Authored by Simon White, Bloomberg macro strategist,

Higher-duration equity sectors are exposed to a resurgence in inflation. Sectors of lower duration such as energy are more resilient to price growth, are less overbought and – unlike tech-focused sectors – continue to act as a hedge for bonds.

After a brief hiatus in 2020/21, investors have been happy to look through inflation risks and sit on duration-heavy portfolios. But this could be the year that that strategy faces a reckoning if, as multiple leading indicators anticipate, inflation returns.

Over the last 12 months, higher-duration sectors have vastly outperformed their lower-duration counterparts.

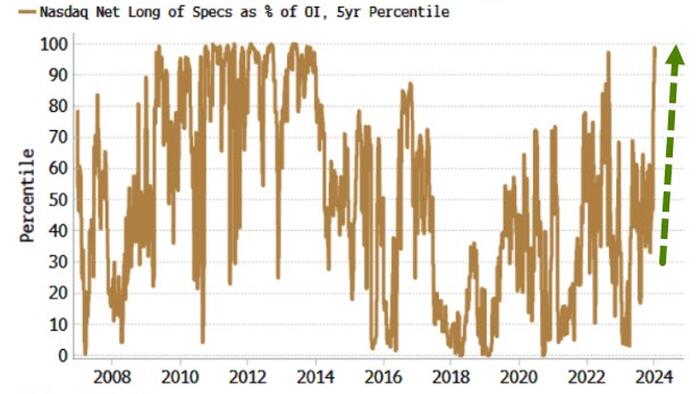

Moreover, in recent weeks, there has been a surge in inflows to the tech sector, which have become an even-more consensus trade in the wake of the Federal Reserve’s pivot.

However, each Fed cut does not reduce risks – it increases them through stoking an eventual larger rise in inflation. Portfolios that see duration incrementally fall – rather than rise, which might be the temptation – will be more resilient to an increase in price growth.

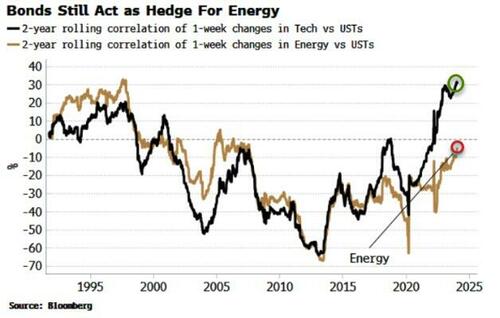

Equity portfolios with slimmed down duration profiles confer another advantage: they will have a lower – or even still-negative – correlation with bonds. Stocks overall have been negatively correlated with bonds for decades. But in this cycle they have become positively correlated, meaning bonds now reinforce losses from stocks rather than acting as a hedge.

Tech’s correlation with bonds has risen far into positive territory. The energy sector, however, is still negatively correlated with bonds, while in general low-duration sectors are less correlated with fixed-income than high-duration ones.

As well as providing a better risk-adjusted return for multi-asset strategies, lower-duration equity portfolios are cheaper, less prone to a correction, and better placed to weather a recrudescence in inflation.

Loading…