical for electric vehicles (EVs) and energy storage.

-

Nickel: Critical for battery performance and an important component of wind turbines and green hydrogen technologies.

-

Copper: Required for electrical wiring and expanding transmission infrastructure.

-

Lithium: Central to batteries in EVs and energy storage.

Projected Supply Deficits

Here are the supply deficits expected by 2030 if the mining sector grows at its current trajectory, along with the investments needed to balance these deficits.

Together, the above energy transition materials require more than $700 billion of investment through 2050 to balance their supply deficits.

75% of these capital investments should be made by 2030 in order to meet demand by 2050, according to the ETC.

Loading…