Authored by Ven Ram, Bloomberg cross-asset strategist,

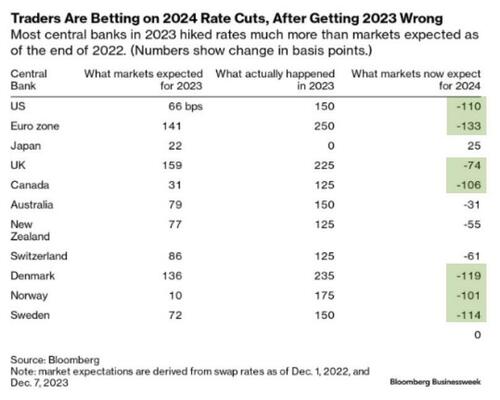

Markets expect the European Central Bank to start slashing interest rates in the spring, followed by the Bank of England in the summer.

And once the central banks start, traders reckon they will keep going at a brisk pace.

That might be pricing too much, too soon.

There is no denying that euro-zone headline inflation has slowed impressively so far, having gone from about 9% at the start of the year to within striking distance of 2%.

That may embolden the ECB to reduce its inflation estimates for 2024 and beyond when it meets this week, though the central bank is unlikely to say that it is willing to consider rate cuts yet.

Yes, momentum in the euro-area economy is waning.

But, with the jobless rate holding near a multi-decade low, the governing council is unlikely to pivot soon. Not when core inflation is still running near 4%. Given that the ECB’s real policy rate is just modestly positive, there isn’t much scope for easing as yet. Which is why President Christine Lagarde may not offer any Christmas gift to the markets.

Meanwhile, the BOE led by Governor Andrew Bailey is in a far worse predicament.

Headline inflation is still around 5%, core inflation within reach of 6% and services inflation not too far from 7%. While data this morning showed weekly earnings growth slowed, the reality is that it is still above 7%.

Last I looked, those aren’t numbers screaming “2% inflation is here,” so the right question for the markets to ask isn’t really how many times the BOE will be able to cut rates in 2024, but whether it can avoid tightening more.

While headline inflation came in at 4.6% for October, each of the three prints before that was 6.7% or higher.

Those are not numbers that suggest the disinflationary process in the UK is clear and well embedded — unlike the case in the US and the euro zone.

Sure, there is room for some policy loosening next year, especially from the ECB.

Still, overstating that point in terms of rates’ positioning may not be what the doctor ordered.

Loading…